GST IN TIME

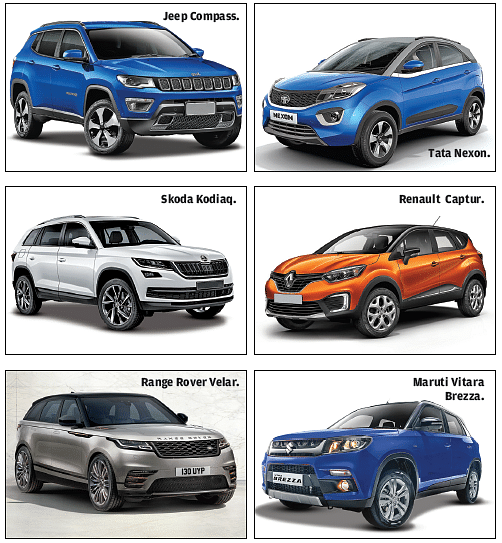

The biggest gainers in the GST regime are SUVs which see a sharp 12 percent reduction in tax from 55 percent to 43 percent. Accounting for a fourth of all passenger vehicle sales in India, and having notched near-30 percent year-on-year growth in FY2017 (761,997 units), FY2018 should see demand for SUVs surge even more.

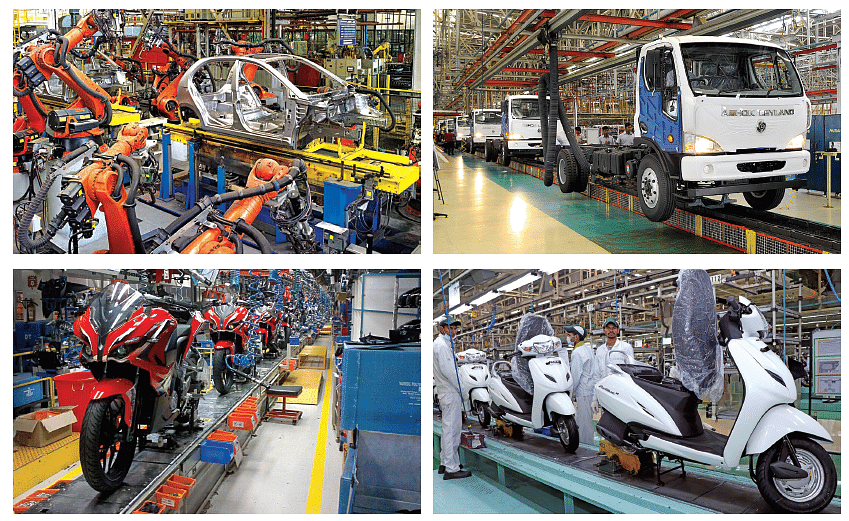

For India’s automotive industry, which has faced speedbreakers in the past few years in the form of the NGT and Supreme Court bans on diesel vehicles, demonetisation and the upgrade to BS IV, the recent rollout of the Goods & Services Tax (GST) bids fair to give a new charge to vehicle sales across segments and also drive an optimised manufacturing supply chain operation.

The automotive industry is well known to be the leading adopter of the lean manufacturing mantra of Just In Time (JIT). Introduced by Toyota Motor Corporation, this vehicle production system aims at complete elimination of all waste across all aspects of production in pursuit of the most efficient methods.

Briefly put, its overarching goal is to optimise processes and procedures in line with the overall goal of continuous improvement of productivity. This is turn leads to quality and cost gains, both to the manufacturer and the end consumer – and in turn to the industry at large.

That’s just what the Goods & Services Tax (GST) – the biggest-ever tax reform India has introduced – is attempting. More than five years in the making, the government finally rolled out GST at the stroke of midnight on July 1, 2017, as an efficiency enhancer of doing business in the country, aiming to dynamically change the way industries and the supply chain operate. As a single indirect tax for the whole nation, GST essentially is only one tax from the manufacturer through to the consumer, making the taxation process transparent and India into one unified common market.

