Maruti Suzuki tops latest India brand influence study

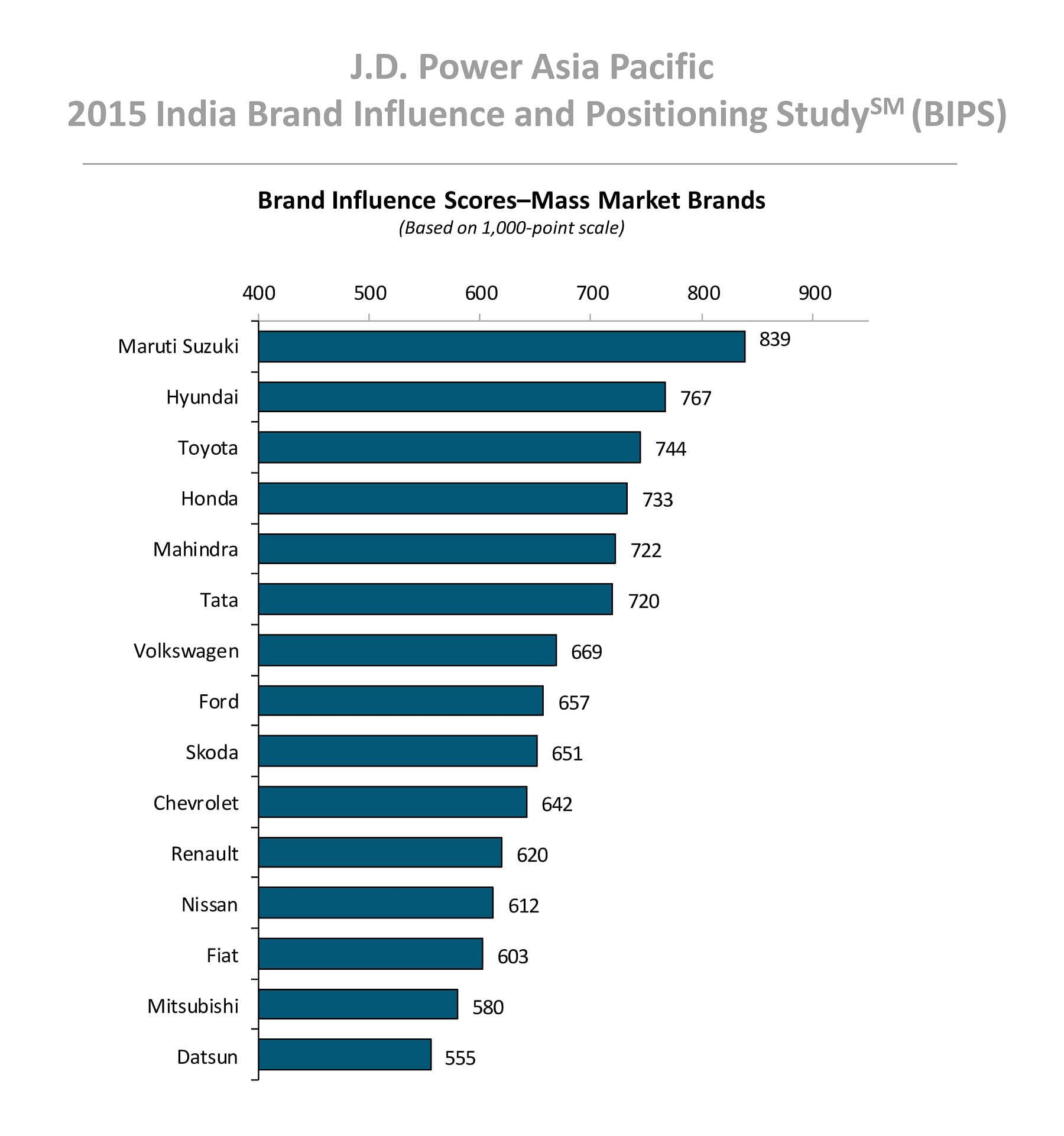

Maruti Suzuki ranks highest in brand influence with a score of 839 (on a 1,000-point scale). Hyundai ranks second (767) and Toyota third (744).

