Car sales at pre-Covid levels but 2W sales playing spoilsport: FADA

Chip crisis sees passenger vehicle inventory at record 15-20 day low; poor demand for entry-level two-wheelers; three-wheeler segment seeing strong shift to electric.

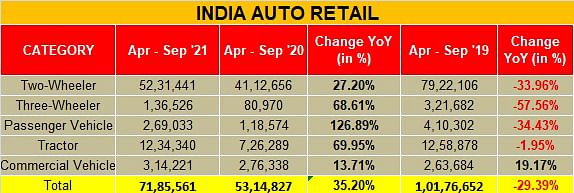

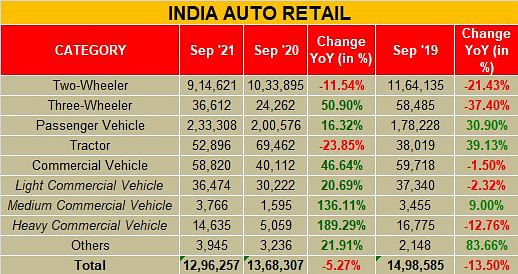

The first half of fiscal year 2022 has been a mixed bag for India Auto Inc, says apex dealer body FADA. Total retail sales in September 2021 were 12,96,257 units (-5.27% YoY) with all segments in the green except for two-wheelers and tractors. In terms H1 FY2022, auto retail grew by 35.2% at 71,85,561 units albeit on a low-year ago base, which is 29.39% lower April-September 2019 pre-Covid levels.

