Toyota tops 2014 JD Power dealer satisfaction study

Toyota Kirloskar Motor has been ranked the highest in the J D Power Asia Pacific 2014 India Dealer Satisfaction with Automotive Manufacturers Index (DSWAMI) Study released today.

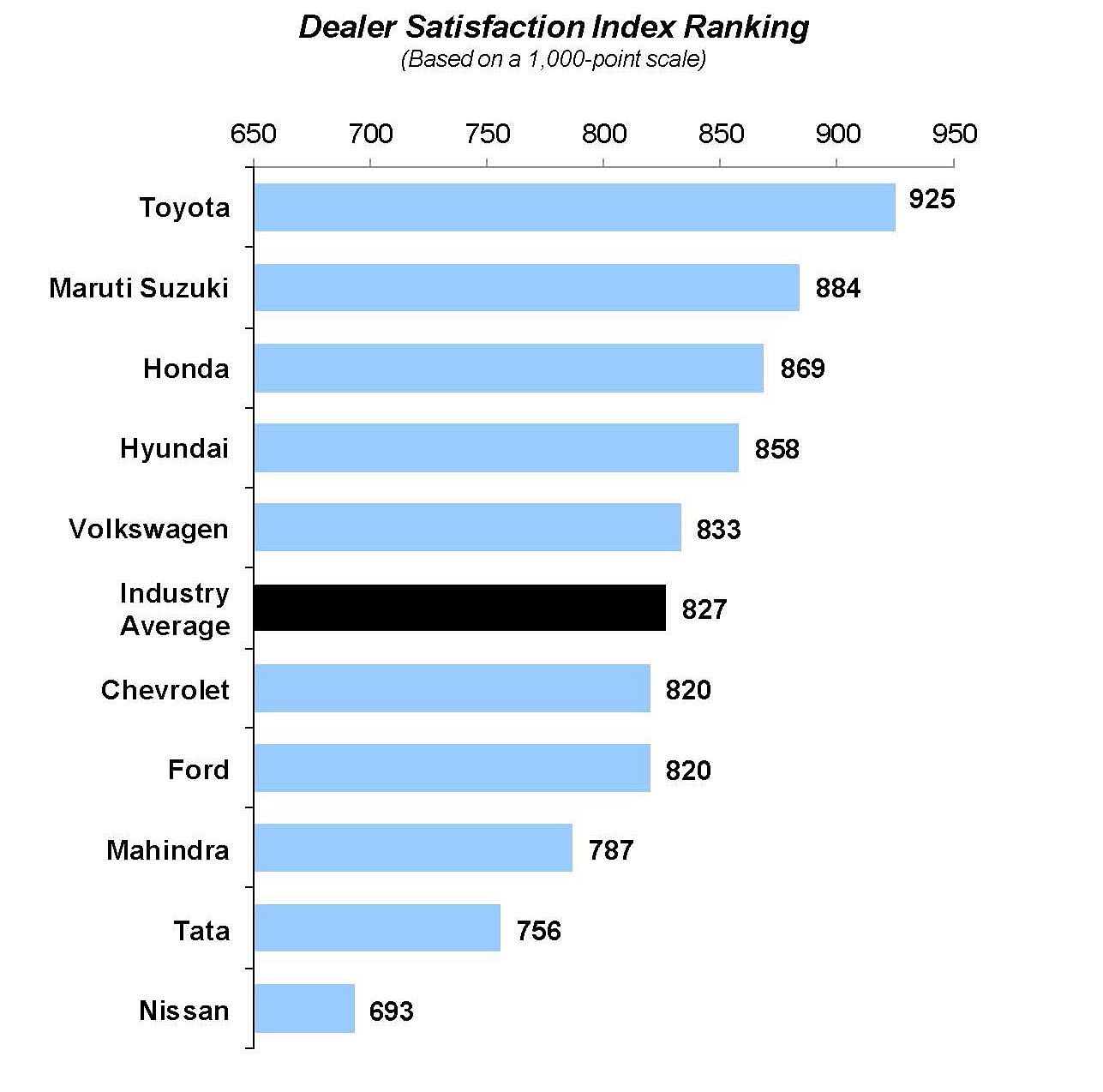

Toyota Kirloskar Motor has been ranked the highest in the J D Power Asia Pacific 2014 India Dealer Satisfaction with Automotive Manufacturers Index (DSWAMI) Study released today. Topping all other OEMs with a score of 925 on a 1,000-point scale, it is followed by Maruti Suzuki with a score of 884 and Honda Cars India at 869. Overall dealer satisfaction with carmakers averages 827 points in 2014, up from 817 points in 2013.

Now its fourth year, the study measures dealer satisfaction with vehicle manufacturers or importers in India and identifies dealer attitudes regarding the automotive retail business. Overall dealer satisfaction is determined by examining nine factors: marketing and sales activities; product; vehicle ordering and delivery; sales team; parts; warranty claims; aftersales team; training; and support from the manufacturer.

The findings of the study reveal that auto manufacturers in India are striving to help their dealers cope with a slowing domestic market by helping them improve the aftersales aspect of their business.

Despite an overall improvement in satisfaction, only 42 percent of dealers estimate they will be profitable in FY2013-2014. The situation is more critical for dealerships based in India’s six largest cities, with only 31 percent expecting to make a profit this year. Dealers rely on sales-related proceeds from new-car sales, accessories, insurance and credit/ loans commissions for about half of their revenues. Given that the overall vehicle sales are down 6 percent from 2013, a larger number of dealerships have reported estimated losses in 2014.

“Given the relatively weak outlook on vehicle sales, dealerships are concerned about the viability of their business,” said Mohit Arora, executive director of J D Power Asia Pacific. “Increasing the share of service revenue is one of the ways in which dealers can survive in these tough times. Retaining customers beyond the standard warranty period has always been a challenge for dealerships in India. With sales revenues under pressure, focusing on their service business is essential not only for enhancing dealer viability, but also ensuring survival,” added Arora.

Key findings of the study are:

- Automakers are increasingly helping dealers fund their spare parts inventories, as 48 percent of dealers indicate receiving financial assistance to buy spare parts stock in 2014, up from 41 percent in 2013.

- Nearly half (48%) of dealers indicate their warranty claims are settled within 15 days, compared with 42 percent in 2013.

- Warranty labour rate—the hourly rate at which the automaker reimburses the dealership for any work performed on the vehicle under warranty—is reported to be higher this year with 25 percent of dealerships reporting warranty labour rates of more than Rs 300/hour, up from 18 percent in 2013.

- The study finds that 19 percent of dealers perceive that their automaker does not have a range of vehicles to compete effectively in the market. This leads to a substantial dip in their overall satisfaction score.

- The study says that dealers in India are increasingly seeking greater support from automakers towards enhancing the effectiveness of their marketing and sales-related activities. Those who receive such support have not only reported higher satisfaction scores but also are more likely to indicate they are profitable.

RELATED ARTICLES

Hyundai walks the eco talk with biogas plant, material recovery plant in Gurugram

Operational since October 2022, the facility targets sustainable waste management in Gurugram by undertaking scientific ...

Rajiv Bajaj reappointed MD and CEO of Bajaj Auto for five-year term

Bajaj Auto’s Board of Directors has approved the re-appointment of Rajiv Bajaj as the company’s MD and CEO for another f...

JSW MG Motor launches Comet EV Blackstorm edition

The key highlights of the Comet EV Blackstorm, which is now the top-end variant, are its ‘Starry Black’ exterior along w...

29 May 2014

29 May 2014

5529 Views

5529 Views

Autocar Professional Bureau

Autocar Professional Bureau