Contrary to the Indian automotive industry’s expectations, there have been no major hiccups other than the steep tax on hybrids. Instead, the overall impact of the reformative one-country-one tax on the automotive sector will only serve to accelerate growth, particularly for the passenger vehicle sector which in FY2017 crossed the landmark three million units sales in the domestic market. The GST Council first released the rates on May 19. Under GST, there are four main vehicle categories – small cars, large cars, electric vehicles and hybrids. Most vehicle categories fall under a standard 28 percent tax rate, along with a provision that separately levies an additional variable cess on any category. Considering there has been a reduction in taxation across the board with the drop ranging from 2.25 to 12 percent, the automobile sector is set to see a huge jump in sales. Overall June 2017 sales were tepid as a good number of passenger vehicle and two-wheeler buyers delayed their purchase decisions to after GST kicking in, and vehicle manufacturers undertook stock rationalisation, especially at the dealer end, with most dealers focusing on liquidating their existing inventory so as to not carry it forward into July.

SUVs TO POWER PV SALES

The biggest gainers in the GST regime are SUVs which see a sharp 12 percent reduction in tax from 55 percent to 43 percent. Accounting for a fourth of all passenger vehicle sales in India, and having notched near-30 percent year-on-year growth in FY2017 (761,997 units), FY2018 should see demand for SUVs surge even more.

With handsome price-cuts and a flurry of new models expected in FY2018, expect SUVs to take a bigger share of the passenger car market. In FY2017, the passenger car segment sold a total of 2,102,996 units (+3.85%) but what helped the overall PV industry achieve the 3-million milestone has been the sharp growth in SUV sales at 761,997 units (+29.91%). Autocar Professional’s analysis reveals that over the past seven fiscal years, even as the overall PV market size has grown, the overall share of the passenger car market has fallen by 10 percent while that of UVs has risen by 12.5 percent, clearly indicating that SUVs have eaten into the car market and it’s a trend that’s set to continue. From a high of 79 percent market share (1,982,702 units) in 2010-11, the passenger car market has declined to 69 percent share (2,102,996) in 2016-17 even as the overall PV market has grown by 21 percent over a seven-year period.

For the SUV segment, of course, it’s been boom time particularly in 2016-17, where it recorded handsome 29.91 percent YoY growth coming on a back of plenty of new product launches, continuing demand for compact SUVs and a marked shift of customer preference for such models over conventional hatchbacks. Sales data from the past seven fiscals indicates that from a 12.59 percent share of the PV market in 2010-11, SUVs now account for 25 percent. This confirms what the industry had known all along – that out of every four new vehicles sold in India, one is an SUV. And the trend looks set to get stronger what with most PV manufacturers hard at work on developing new SUVs for the Indian market. Now, with GST rates adding wind to their sail, the SUV sales juggernaut can only get bigger.

Hybrids, surprisingly, have been kept in the highest rate bracket of 28 percent with an additional 15 percent cess (total of 43 percent), thus attracting the same amount of tax as a large car. But in a move that highlights the government’s push towards electric vehicles, EVs have been kept in a tax band of 12 percent, which is 16 percent lower than any other vehicle category.

What is vital is that vehicle manufacturers need to pass on the entire benefit of this overall drop in taxation rate to customers. And it was not long before OEMs – across segments – rushed to announce price cuts. In fact, the luxury carmakers were the first OEMs to announce price cuts – and big-ticket ones at that, given the wallet-busting prices. Like SUVs, expect the luxury car market, whose India sales have hovered between the 34,000-36,000 units mark for the past couple of years, to strike out on its own. For market leader Mercedes-Benz India, which has announced its best-ever Q2 sales (April-June 2017 / 3,521 units / +18%) and half-yearly numbers (January- June 2017 / 7,171 units / +8.7%), GST will be a further growth accelerator.

PV PRICES GO DOWN SHARPLY

From the smallest car to the biggest SUV, passenger vehicle prices have been rejigged downwards.

