Covid19-hit Global Auto Inc to see deeper decline than during the Great Recession: LMC

LMC currently is forecasting 2020 global light vehicle sales to fall below 77 million units, a decline of nearly 14 million units or -15% from the 2019 level. In India, sales in 2020 are expected to plunge nearly 20% from 2019.

As the COVID-19 pandemic unleashes unprecedented uncertainty and risk on the world’s population and economy, automotive forecasting company LMC expects the impact on the global auto industry to be substantial, with the percentage decline significantly worse than that experienced during the Great Recession.

While the environment remains extremely dynamic, LMC currently is forecasting 2020 global Light Vehicle sales to fall below 77 million units, a decline of nearly 14 million units or -15% from the 2019 level. For comparison, global Light Vehicle sales fell 6 million units from 2007-2009 to 64 million units, a two-year decline of 8.7%, or 4.5% CAGR (compounded annualised growth rate).

The economic backdrop has deteriorated rapidly, and the global economy is already in a recession. GDP growth expectations have turned negative in most countries, resulting in zero global GDP growth for 2020, down significantly from the January forecast of 2.5% growth for the year. A key part of the economic shock has been the massive lockdown of normal consumer and business activity in most major markets around the world. Many OEMs have shut down assembly across Europe, North America and parts of Asia as population controls have been applied in order to slow the spread of the virus. Unemployment is expected to rise considerably across the world, hitting larger purchases such as vehicles beyond the near-term, even as business starts to return to normal activity.

LMC is also modelling a scenario in which COVID-19 impact continues well into H2 2020 or relapses in late Q3 and Q4. If that were to take place, we would expect global Light Vehicle sales to decline more than 20%, with volume falling to 69 million units. Such a scenario would put 2021 and the longer-term recovery pattern at further risk. Even with a high level of risk to global autos, the industry is far better prepared to weather this, and is in a healthier position, after experiencing the 2008-2009 Great Recession. In addition, policy makers have taken a matter of weeks in this crisis to do what took a couple of years during the financial crisis – combining huge monetary and fiscal support packages. The responses may not be perfect, but such coordinated efforts should help facilitate a faster recovery. LMC revises 2020 forecast, significant cut to India

LMC revises 2020 forecast, significant cut to India

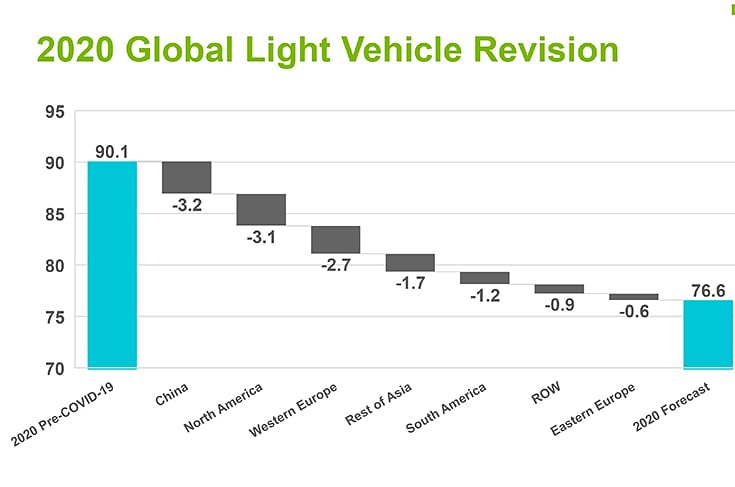

Just two months ago and prior to the outbreak of COVID-19, LMC expected global Light Vehicle sales to be flat from 2019, at 90.1 million units. Several major markets, including the US, Western Europe and Japan were expected to contract in 2020. Auto sales in China had already declined for the last two years and there was some expectation of the market turning the corner in 2020, with slight volume growth expectations.

A global market, with some growth headwinds from a slowing economy and trade still a risk in the background, quickly changed to a global market in chaos, a situation that is likely to remain for some time. In assessing the composition of the 2020 forecast revision, it is clear that no market will escape the impact of the COVID-19 pandemic. LMC has taken out approximately 3 million units from China, North America and Western Europe each, accounting for more than two-thirds of the entire volume reduction. China appears to be past the worst as business goes back to work, but it is unclear if this is temporary or a true stabilisation of the environment. Europe and the US have taken over as the new epicentres, with a high probability of further material downside risk.

The latest round of revisions includes a significant cut to India, as the country is now on lockdown for 21 days. Sales in 2020 are expected to plunge nearly 20% from 2019. The ASEAN-5 market has been cut by 500,000 units, or 14%, and Iran is expected to be down by more than a third. South America was a week or two behind other markets in both outbreaks and aggressive response, but that has changed. Argentina has started a 12-day mandatory quarantine while several states in Brazil are imposing lockdowns for up to a two-week period. The result is a pullback of 1.2 million units across the region, sending the market into an expected 27% decline from 2019.

Report and data: LMC Automotive

RELATED ARTICLES

Horse Powertrain reveals hybrid conversion for electric cars

Engine-making joint venture of Geely and the Renault Group announces new hybrid powertrain that fits into the same space...

Aisin to produce hybrid motor for Mitsubishi in Thailand

The hybrid drive motor and gearbox, will be produced at Aisin Powertrain (Thailand) Co for use in the Mitsubishi XForce ...

GM reports strong Q1 sales in China, demand for EVs and hybrids surges 53%

General Motors and its joint ventures in China have sold more than 442,000 units between January and March 2025.

By Autocar Professional Bureau

By Autocar Professional Bureau

27 Mar 2020

27 Mar 2020

16853 Views

16853 Views