Indian motorists lack awareness about driving through water-logged areas

ICICI Lombard survey indicates high incidence of motorists tackling water-logged areas without complete know-how.

When the monsoons hit India every year, poor drainage and infrastructure, especially in low-lying areas lead to a lot of streets being left submerged. Unsurprisingly, there are always many incidences of cars as well as two-wheelers breaking down or sustaining damage when traversing these water-logged roads.

A survey by ICICI Lombard has revealed the high incidence level of Indians driving through water-logged areas and even cranking the engine while their car is partly submerged. Many of them believed regular motor insurance covered the losses arising out of the resulting engine failure, while in reality, it didn’t.

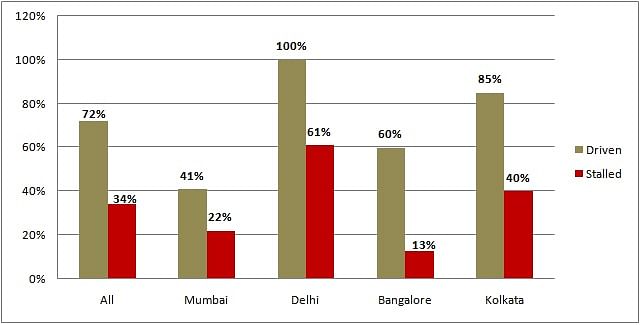

In July, ICICI Lombard undertook an on-field survey across Mumbai, Delhi, Bangalore and Kolkata. The sample size for the survey was 1,000 respondents who owned a four-wheeler and, in the past, had driven their vehicle during the monsoon season.

According to the survey, 72 percent of respondents admitted to having driven their vehicle in water-logged areas despite being aware that doing so would harm the engine, and 34 percent among them found themselves in a situation where their car had stalled. Of them, 100 percent of motorists from Delhi admitted to driving through water-logged areas with 61 percent of them getting stalled. In Mumbai, 41 percent of motorists admitted to having driven through water-logged areas and 22 percent faced an issue while doing so.

Further, around 64 percent of the respondents tried to restart the vehicle by pushing it with help from bystanders and 58 percent of them admitted to cranking the engine in order to start the vehicle while it was still submerged.

ICICI Lombard pointed out that cranking the engine while the vehicle is submerged in water or driving through water-logged areas causes a mechanical failure in the vehicle known as hydrostatic lock. A mere 7 percent of the respondents were aware of this technical failure, according to the survey.

Moreover, hydrostatic lock is not covered under a regular motor insurance policy. The survey report pointed out that, “It (the lock) is classified as ‘consequential loss’ as per motor insurance regulations because the damage is a consequence of having cranked the engine and not an outcome of an uncertain event.”

However, according to the report, insurance companies these days do offer add-on covers such as ‘engine protect’ that reimburses the claims arising due to hydrostatic lock failure. But barely 11 percent of the respondents were aware of this and only 1 percent had opted for an engine protection cover.

RELATED ARTICLES

Rajiv Bajaj reappointed MD and CEO of Bajaj Auto for five-year term

Bajaj Auto’s Board of Directors has approved the re-appointment of Rajiv Bajaj as the company’s MD and CEO for another f...

JSW MG Motor launches Comet EV Blackstorm edition

The key highlights of the Comet EV Blackstorm, which is now the top-end variant, are its ‘Starry Black’ exterior along w...

Maruti Suzuki begins production at new Kharkhoda plant

Phase 1 of the Kharkhoda plant will have an annual production capacity of 250,000 units and produce the Brezza compact S...

14 Aug 2015

14 Aug 2015

8307 Views

8307 Views

Autocar India

Autocar India

Ajit Dalvi

Ajit Dalvi