With a plethora of models across different vehicle categories, Maruti Suzuki seems to have balanced the net impact of GST on its portfolio, with average price of its range going down by up to 3 percent. The country’s top-selling car, the Alto 800, along with other big sellers like the Alto K10, Wagon R and the Swift, has received a marginal price cut of Rs 1,000. The hot-selling Vitara Brezza compact SUV and Dzire compact sedan now cost around Rs 3,000 less, albeit consumers would have desired a bigger cut on the Brezza given that SUVs have benefitted the most under GST. The company though has been adversely impacted by the high taxation on hybrids – its diesel-engined mild-hybrids, the Ciaz SHVS and Ertiga SHVS now completely lose their value propositions with price rises of up to Rs 188,000 and Rs 169,000 respectively. The Ciaz petrol, however, now costs Rs 7,000 less.

No. 2 player Hyundai Motor India has also cut prices across its portfolio, with the Grand i10 hatchback becoming cheaper by up to Rs 7,000. Of its SUVs, the popular Creta SUV has gone more affordable by up to Rs 63,000, the Tucson by Rs 115,000 and the Santa Fe by Rs 172,000. The lower D-segment Elantra sedan also gets a price drop of up to Rs 85,000.

Toyota Kirloskar Motor, with its solid line-up of brawny SUVs and MPVs, is among those offering the biggest price benefits across its range. The popular Fortuner SUV has seen a phenomenal cut of Rs 269,000, with the Innova Crysta MPV following suit with up to Rs 138,000. The company, like Maruti, has borne the brunt of the abysmal tax rate on hybrids, with its Camry Hybrid becoming dearer by Rs 524,000 and the Prius Hybrid seeing a price hike of up of Rs 510,000. Expressing his views on the post-GST pricing strategy, N Raja, director and senior vice-president, Marketing and Sales, Toyota Kirloskar Motor, said: “We are happy to pass on the benefits of GST rates on vehicles to our customers. A customer-first philosophy has always been our cornerstone. Thus, we are delighted that with the GST rates our best quality products will become more affordable for buyers. We are hopeful that the price decrease after GST will further boost customer demand in the coming months. GST will be fruitful for the growth of the Indian auto industry. We think the industry will break into double-digit growth territory this year,” said Raja.

Honda Cars India’s popular City sedan is now cheaper by around Rs 28,000. While the in-demand WR-V crossover will cost up to Rs 9,000 less, hatchback sibling Jazz stands reduced by Rs 8,000. The most drastic cut though is on the flagship SUV, CR-V – down by nearly Rs 132,000.

In the premium car space, Audi India has offered price benefits of up to Rs 84,000 on its big-selling A6 sedan, up to Rs 60,000 on its Q3 compact SUV while the flagship Q7 gets a substantial cut of Rs 311,000.

Jaguar Land Rover’s entry-level XE sedan sees its price reduce by up to Rs 313,000, the XJ petrol by Rs 661,000, and sitting atop the portfolio, the recently launched F-Pace SUV by Rs 12,00,000!

With the anti-profiteering provisions under the GST law in place, companies are bound to transfer the benefits received due to reduction in tax rates or input credit. Toyota seems to be among the few to have passed on the entire GST benefits to consumers. But, with GST being a credit-based taxation scheme, it needs to be focused that there still could be more scope to further review prices, when OEs arrive at a clearer picture of the net savings being incurred in their entire back-end, including their procurement and supply chain systems.

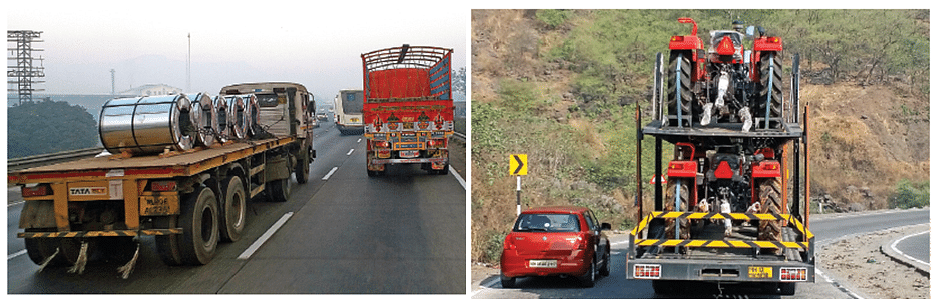

TRANSFORMING LOGISTICS

GST is already having a big transformative impact on the transport and logistics sector in India as free movement of goods and shorter duration trips will bring down costs significantly and make the sector efficient. In India, nearly 85 percent of goods transportation happens by road, although the government is now looking at shipping services as another key transport provider, helping take some load off the country's roads.

