Vehicle sales in China keep sliding, no immediate respite in sight

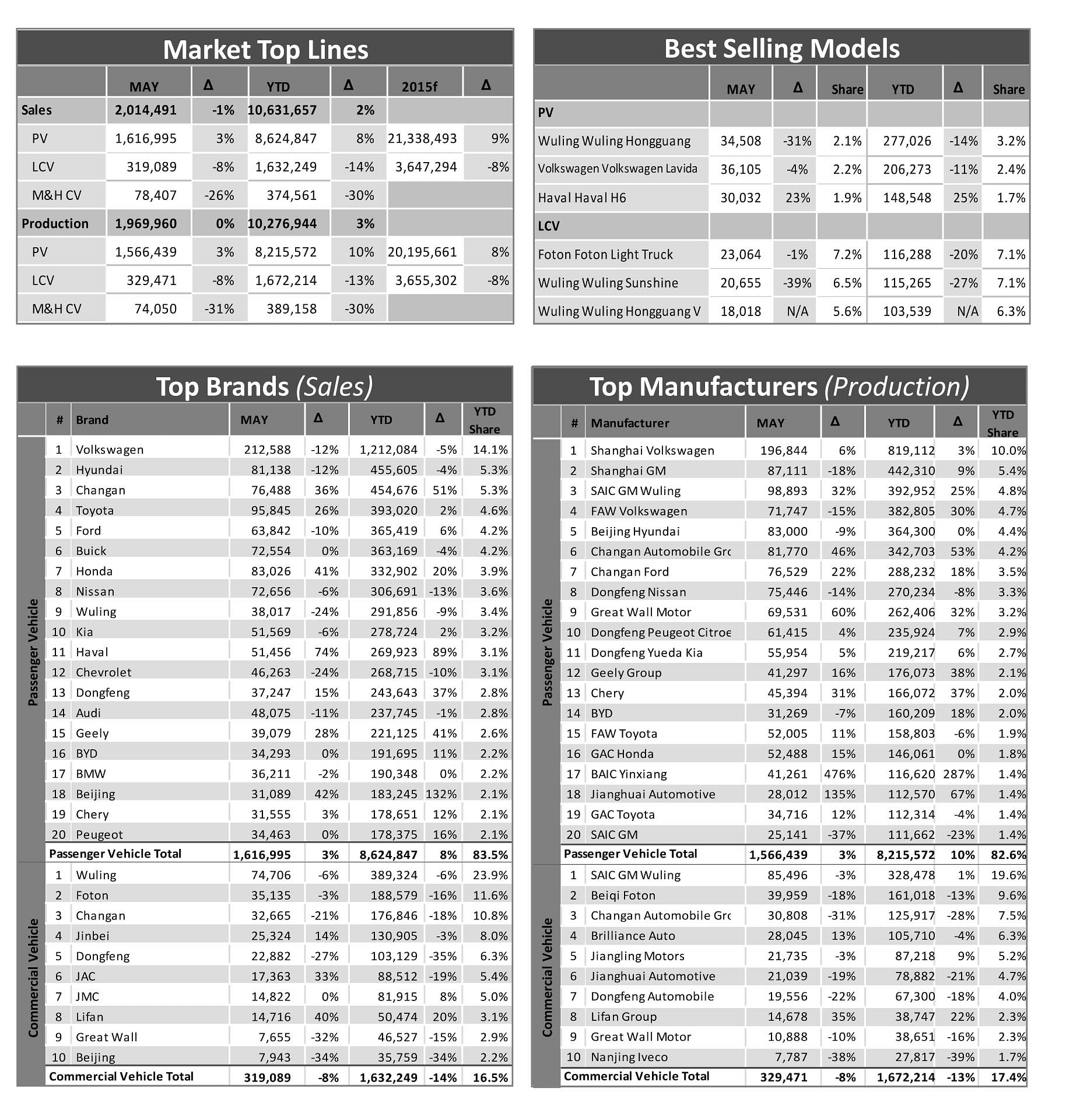

China’s passenger car market continued its slowdown in May 2015, with year-on-year (YoY) growth in sales of locally-made models dropping to 1.4%, the lowest level since September 2012.

China’s light vehicle market continued its slowdown in May 2015, with year-on-year (YoY) growth in sales of locally-made models dropping to 1.4%, the lowest level since September 2012.

Within the light vehicle market, the Light Commercial Vehicle sector showed some signs of improvement as the yearly sales decline narrowed to 8.4% in May, versus 13.3% in April and 16.2% in March.

YoY growth in sales of locally-made passenger vehicles slipped to 3.7% in May, versus 5.8% in April and 12.3% in March. These poor results have brought YoY growth in the passenger vehicles space in YTD terms down to 8.9%, well below the all‐important double‐digit growth threshold.

A look at the fluctuations in inventory levels does not reveal any reason for optimism either, at least in the short-term. A monthly survey administered by the China Automobile Dealers Association (CADA) indicates that the dealer‐level destocking process came to an end in May, with the inventory index edging up to 1.70 months, from 1.67 months in April. Due to the high levels of inventory at dealers, OEMs are likely to adopt a cautious approach when it comes to flooding the dealer network with excess units in a bid to fulfill their wholesales targets.

Production exceeds sales in 2014

In 2014, production exceeded sales by 270,000, or 1.4% of total production for the year, the highest level seen in the market since 2007 and well above the average of 0.6% seen between 2010‐2013. The gap between production and wholesale increased by another 140,000 units during the first five months of this year, which is expected to place a heavy burden on production schedules in the months ahead.

The restrictions on vehicle purchases in China’s largest cities have led to a flat sales trend in Tier 1 cities so far this year for passenger vehicles. Sales in Tier‐2 cities have seen only single‐digit growth to date in 2015, in contrast to the same period last year when they drove overall market growth. Meanwhile, the current gloomy economic outlook has stifled any potential momentum in less developed areas of China.

With this in mind, chances are that the painful market adjustment currently under way is far from over. In light of the lower‐than‐expected sales of passenger vehicles in May and the slower‐than‐expected reduction in inventory levels, LMC Automotive, a leading provider of automotive forecasts in China, has downgraded its full‐year forecast for passenger vehicle sales in 2015 by around 100,000 units and now expects to see growth of 8.6% in the sector and 5.7% in the light vehicle market as a whole.

RELATED ARTICLES

Horse Powertrain reveals hybrid conversion for electric cars

Engine-making joint venture of Geely and the Renault Group announces new hybrid powertrain that fits into the same space...

Aisin to produce hybrid motor for Mitsubishi in Thailand

The hybrid drive motor and gearbox, will be produced at Aisin Powertrain (Thailand) Co for use in the Mitsubishi XForce ...

GM reports strong Q1 sales in China, demand for EVs and hybrids surges 53%

General Motors and its joint ventures in China have sold more than 442,000 units between January and March 2025.

By Autocar Professional Bureau

By Autocar Professional Bureau

30 Jun 2015

30 Jun 2015

2244 Views

2244 Views