LIVE UPDATES: Mahindra & Mahindra Quarterly Results Oct-Dec FY25

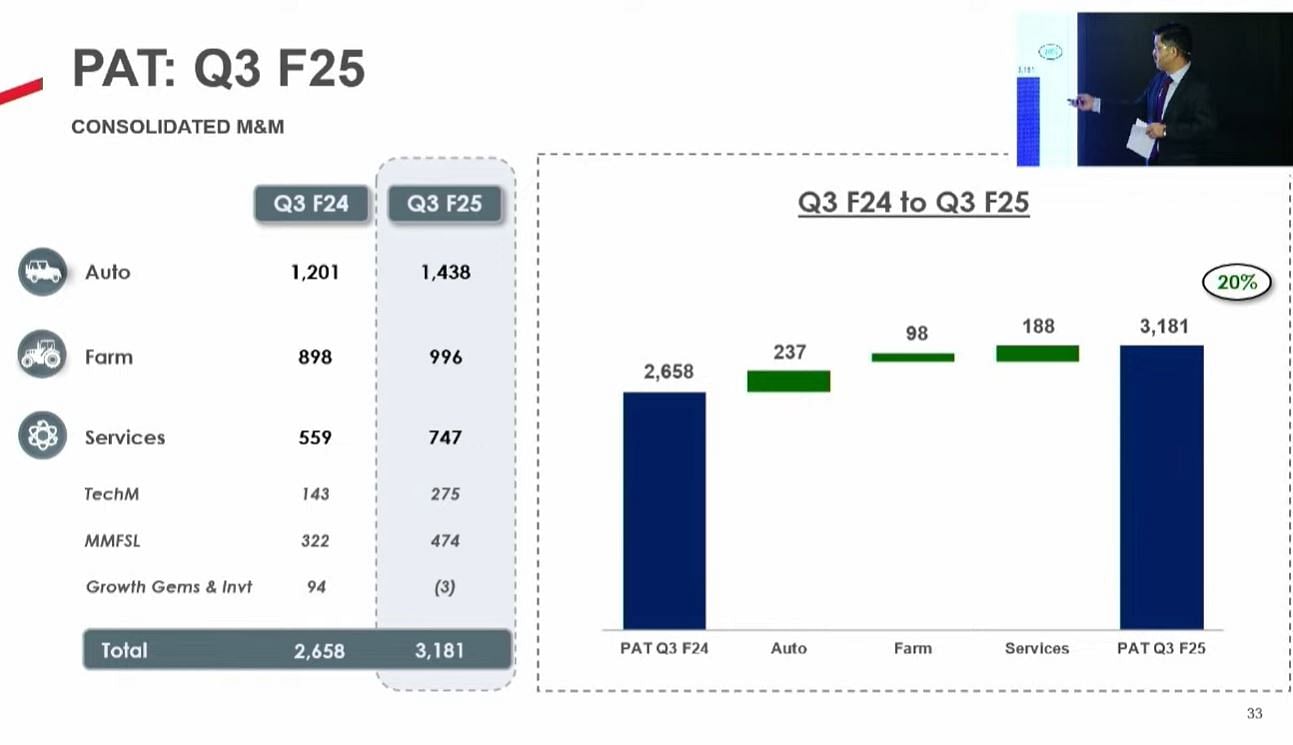

The company reported a strong third quarter of FY25, with consolidated profit after tax rising 20% to Rs 3,181 crore, driven by strong showing across its automotive, farm equipment, and services businesses.

Mahindra & Mahindra has announced its quarterly results for Oct-Dec 2024. Here are live updates from its press conference.

- M&M: Expect tractor industry to grow over 15% in Jan-Mar

- Domestic market is doing well, expect strength to continue

- International operations are weak due to macro headwinds

- Expect to reach certain decisions on Int'l business in Q4

- To carve out contract manufacturing of e-SUVs from auto financials

- Fundamentals for Indian economy strong; relief in income tax to drive growth

- Effect of income tax relief to increase XUV 3XO traction

- Expect demand to be robust in Rs 10-25 lakh auto segment

- There is raw material inflation; steel remains benign, but other raw material prices creeping up

- 30% of the volume for Thar is for three-door, remaining for 5-door

- Urban and rural growth is similar for us, unlike for some others for whom rural has outperformed

- Current inventory at 30 days

- EV bookings to be available at 250+ dealerships at the beginning

- Increased prices of XUV700 and 3X0 during the quarter, helping margins

- Dealers offering discounts on 2024 inventory

- Anti-dumping measures should not lead to higher steel prices, hope govt will keep this in mind

- We have specific product lines to de-bottleneck. Need to increase capacities in 3XO and ROXX. These will be small incremental capacities added over the next six months.

- Selling 700+ 3XO in South Africa, selling more than 1200 vehicles per month in South Africa

- M&M: Expect tractor sales in US to pick up in Apr-Jun quarter

- MHCV sales muted: expected to pick up with infra development

The Mumbai-based conglomerate saw its consolidated revenue grow 17% year-on-year to Rs 41,470 crore. The company strengthened its grip on the SUV market with a revenue market share of 23%, up 200 basis points, while SUV volumes surged 20% during the quarter.

The automotive division emerged as a key growth driver, with quarterly volumes reaching 245,499 units, up 16% year-on-year. The segment's standalone PBIT (Profit Before Interest and Tax) jumped 37% to Rs 2,167 crore on a standalone basis, with margins expanding 120 basis points to 9.7%.

In the farm equipment sector, M&M achieved its highest-ever Q3 market share of 44.2%, with volumes growing 20% to 120,624 units. The segment's standalone PBIT rose 42% to Rs 1,479 crore, while margins improved significantly by 260 basis points to 18.1%.

RELATED ARTICLES

Mercedes-Benz Expands Its Network in Southern India

Mercedes-Benz India expands its presence in Bengaluru and Hyderabad with the inauguration of three new service facilitie...

Craftsman Automation Begins Commercial Operations at New Kothavadi Facility

Craftsman Automation Limited has commenced commercial operations at its newly established manufacturing facility in Koth...

Delhi EV Policy 2.0: Ban on Petrol Two-Wheelers Not Included for Now

Earlier reports said that a ban on petrol-run two-wheelers was being considered for the upcoming policy.

By Sarthak Mahajan & Darshan Nakhwa

By Sarthak Mahajan & Darshan Nakhwa

07 Feb 2025

07 Feb 2025

2269 Views

2269 Views

Sarthak Mahajan

Sarthak Mahajan