As part of GST reforms, most state governments have removed inter-state check-posts due to which fleet operators are logging considerably improved times. Nearly 22 states have removed barriers and other states are set to follow shortly. However, after the GST introduction, inter-state movement of goods has come down significantly as SMEs and key business are yet to formally adopt the new mechanism and nuances under new reforms.

Ratings agency ICRA said, "GST implementation and evolving customer needs are expected to favour organised logistics players going forward. GST implementation will also support organised players as it would have three major implications for the logistic sector – consolidation of warehousing network and a shift towards a ‘hub-and-spoke’ model, higher degree of tax compliance and creation of a level playing field between express and traditional transport services providers by virtue of access to input tax credit. There is also an increasing shift from pure transportation business to becoming end-to-end service providers, facilitating the growth of the Third- Party Logistics (3PL) and Supply Chain Management (SCM) industries in India.

Speaking to Autocar Professional, Parth Baweja, director, Delhi Baroda Road Carrier, a large fleet operator from Gurgaon, which transports automobiles as well as frozen goods across the country, said, “GST is good for the country and economy as a whole because it will help business become efficient. However, over the past 10 days, things have not improved to a large extent as there are a number of technical issues to address and government officials have no clue about the new system yet. The physical check-posts have disappeared but it will take at least 3-6 months before seamless transport and

faster movement of goods is achieved.”

Truck drivers are already experiencing huge relief. For instance, the Walayar check-post located on the Tamil- Nadu Kerala border is one of the busiest and sees nearly 800-900 trucks pass through every day. Before GST kicked in, truckers had to idle for as long as 7-8 hours to get their papers cleared by the authorities and sometimes even had to unload and reload goods for checking purposes. However, since July 1, the scenario has seen a sea-change.

Nevertheless, fleet operators and truckers fear that state governments may set up mobile or roaming squads till the E-Way Bill mechanism is in place. The E-Way Bill, which is likely to come into effect early next year, provides details of goods, the consignee and the consignor and the key documents for inter-state movement and tax compliance.

GST GETS A THUMBS UP FROM SIAM

Industry body, the Society of Indian Automobile Manufacturers (SIAM) is extremely optimistic over the impact of GST but has decided to be cautious for the next few months, before going ahead and revising its growth projection for FY2018. While the industry saw one of its slowest wholesale months in recent times in June, with most dealer inventories being cleared off, the retail business was already soaring at 15-20 percent up on a year-on-year basis.

According to Sugato Sen, deputy director general, SIAM, “The June wholesale numbers are not at all a projection of the fiscal. These numbers have to be seen in isolation and they are so because of the stock rationalisation before the implementation of the GST from July.”

Industry exports were also high in Q1 FY18, with PVs registering 14 percent growth at 181,000 units in Q1 2018. Two-wheelers too saw a 15 percent uptick with 12 percent of the production being shipped out, at 663,000 units in Q1 FY2018 (Q1 FY16: 577,000 units).

With most OEs having come out with their revised vehicle prices following GST implementation, and benign inflation supporting the cause, the industry body believes that the pent-up demand in the market, some of which is also due to the impact of demonetisation, will now be working towards driving consumption growth in the automobile sector.

Apart from this, the auto industry witnessed a reduction in major commodity prices in the last six months from December 2016 until May, with prices of HR steel dropping 4.71 percent, CR steel by 2.16 percent and lead by 4.68 percent. However, some materials have also seen a sharp rise; pig iron has gone up by 16.03 percent, virgin aluminium by 11.27 percent and carbon black, used in tyre manufacturing, by 32.93 percent during the same time.

