Bajaj Auto takes 57% market share in three-wheelers

Making the most of the resurgent demand for three-wheelers is market leader Bajaj Auto, which has sold a total of 325,024 units in the first 11 months of FY2018, notching year-on-year growth of 38.07 percent.

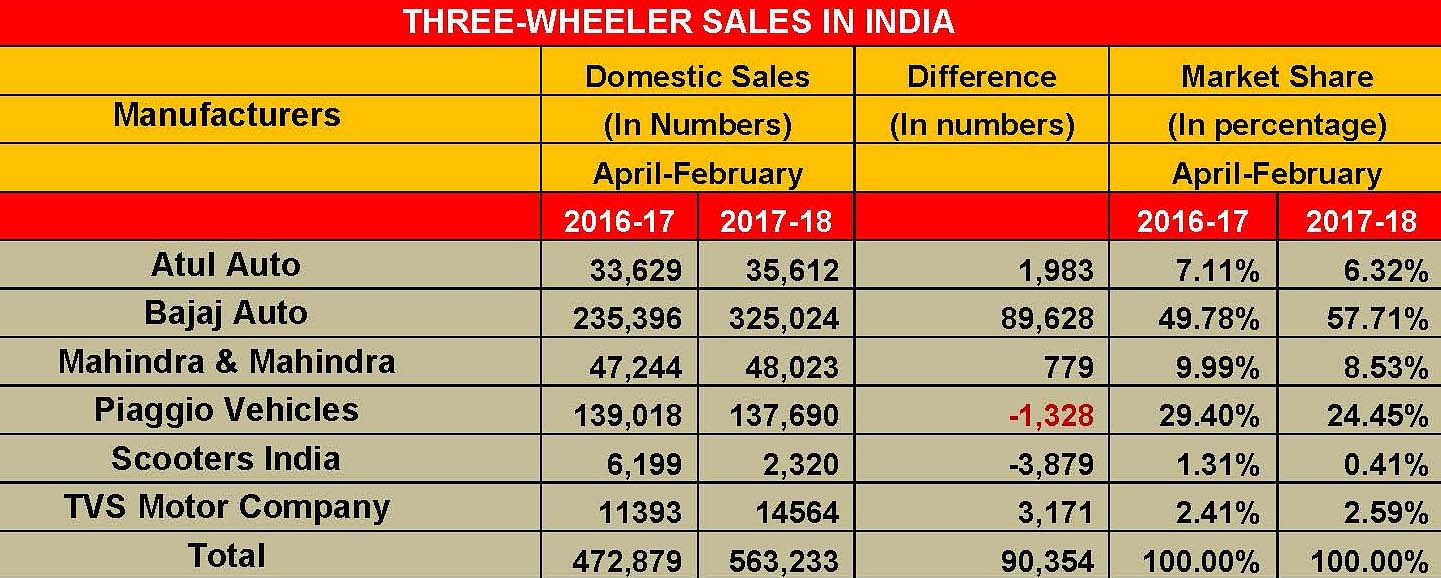

With all vehicle segments, barring mopeds and M&HCV and LCV (passenger carriers), registering strong growth in the first 11 months of the ongoing fiscal, FY2018 looks set to be a news-making year for the Indian automobile industry. The three-wheeler segment too is firing on all cylinders, having recorded total sales of 563,233 units (+19.11%).

These numbers indicate that demand in the three-wheeler market, which in FY2016-17 fell 4.93 percent to 511,658 units, has returned. Industry experts had said that the decline was due to three-wheelers being replaced by aggressively priced, small four-wheeled mini-trucks. But current industry numbers belie that. Within the three-wheeler segment, both passenger carriers (457,719 / +22.36%) and goods carriers (105,514 / +6.80%) have seen demand come their way this fiscal.

How the OEMs fared

Making the most of the resurgent demand for three-wheelers is market leader Bajaj Auto, which has sold a total of 325,024 units in the first 11 months of FY2018, notching year-on-year growth of 38.07 percent. This comprises 305,053 passenger carriers (+36.23%) and 19,971 goods carriers (73.87%). This handsome uptick in its sales has seen Bajaj Auto record a remarkable increase in market share – from 49.78 percent in April-February 2017 to 57.71 percent in April-February 2018.

TVS Motor Co has also made gains, albeit smaller. The Chennai-based manufacturer sold 14,564 units in the fiscal year till now, which marks a YoY growth of 27.83 percent. This performance has helped the company increase its market share to 2.59 percent from 2.41 percent a year ago.

All the other players in this segment have seen market share declines, which could be a result of Bajaj Auto and TVS eating into their share despite the overall market growing by 19.10 percent to 563,233 units from 472,879 units a year ago.

While Piaggio Vehicles, the No. 2 player, has sold 137,690 units, which marks flat growth of 0.95 percent, Mahindra & Mahindra sold 48,023 units (+1.64%). Meanwhile, the Rajkot-based Atul Auto sold a total of 35,612 units, a 5.89 YoY increase.The final OEM in the segment is Scooters India which, with sales of 2,320 units, is down 62.57 percent.

Also Read:

Exclusive: TVS Motor sells a million scooters in India for first time ever in a fiscal

Winners and losers in the SUV market share game

Two-wheeler sales grow by 26.33% YoY in February 2018

Boom time for midsize motorcycles in India

Movers and shakers in the Indian two-wheeler industry

Scooters power two-wheeler industry growth in Q1 FY2018

Top 10 Scooters – January 2018 | Honda Activa and TVS Jupiter firing on all cylinders

RELATED ARTICLES

Rajiv Bajaj reappointed MD and CEO of Bajaj Auto for five-year term

Bajaj Auto’s Board of Directors has approved the re-appointment of Rajiv Bajaj as the company’s MD and CEO for another f...

JSW MG Motor launches Comet EV Blackstorm edition

The key highlights of the Comet EV Blackstorm, which is now the top-end variant, are its ‘Starry Black’ exterior along w...

Maruti Suzuki begins production at new Kharkhoda plant

Phase 1 of the Kharkhoda plant will have an annual production capacity of 250,000 units and produce the Brezza compact S...

By Autocar Professional Bureau

By Autocar Professional Bureau

15 Mar 2018

15 Mar 2018

71556 Views

71556 Views

Ajit Dalvi

Ajit Dalvi