FADA Report Shows India's Electric Vehicle Market's Segmented Growth in January 2025

Latest registration data reveals diverse adoption rates across vehicle categories, with three-wheelers maintaining 56% market share while other segments display varying growth trajectories amid evolving consumer preferences.

The electric vehicle market showed varying penetration rates across different segments. Three-wheelers continued to lead with the highest market share at 56.0% of their segment. The two-wheeler segment had grown to capture 6.4% of its market. Commercial vehicles maintained a steady presence with a 0.98% share, while passenger vehicles had reached 2.4% of their respective market.

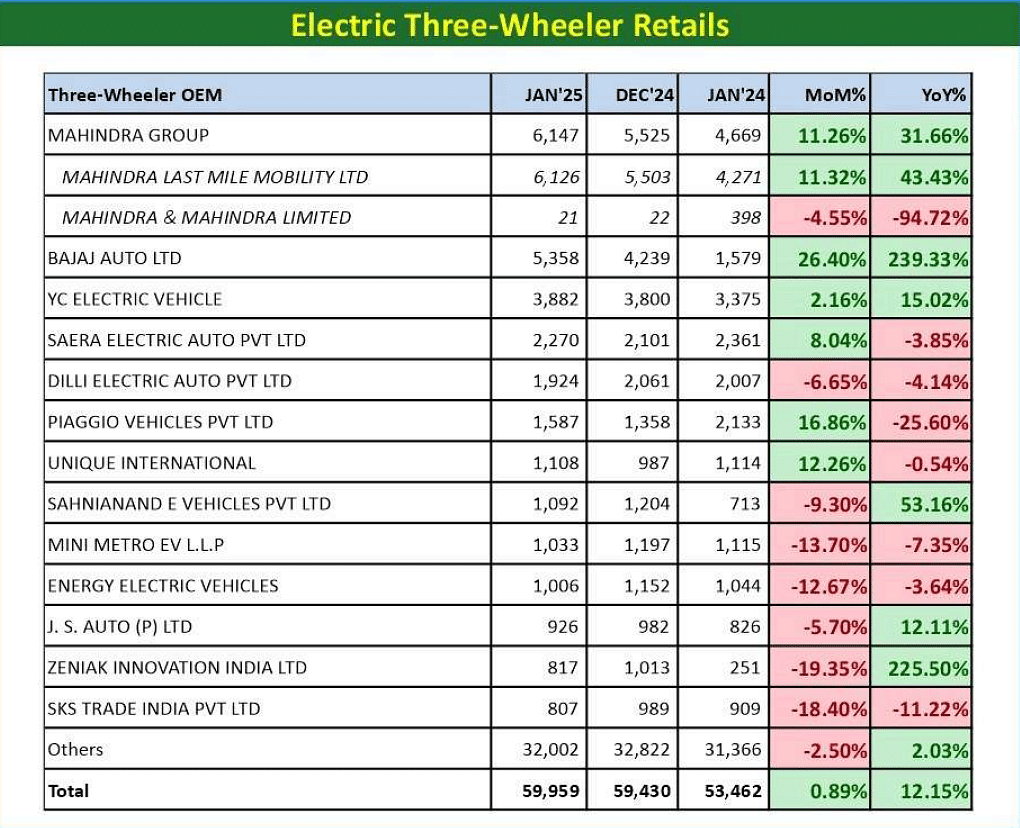

Three-Wheeler Segment Records Steady Growth

The Federation of Automobile Dealers Associations (FADA) reports that electric three-wheeler registrations reached 59,959 units in January 2025, marking a 0.89% increase from December 2024 and a 12.15% rise from January 2024. The segment's market share increased to 56% from 53.4% year-over-year.

Mahindra Group led the segment with 6,147 units in January 2025, with its Last Mile Mobility division contributing 6,126 units. Bajaj Auto Ltd registered 5,358 units, showing a 26.40% month-on-month increase. YC Electric Vehicle maintained its position with 3,882 units.

Several manufacturers experienced declining sales compared to December 2024. Dilli Electric Auto Pvt Ltd saw a 6.65% decrease, while Mini Metro EV LLP and Energy Electric Vehicles reported declines of 13.70% and 12.67% respectively.