Factors contributing further to a strong growth trajectory for FY2018 are a strengthening Indian rupee against the US dollar, and, vehicle finance rates, which, in the last one year have consistently trekked down, with nationalised banks dropping PV interest rates from 10.13 percent in July 2016, to 9.63 percent in June 2017.

SIAM expects the country's economic GDP to grow to 7.4 percent in FY2018, up from 7.1 percent in FY2017. Also, payouts of the Seventh Pay Commission, a better monsoon, good crop output, and additional OE capacities becoming functional to help reduce waiting periods for popular models, are key factors designed to drive a PV sales surge in FY2018.

All these factors are also going to remain beneficial to the two-wheeler space, with sales continuing to surge, and more so, better in the scooter segment, which will continue to grow at three times that of motorcycles. Bikes will see more growth in the premium motorcycle segment because of rising consumer aspirations.

However, SIAM has also projected that the overall cost of vehicle ownership is going to increase in FY18, on the basis of rise in insurance expenses, and incremental fuel costs, which are expected to remain higher at US$ 44-48 per barrel in CY2017, as against US$ 42 per barrel in CY2016.

With FY2017 having had more focus on UVs, the current fiscal is going to be more passenger car-centric, with new model launches, albeit marginally lesser than FY2016, slated to be more in the hatchback and sedan categories.

While being overall upbeat with GST, some key concerns remain and pose a threat to the PV space. The high tax levied on hybrid vehicles is one of the major grouses of industry. According to Vishnu Mathur, director general, SIAM, “We have already submitted our recommendations for a 10 percent cut in the GST rates placed on hybrid vehicles. There are different categories of hybrid vehicle technologies, and in the FAME Scheme as well, there is a different subsidy for each technology, based on the fuel efficiency offered. While there has not been any response yet from the GST Council, if we are further asked for suggestions, then we would propose on similar lines.”

Moreover, the reaction of certain states to resort to revising the road tax rates after GST, the only example, right now being that of Maharashtra, is being viewed as a major disappointment by the industry body and hopes that other states do not follow suit.

MAHINDRA SETS UP A GST TASK FORCE

A major vote of confidence for GST has come from Dr Pawan Goenka, managing director, Mahindra & Mahindra, who says the tax reform will help the Indian auto industry see accelerated growth. On July 6, he said, “We have set up a GST Implementation Task Force comprising of CFOs of various divisions of the automotive and tractor business. The transition to GST has been surprisingly smooth. All our suppliers have started delivering, our dealers have begun invoicing, despatches of vehicles and spare parts are also underway. What’s more, export billing has also started. It’s business as usual.”

Dr Goenka added that while it is still early days to quantify the transition loss from pre-GST to post-GST, there has been no disruption in business. Along with the process change, benefits to consumers, ease of doing business and simplification of the input value chain, there will be cascading benefits of GST, he said.

Commenting on the auto industry’s growth in the ongoing fiscal, he said: “I am positive about growth for industry overall. Along with GST reductions, if there is a reduction in interest rate of about 15-20 basis points (by RBI)), there will be further growth. The monsoon is on track and disrupters over the past few years – NGT, demonetisation, BS III and now GST – are all done now. I am looking forward to a very festive season this year.”

ACMA ALSO UPBEAT ABOUT INDIA'S BIGGEST TAX REFORM

The Automotive Component Manufacturers Association of India (ACMA), the apex body representing over 750 suppliers who contribute

more than 85 percent of the auto component industry’s turnover in the organised sector, is upbeat on GST. Vinnie Mehta, director general, ACMA, told Autocar Professional: "We are happy and welcome the new goods and service tax regime across India. This is a revolutionary tax reform which was awaited for years. It will no doubt bring ease of doing business across sectors including the automotive component industry."

"The Tier 1 suppliers are prepared for GST as the industry was anticipating the implementation of this new tax regime. However, there could be some issues and challenges on the front of compliance and IT elements. These teething issues can be solved if the Tier 1 component manufacturers handhold the Tier 2 and Tier 3 partners through this transition phase."