Maruti Suzuki India, which has 13 models in the domestic market and a market share of 53 percent in the passenger car market, has topped the J.D. Power Asia Pacific 2015 India Brand Influence and Positioning Study (BIPS).

Maruti Suzuki ranks highest in brand influence with a score of 839 (on a 1,000-point scale). Hyundai Motor India ranks second (767) and Toyota Kirloskar Motor third (744). The brand influence gap between the brand with the highest score and the one with the lowest score narrows to 259 points in 2015 from 272 in 2014.[1] All brands with scores below 700 in the 2014 study improve by double-digits in 2015. Mahindra improves the most (+44 points), followed by Renault (+28) and Nissan (+23).

As per the findings of the study, all automotive brands have recorded an increase in their brand influence score. Further, brands that relatively underperformed in 2014 have shown the highest increase in influence.

The study, now in its second year, measures automotive brand influence in India of mass market passenger car brands, based on consumer awareness and perceptions of the brand. Strong brand influence has a positive effect on purchase intent for a particular brand, as brand influence scores correlate highly with brand consideration and purchase rates. The study also segments the market using psychographic, demographic and behavioral attributes to help automakers identify and understand who their best prospects are in the new-car market.

“Consumers are likely to have a more favorable opinion of a brand that has been in the market for several years versus one that is a recent entrant,” said Mohit Arora, executive director at J.D. Power Asia Pacific, Singapore. “For a relatively new entrant, the progression of brand influence depends on how a brand engages and builds relationships with its initial base of customers, thereby creating positive word-of-mouth.”

According to Arora, the key to sustained progress in building long-term brand influence is for automakers to identify what appeals most to their target segment and consistently communicate their core message to that segment.

The study also finds a marked difference in the perceived image between owners and non-owners of a brand. In general, owners have a much more favorable opinion of a brand compared with non-owners; however, Maruti Suzuki stands out as one of the few brands where the gap is relatively small. At the other end of the spectrum are brands like Fiat, Nissan and Renault where the image gaps between owners and non-owners are sizeable.

KEY FINDINGS OF THE STUDY

- Datsun (555) and Mitsubishi (580) are among brands with the lowest influence.

- The percentage of customers who indicate they regularly post ratings/reviews for others to view online has increased notably to 55 percent in 2015 from 51 percent in 2014. One-third of car buyers in the Western India indicate they regularly post ratings/reviews for others to view online, which is higher than for the other regions.

- The proportion of vehicle owners in India who say they “want to buy a brand that reflects my social status” has increased to 79 percent in 2015 from 71 percent in 2014.

- Proportion of vehicle owners in India who say they “prefer to buy a vehicle made/ assembled locally” has increased to 80 percent in 2015 from 74 percent in 2014.

The 2015 India Brand Influence and Positioning Study is based on interviews with 8,507 car owners who have owned their vehicles from 30 to 42 months and who were asked to compare two vehicle brands. The study was fielded from January through April 2015 across 30 cities in India.

RELATED ARTICLES

Rajiv Bajaj reappointed MD and CEO of Bajaj Auto for five-year term

Bajaj Auto’s Board of Directors has approved the re-appointment of Rajiv Bajaj as the company’s MD and CEO for another f...

JSW MG Motor launches Comet EV Blackstorm edition

The key highlights of the Comet EV Blackstorm, which is now the top-end variant, are its ‘Starry Black’ exterior along w...

Maruti Suzuki begins production at new Kharkhoda plant

Phase 1 of the Kharkhoda plant will have an annual production capacity of 250,000 units and produce the Brezza compact S...

By Autocar Professional Bureau

By Autocar Professional Bureau

16 Sep 2015

16 Sep 2015

5350 Views

5350 Views

Ajit Dalvi

Ajit Dalvi