Global light vehicle sales move up a gear in May

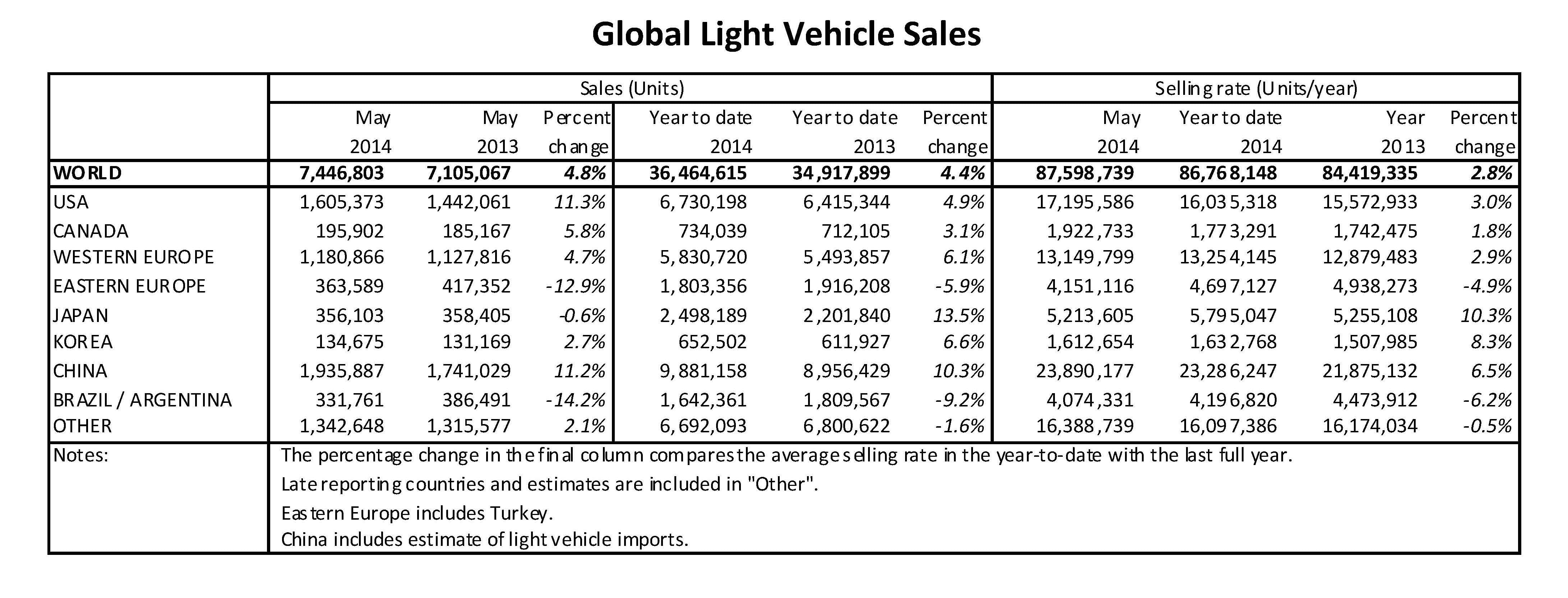

Global light vehicle sales have moved up a gear in May 2014 as the seasonally adjusted annualised rate (SAAR) of sales hit near-record levels of 87.6 million units/year, only slightly below the peaks of late last year.

Global light vehicle sales have moved up a gear in May 2014 as the seasonally adjusted annualised rate (SAAR) of sales hit near-record levels of 87.6 million units/year, only slightly below the peaks of late last year.

According to global automotive intelligence provider LMC Automotive, strong results in China, the US and Canada, coupled with solid outcomes in Western Europe,Japan and Korea combined to offset weakness in Eastern Europe and South America.

North America

In the US, a number of positive factors for Light Vehicles came together to produce a strong selling rate of over 17 million units/year in May, representing a full recovery to pre-crisis levels. LMC Auto does not expect such a strong market to be sustained for the full year but a solid result appears to be in prospect for this year.

In Canada, Light Vehicle sales were up almost 6 percent in an already strong market. With an estimated selling rate of 1.9 million units/year, a new full-year record is increasingly likely.

Europe

West European sales remain on course for a 4-5 percent increase in 2014. The May result in France and Germany was a little disappointing but this was offset by better performances in Italy and the UK, where the Light Vehicle selling rate closed in on 2.8 million units/year.

The same improving trends are not at all evident in Central and Eastern Europe where the Russia-Ukraine situation is inflicting damage on markets. The important Russian market, having ended 2013 at a 3.0 million units/year selling rate, has now dipped to a rate of around 2.4 million

units/year, thereby losing around 20 percent of ongoing sales volume. Early signs of a more stable political situation may lead to the market to bottom out soon, but there are clearly significant risks.

China

According to preliminary data, China’s selling rate in May reached a record high of 23.9 million units/year, accelerating from a downwardly revised 23.0 million units/year in April. On a year-over-year basis, sales increased by 11 percent in May. Sales are continuing to be boosted by panic buying on the expectation that an increasing number of major cities will impose purchasing restrictions to reduce air pollution.

There are, however, reports that inventory at the dealer level has risen, which suggests that some slowdown in sales ahead. In the economy, the central bank has been increasing liquidity in the market to prop up economic growth, which, along with the government’s mini-stimulus measures, may help support vehicle sales.

Other Asian markets

In Japan, sales have been resilient since the consumption tax was raised on April 1. The May selling rate was a stronger-than-expected 5.2 million units/year, up marginally after a 15 percent (month-over-month) decline in April. Yet such a pace may not be sustainable, as income growth is not catching up with rising inflation.

In South Korea, the selling rate moderated to 1.6 million units/year in May from an exceptionally strong April. However, the sustainability of such a robust pace is in question, as the country’s large export sector continues to struggle and the unemployment rate is rising.

South America

In Brazil, the May selling rate of 3.4 million units/year was slightly higher than expected, but June and July are expected to see a marked slowdown, as consumers will be busy watching the World Cup soccer games. Inflation has continued to rise which, along with high interest rates, should continue to constrain spending on new vehicles this year.

In Argentina, sales plunged by over 35 percent year on year for the third consecutive month in May along with a deteriorating economy. Rampant inflation, a weakening job market, and the rising prospect of a financial crisis continue to depress consumer confidence and vehicle sales.

Source: LMC Automotive

RELATED ARTICLES

Isuzu unveils D-Max EV at 2025 Commercial Vehicle Show

Revealed at the 2025 Commercial Vehicle Show in Birmingham, the Isuzu -Max EV is the first fully electric commercial pic...

Hyundai unveils next−gen highly efficient hybrid system

The next-gen hybrid system is claimed to offer 45% better fuel efficiency and 19% more power compared with ICE powertrai...

Horse Powertrain reveals hybrid conversion for electric cars

Engine-making joint venture of Geely and the Renault Group announces new hybrid powertrain that fits into the same space...

13 Jun 2014

13 Jun 2014

2835 Views

2835 Views

Autocar Professional Bureau

Autocar Professional Bureau