Commenting on the impact of GST across the auto industry, Rakesh Batra, partner and sector leader, Automotive, EY India, says: “We expect an overall sales growth in the passenger vehicle sector in low teens during FY2018, owing to reduced vehicle prices as a result of GST, expectations of a good monsoon season, new model launches and low fuel prices as well as financing costs.

"M&HCVs are expected to return to their path of growth during the latter part of the year with the effects of demonetisation gradually wearing-off, along with the government’s focus on infrastructure development.

"Going forward, LCVs are likely to witness stronger growth, driven by continued replacement demand and stronger demand from consumption-driven sectors and e-commerce companies. The overall commercial vehicle industry is expected to witness 5-7 percent growth in FY2018, on the back of infrastructure and rural sector development, passenger carrier segment, potential implementation of a scrappage program and the positive impact of GST on the logistics sector in driving the emergence of hub-and-spoke model. The implementation of GST is expected to drive freer and faster movement of goods across states. However, one would hope that the objective of GST does not get defeated as individual states come up additional levies.

"The two-wheeler segment is likely to witness a growth of 8-11 percent in FY2018, with expectations of a good monsoon, rural spending schemes by the government and personal income tax reduction in the low-income slab. The GST implementation is expected to benefit the mass market, as manufacturers have already reduced prices in the below-350cc segment.

"We expect the Indian automotive market to witness growth in several pockets in FY2018, driven by a good monsoon, lower interest rates, strong rural economy and smooth implementation of the GST pushing automakers to offer price cuts on vehicles. With the GST regime kicking in, luxury cars and SUVs are expected to witness an impetus, due to a considerable reduction in taxes. A key risk would be increased levy of registration taxes by state governments, which is outside of the GST scope.”

GST AS A GROWTH ACCELERATOR

FY2016-17 was a decent year for the overall Indian vehicle manufacturing industry which sold a total of 21,862,128 units for a year-on-year growth of 6.81 percent. Passenger vehicle sales crossed the 3-million mark at 3,046,727 units (+9.23%); the passenger car (2,102,996 / +3.85%) and utility vehicle (761,997 / +29.91%) segments notched their highest ever sales; and two-wheeler sales at 17.6 million units (+6.89%) were also a record for a fiscal. Export numbers for the PV (758,830 / +16.20%) and CV (108,271 / 4.99 %) sectors were the best-ever too as were shipments of scooters (293,592 / +14%).

Along with the upbeat market sentiment, a bountiful monsoon underway across the country and key growth parameters in place, GST is set to provide the accelerative force for India’s automotive industry to take the next leap of faith.

The country, which is billed to be the world’s third largest automobile major by 2020, is now at an inflection point. With

growth rates which are the envy of many a developed nation and an industry – OEMs and component suppliers – which is also exporting quality products and services the world over, a GST-enabled India now has the chance to notch higher and speedier growth.

Given the current domestic market indices, SIAM’s growth outlook for FY2018 – PVs (7-9%), CVs (4-6%), two-wheelers (9.11%) and three-wheelers (4-6%) is likely to be revised upwards, maybe later in the year.

The industry growth catalyst in the form of GST is a long-term one. There is no doubt that there will be some hiccups along the way for industry, as it comes to terms with the new tax reform but, once absorbed in its entirety, the dividends will be long-lasting. However, what will be imperative for continuity and sustained growth is that there be no abrupt policy changes from the government’s side. If that be the case, as it should be, then industry will be putting its shoulder to the GST wheel to drive India firmly on the global growth path.

RELATED ARTICLES

JSW MG Motor launches Comet EV Blackstorm edition

The key highlights of the Comet EV Blackstorm, which is now the top-end variant, are its ‘Starry Black’ exterior along w...

Maruti Suzuki begins production at new Kharkhoda plant

Phase 1 of the Kharkhoda plant will have an annual production capacity of 250,000 units and produce the Brezza compact S...

Eurogrip aims for price parity with ICE in low rolling resistance tyres

With its two-pronged approach that focuses on optimising energy consumption in the manufacturing process of low rolling ...

26 Jun 2011

26 Jun 2011

2305 Views

2305 Views

Autocar India

Autocar India

Ajit Dalvi

Ajit Dalvi