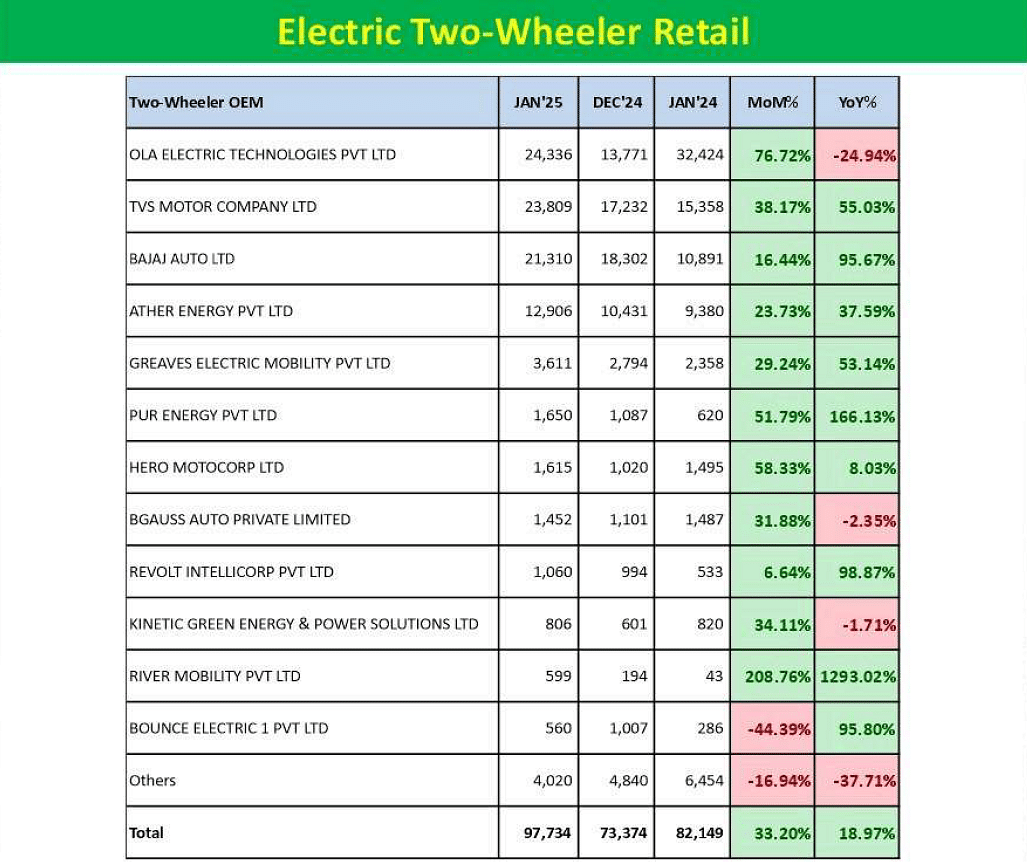

Two-Wheeler Market Shows Volume Growth

Electric two-wheeler registrations totaled 97,734 units in January 2025, representing a 33.20% increase from December 2024. The segment's market share reached 6.4%, up from 5.6% in January 2024.

Ola Electric Technologies registered 24,336 units, leading the segment despite a 24.94% year-over-year decline. TVS Motor Company followed with 23,809 units, while Bajaj Auto secured 21,310 units. Ather Energy Pvt Ltd reported 12,906 units.

River Mobility Pvt Ltd recorded 599 units, showing significant growth from its previous year's performance. However, Bounce Electric 1 Pvt Ltd experienced a 44.39% decline from December 2024, with registrations falling to 560 units.

