Two-wheelers drive auto retail growth with 15.8% surge in November 2024: FADA

For the year-to-date period from April to November 2024, the overall vehicle retail market showed an almost 11% growth.

The Indian automotive retail market demonstrated a complex performance in November 2024, with significant variations across different vehicle segments. The Federation of Automobile Dealers Associations (FADA) revealed robust two-wheeler sales, struggling passenger vehicle markets, and modest growth in commercial and tractor segments.

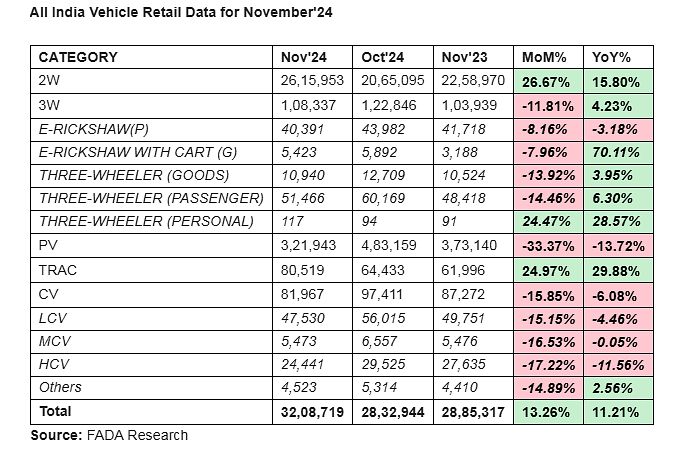

Total vehicle retail for the month reached 32,08,719 units, representing an 11.21% year-on-year increase from 28,85,317 units in November 2023. While the overall numbers suggest a positive trend, the growth was uneven, with two-wheelers and tractors driving expansion, while passenger and commercial vehicles faced considerable headwinds.

Two-Wheeler Market Dynamics

The two-wheeler segment demonstrated robust performance in November 2024, with total sales reaching 26,15,953 units, compared to 22,58,970 units in November 2023 - a significant 15.8% year-on-year growth, according to the Federation of Automobile Dealers Associations’ (FADA) November vehicle retail data released today.

Hero MotoCorp maintained its market leadership, capturing 35% of the market share with 9,15,468 units sold. Honda Motorcycle and Scooter India followed closely, securing 25.02% of the market with 6,54,564 units. TVS Motor Company and Bajaj Auto completed the top four manufacturers, contributing 16.09% and 11.63% of the market share respectively.

Interestingly, the electric vehicle segment within two-wheelers showed modest presence, with Ola Electric Technologies and Ather Energy collectively accounting for about 1.61% of the market. Royal Enfield and Suzuki Motorcycle India also maintained their niche positions in the market.

Passenger Vehicle Segment Challenges

The passenger vehicle market experienced a notable downturn, with sales declining to 3,21,943 units in November 2024, compared to 3,73,140 units in the same month last year - a 13.72% year-on-year decrease. Maruti Suzuki remained the market leader, despite experiencing a decline, with a 39.92% market share and 1,28,521 units sold. Hyundai Motor India, Mahindra & Mahindra, and Tata Motors followed, each holding between 13-14% of the market share.

Premium and luxury segments showed varied performance. Toyota Kirloskar Motor saw a relatively stable position, while brands like MG Motor India and premium manufacturers like Mercedes-Benz maintained their presence in the market. Notably, emerging electric vehicle manufacturers like BYD India are gradually increasing their market footprint.

Commercial Vehicle and Tractor Market Insights

The commercial vehicle segment recorded 81,967 units in November 2024, a 6.08% decline from the previous year. Tata Motors led the segment with a 33.76% market share, followed closely by Mahindra & Mahindra at 28.12%. Ashok Leyland maintained its strong position with 15.65% market share. Smaller players like VE Commercial Vehicles and Maruti Suzuki also contributed to the segment's diversity.

The tractor market painted a more optimistic picture, with total sales of 80,519 units - a remarkable 29.88% increase from November 2023. Mahindra & Mahindra dominated this segment, combining its main brand and Swaraj division to capture over 42% of the market. International Tractors, TAFE Limited, and Escorts Kubota Limited rounded out the top performers in this agricultural machinery market.

Market Outlook and Dealer Sentiment

Looking ahead to December, dealer sentiment remains cautiously optimistic. A survey revealed that 40.54% of dealers anticipate flat sales, while 39.19% expect growth. Only 20.27% predict a potential de-growth. Liquidity and overall market sentiment reflect this measured optimism, with 53.72% of dealers reporting neutral liquidity conditions and 49.66% describing their sentiment as neutral.

The potential for a bumper Kharif harvest, possible year-end promotional schemes, and stable rural demand are expected to provide mild support across automotive segments. However, challenges such as high inventory levels in passenger vehicles and subdued infrastructure activity continue to temper full-scale optimism.

Year-to-Date Performance

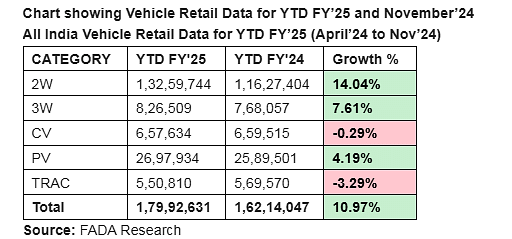

For the year-to-date period from April to November 2024, the overall vehicle retail market has shown growth. Total vehicle retail stood at 1,79,92,631 units, compared to 1,62,14,047 units in the same period last year - representing a 10.97% increase. Two-wheelers have been the primary growth driver, with a 14.04% year-to-date increase.

For the year-to-date period from April to November 2024, the overall vehicle retail market has shown growth. Total vehicle retail stood at 1,79,92,631 units, compared to 1,62,14,047 units in the same period last year - representing a 10.97% increase. Two-wheelers have been the primary growth driver, with a 14.04% year-to-date increase.

RELATED ARTICLES

Mercedes-Benz Expands Its Network in Southern India

Mercedes-Benz India expands its presence in Bengaluru and Hyderabad with the inauguration of three new service facilitie...

Craftsman Automation Begins Commercial Operations at New Kothavadi Facility

Craftsman Automation Limited has commenced commercial operations at its newly established manufacturing facility in Koth...

Delhi EV Policy 2.0: Ban on Petrol Two-Wheelers Not Included for Now

Earlier reports said that a ban on petrol-run two-wheelers was being considered for the upcoming policy.

By Autocar Professional Bureau

By Autocar Professional Bureau

09 Dec 2024

09 Dec 2024

3507 Views

3507 Views

Sarthak Mahajan

Sarthak Mahajan