India's Auto Component Industry Targets $100 Billion in Exports: ACMA-BCG Report

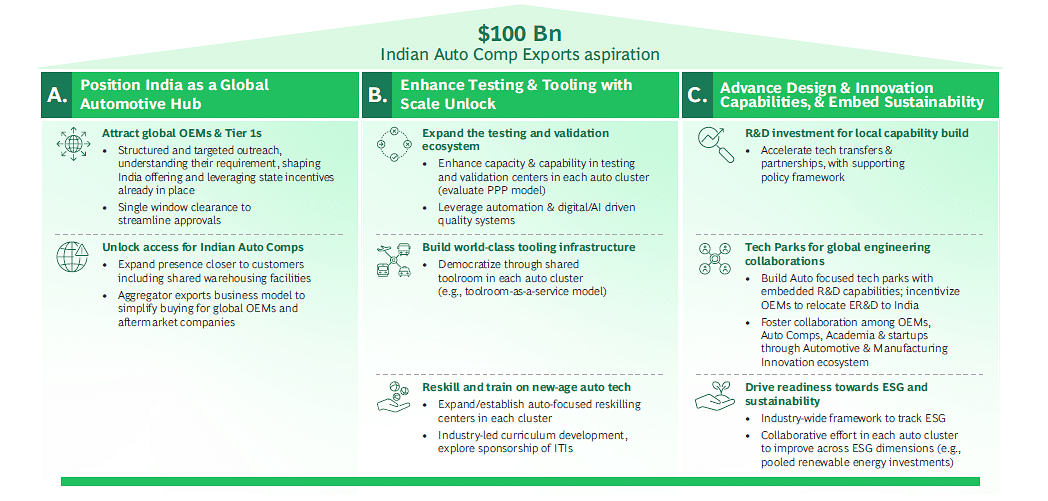

The report outlines three key pillars to drive India's auto component exports: positioning India as a global automotive hub, enhancing testing and tooling capabilities, and fostering innovation.

India's auto component industry is poised for exponential growth, setting an ambitious target of $100 billion in exports, according to a joint report by the Automotive Component Manufacturers Association of India (ACMA) and Boston Consulting Group (BCG). The report, titled "Revving Up Exports: The Next Phase of Export Growth for the Auto Component Industry", outlines a strategic roadmap for India to establish itself as a dominant global supplier.

The report highlights India's remarkable progress in the sector, with auto component exports reaching $21.2 billion in FY24. This represents a sharp turnaround from a $2.5 billion trade deficit in FY19 to a $300 million surplus, signaling India's growing competitiveness in the global market.

Aiming for Global Expansion

India's current share of auto component exports to North America and Europe stands at approximately 4.5%, presenting a significant opportunity for expansion. The report identifies two key growth strategies: first, doubling down on traditional components, which could contribute an additional $40-60 billion in exports; second, leveraging emerging electric vehicle (EV) and electronic value chains, potentially adding another $15-20 billion in exports through products like battery management systems, telematics units, and instrument clusters.

According to ACMA President Shradha Suri Marwah, India has already made significant strides. "We have not only achieved a positive trade balance, but for auto-specific use cases, the surplus is even more pronounced, reaching approximately $0.5-1.5 billion. We are committed to sustaining this growth trajectory and have set an ambitious target of $100 billion in exports ahead," she said.

Cost Advantage and Market Opportunities

A cost analysis conducted as part of the report reveals that India offers a competitive advantage in key global markets. In Germany, where Eastern European suppliers currently dominate, Indian components are up to 15% cheaper due to lower manpower and energy costs. In the U.S., where Mexico and China are key suppliers, Indian auto components are significantly more cost-effective than Chinese products, which are 20-25% more expensive due to tariffs.

The report also underscores the increasing confidence of global procurement professionals in India's supply chain. A survey of 40 procurement officers across leading commercial and passenger vehicle manufacturers found that 80% are either already sourcing or open to sourcing auto components from India.

Strengthening India's Position in the Global Market

Vinnie Mehta, Director General of ACMA, emphasized that Indian manufacturers must scale their exports by five to ten times to deepen their presence in global supply chains. He highlighted the need for greater proximity to customers, enhanced testing and tooling capabilities, and improved environmental, social, and governance (ESG) compliance.

Industry leaders also stress the importance of attracting global original equipment manufacturers (OEMs) to set up manufacturing bases in India. Vikram Janakiraman, Managing Director and Senior Partner at BCG, noted that evolving geopolitical dynamics have made India a viable destination for global OEMs looking to diversify their supply chains. "Encouraging 2-3 major global OEMs to set up manufacturing in India would act as an anchor, allowing domestic suppliers to integrate more seamlessly into global supply chains," he said.

The Road Ahead

The report outlines three key pillars to drive India's auto component exports: positioning India as a global automotive hub, enhancing testing and tooling capabilities, and fostering innovation. It also calls for greater automation and adoption of Industry 4.0 standards to strengthen India's competitiveness.

"To emerge as a dominant global player, Indian companies must accelerate automation and leverage AI-driven solutions to improve quality and scalability," said Saurabh Chhajer, Managing Director and Partner at BCG. He also stressed the need for advanced testing and validation centers to support small and medium enterprises (SMEs), ensuring compliance with global OEM standards.

With its cost advantages, growing reputation, and strategic focus on innovation, India is well-positioned to significantly expand its footprint in the global auto component market. However, achieving the $100 billion export target will require coordinated efforts from industry stakeholders, policymakers, and global partners, the report said.

RELATED ARTICLES

Mercedes-Benz Expands Its Network in Southern India

Mercedes-Benz India expands its presence in Bengaluru and Hyderabad with the inauguration of three new service facilitie...

Craftsman Automation Begins Commercial Operations at New Kothavadi Facility

Craftsman Automation Limited has commenced commercial operations at its newly established manufacturing facility in Koth...

Delhi EV Policy 2.0: Ban on Petrol Two-Wheelers Not Included for Now

Earlier reports said that a ban on petrol-run two-wheelers was being considered for the upcoming policy.

By Arunima Pal

By Arunima Pal

04 Mar 2025

04 Mar 2025

3991 Views

3991 Views

Sarthak Mahajan

Sarthak Mahajan

Autocar India

Autocar India