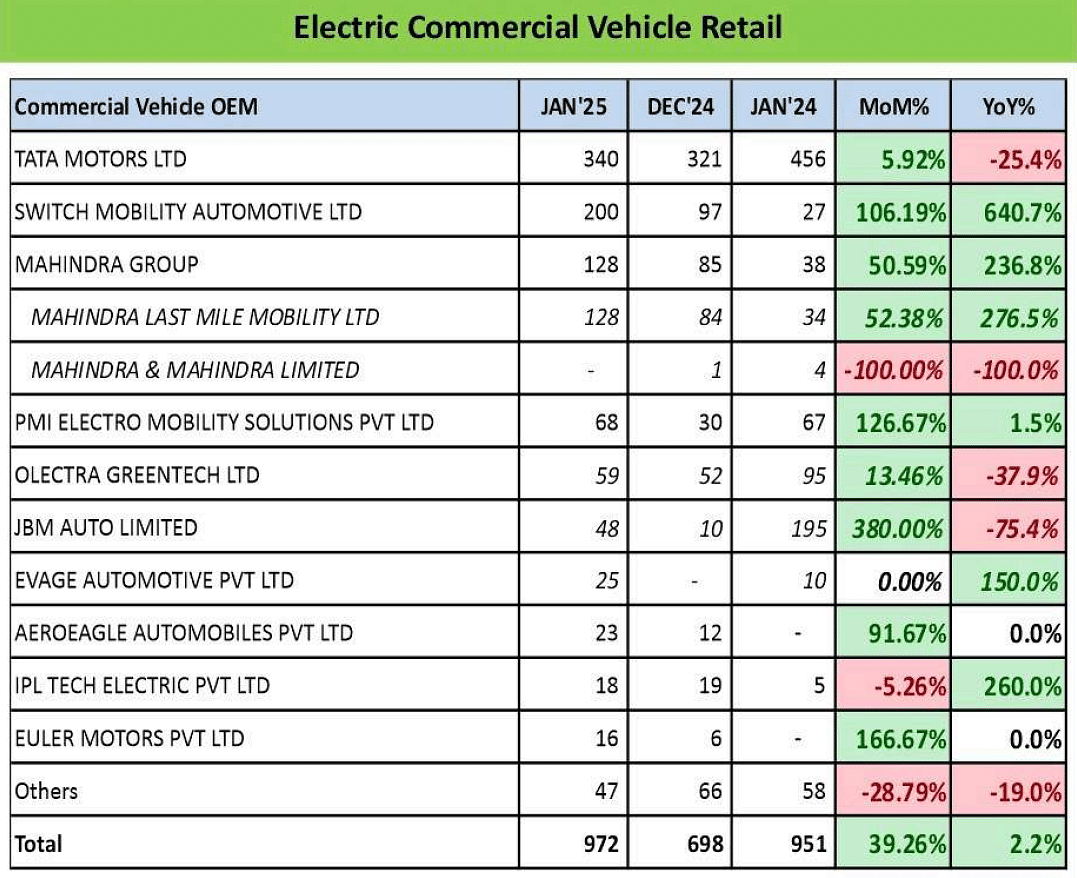

Commercial Vehicle Segment Shows Modest Market Share

The electric commercial vehicle segment maintained a 0.98% market share, with total registrations of 972 units in January 2025. This represents a 39.26% increase from December 2024 and a 2.2% rise from January 2024.

Tata Motors Ltd registered 340 units, maintaining its market leadership despite a 25.4% year-over-year decline. Switch Mobility Automotive Ltd reported 200 units, while Mahindra Group recorded 128 units.

JBM Auto Limited showed significant monthly growth with 48 units, though its year-over-year performance declined by 75.4%. New entrant Euler Motors Pvt Ltd registered 16 units, showing a 166.67% increase from December 2024.

Passenger Vehicle Registrations Display Growth

Electric passenger vehicle registrations reached 11,266 units in January 2025, representing a 27.70% increase from December 2024. The segment's market share stood at 2.4%, compared to 2.1% in January 2024.

Tata Motors Passenger Vehicles Ltd registered 5,047 units, leading the segment despite a 13.01% year-over-year decline. MG Motor India recorded 4,237 units, while Mahindra & Mahindra Limited registered 688 units.

Hyundai Motor India Ltd showed significant growth with 321 units, compared to 19 units in December 2024. Luxury manufacturers including BMW India Pvt Ltd and Mercedes-Benz AG registered 181 and 95 units respectively.

Market Share Analysis

The electric vehicle market shows varying penetration rates across different segments. Three-wheelers continue to lead with the highest market share at 56.0% of their segment. The two-wheeler segment has grown to capture 6.4% of its market. Commercial vehicles maintain a steady presence with a 0.98% share, while passenger vehicles have reached 2.4% of their respective market.

FADA's research encompasses data from 1,375 out of 1,436 Regional Transport Offices (RTOs) across India, as collected in collaboration with the Ministry of Road Transport and Highways (MoRTH). The figures exclude data from Telangana State.

The month-on-month comparisons reflect changes from December 2024, while year-over-year analysis compares with January 2024 figures. The data presents registration numbers rather than wholesale figures, providing a direct measure of vehicles reaching end consumers.

Companies across segments show varying performance patterns, with some demonstrating strong growth while others face challenges. The overall market indicates continued evolution in India's electric vehicle sector, with different segments growing at distinct rates and manufacturers adapting to changing market conditions.

The collected data suggests ongoing changes in consumer preferences and manufacturer strategies in the electric vehicle market, with significant variations in performance across different vehicle categories and companies.

RELATED ARTICLES

Mercedes-Benz Expands Its Network in Southern India

Mercedes-Benz India expands its presence in Bengaluru and Hyderabad with the inauguration of three new service facilitie...

Craftsman Automation Begins Commercial Operations at New Kothavadi Facility

Craftsman Automation Limited has commenced commercial operations at its newly established manufacturing facility in Koth...

Delhi EV Policy 2.0: Ban on Petrol Two-Wheelers Not Included for Now

Earlier reports said that a ban on petrol-run two-wheelers was being considered for the upcoming policy.

By Sarthak Mahajan

By Sarthak Mahajan

07 Feb 2025

07 Feb 2025

3315 Views

3315 Views

Autocar India

Autocar India