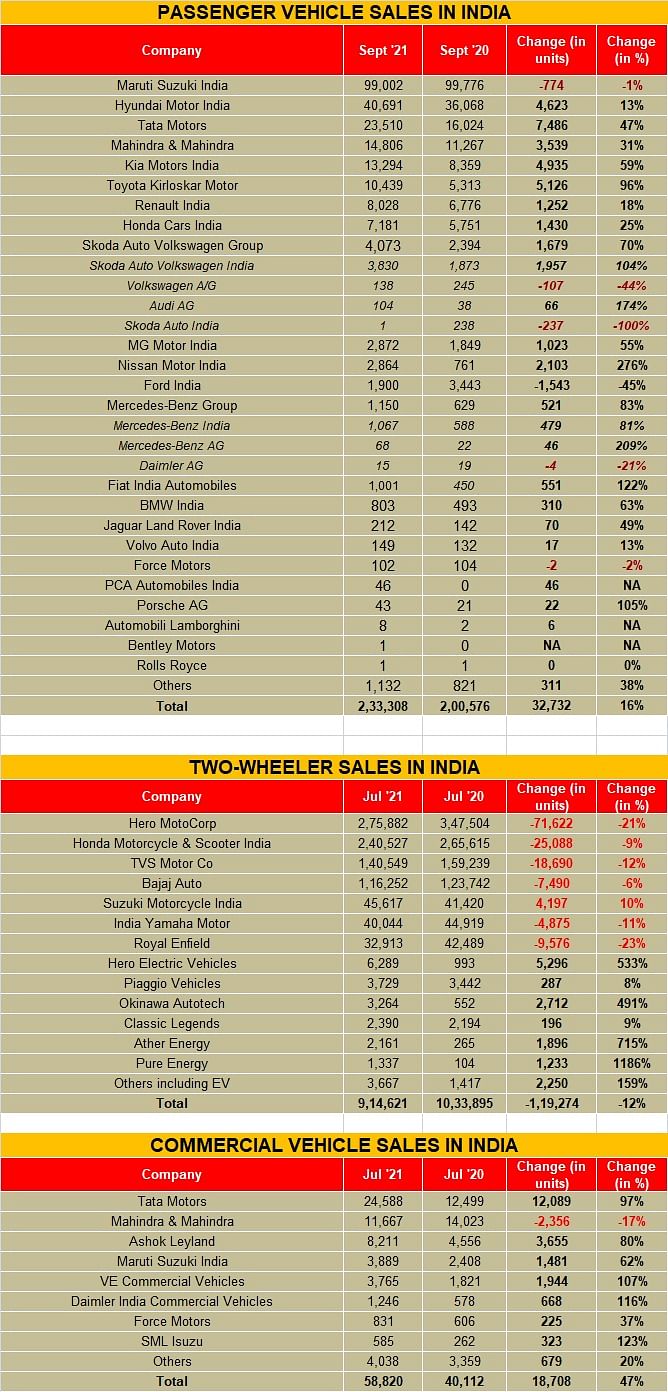

According to Vinkesh Gulati, President, FADA, “Auto retail in September has taken a pause as overall sales were down by 5%. During the first half of FY2022, while overall retails were up by 35%, the same was down by -29% when compared to 2019, a pre-Covid year. On a long-term basis, except tractors which grew by 19% and PVs which has almost reached pre-Covid levels, all the other segments were in the red. Two-wheeler sales continue to play spoilsport as the entry level segment is yet to witness healthy growth.”

He said the sales/performance of entry level two-wheelers is now becoming “critical for the overall two-wheeler segment to come back on the path of recovery as dealer inventory rises to 30-35 days in anticipation of a good festive.” Gulati also pointed out that the semiconductor shortage has also started impacting the 150+cc segment.

Gulati maintains his scepticism about the semiconductor shortage ebbing and its impact on the automotive industry is set to impact this year’s festive season. “The full-blown semiconductor crisis continues to create hindrance in PV sales as vehicle inventory at dealers end dip to record lows of 15-20 days during the current fiscal. With high demand in this segment, long waiting periods continue to frustrate and keep enthusiast buyers in a fix.”

Three-wheelers seeing strong shift to electric

Interestingly, FADA finds that the “three-wheeler segment is now showing clear signs of tactical shift from ICE to EVs as the ratio has hit a 60:40 split. With offices and educational institutions slowly opening up, electrification of three-wheelers will gather a greater momentum in months to come.”

As regards the commercial vehicle segment, the auto retail body finds that the “CV segment is finally showing greater strength as all sub-categories continue to grow YoY. M&HCVs for the first time also grew above the pre-Covid month level of September 2019.”

Mixed-bag outlook for festive season

FADA says with India entering the 42 days festive period beginning today, the near-term outlook for this year’s festive season will be a mixed bag. While dealers have increased their inventory in two-wheelers, PV inventory is at the lowest during this financial year due to the ongoing semiconductor crises. The chip shortage is not likely to ease within the next two quarters. As a result, PV sales are expected to stagnate going ahead even though OEMs are coming ahead with new launches to keep the market buzzing.

“With skyrocketing fuel prices and a drop in purchasing power, entry level customers in rural India are keeping themselves away from fulfilling their mobility needs. India’s vaccination drive has reached a remarkable momentum. This, coupled with a less likelihood of a third wave in the near future, and offices and educational institutions opening up in a phased manner, we anticipate a marginal recovery process to begin in the two-wheeler space. FADA hence requests all two-wheeler OEMs to roll out special promotions schemes so that it can springboard retails for a faster recovery,” concluded Gulati.

RELATED ARTICLES

Rajiv Bajaj reappointed MD and CEO of Bajaj Auto for five-year term

Bajaj Auto’s Board of Directors has approved the re-appointment of Rajiv Bajaj as the company’s MD and CEO for another f...

JSW MG Motor launches Comet EV Blackstorm edition

The key highlights of the Comet EV Blackstorm, which is now the top-end variant, are its ‘Starry Black’ exterior along w...

Maruti Suzuki begins production at new Kharkhoda plant

Phase 1 of the Kharkhoda plant will have an annual production capacity of 250,000 units and produce the Brezza compact S...

07 Oct 2021

07 Oct 2021

4190 Views

4190 Views

Autocar India

Autocar India

Ajit Dalvi

Ajit Dalvi