Brexit shutdowns hit UK car production hard in April

Apex industry body SMMT again warns of no-deal Brexit risks after planned shutdowns lead to sharp decline in manufacturing

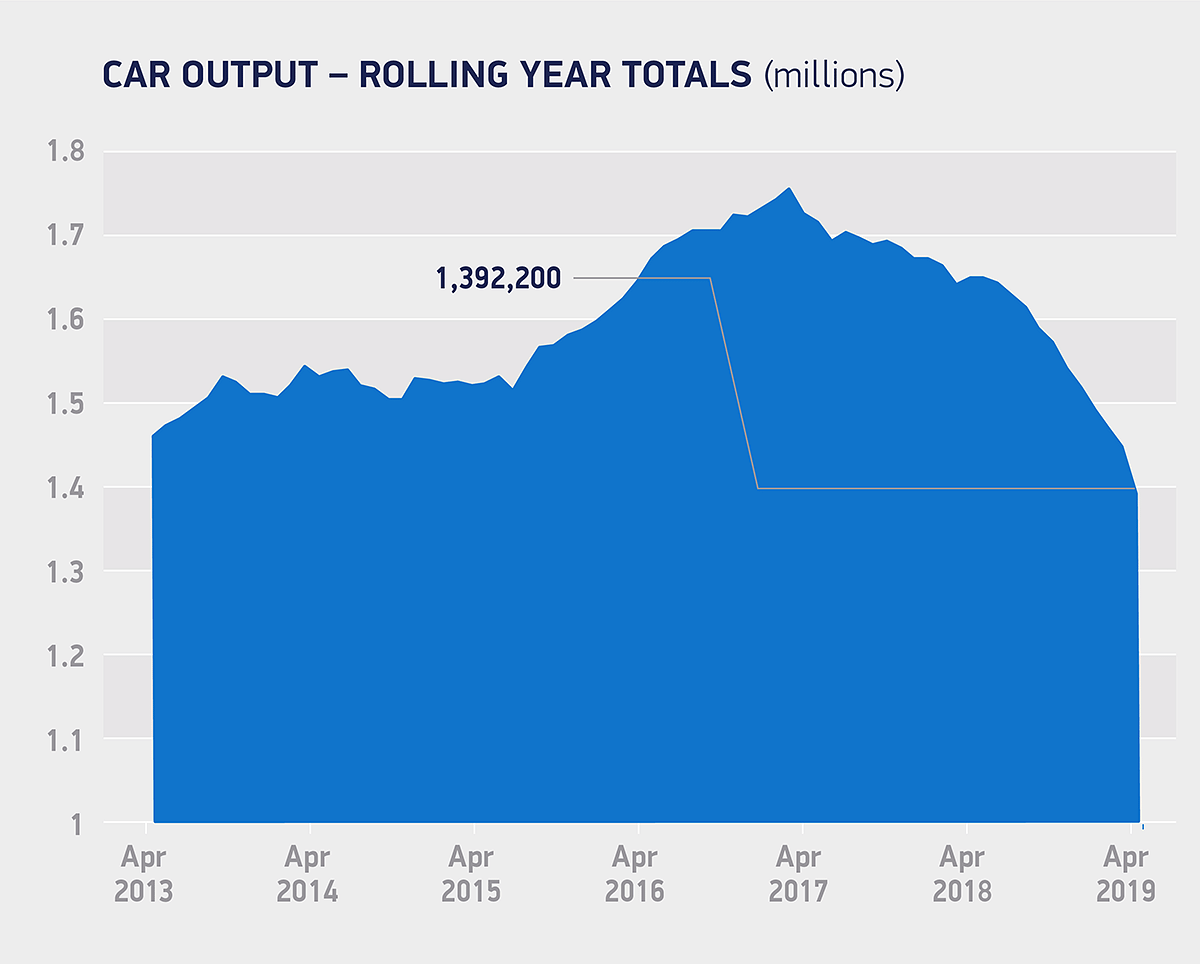

A number of factory shutdowns timed to coincide with the originally scheduled date of Britain's departure from the European Union led to a dramatic 44.5% year-on-year slump in UK car manufacturing in April.

A total of 70,971 cars were built in the UK in April, down 56,999 on the 127,970 produced in the same month of 2018, according to data produced by the Society of Motor Manufacturers and Traders (SMMT). It was the 11th straight month in which manufacturing output declined.

While UK manufacturing has been substantially down in 2019 – with a 22.4% year-on-year decline so far – the April figures were heightened by several car firms, including Jaguar Land Rover, Honda, BMW, Mini and Rolls-Royce, bringing forward production stoppages usually planned for the summer to guard against any delays caused by Britain leaving the European Union, which had been due to take place on 29 March.

Brexit was subsequently delayed, and is now scheduled to take place on 31 October. It is highly unlikely firms will be able to suspend production again following this date, and SMMT president Mike Hawes again called on politicians to rule out a ‘no deal’ Brexit to minimise further damage to the industry.

Hawes said the figures were “evidence of the vast cost and upheaval Brexit uncertainty has already wrought on UK automotive manufacturing businesses and workers”.

He added: “Prolonged instability has done untold damage, with the fear of ‘no deal’ holding back progress, causing investment to stall, jobs to be lost and undermining our global reputation.

“This is why ‘no deal’ must be taken off the table immediately and permanently, so industry can get back to the business of delivering for the economy and keeping the UK at the forefront of the global technology race.”

Production figures in April were also hit by a decline in demand in both the UK and overseas, including the continuing struggles within the Chinese and EU markets.

The SMMT estimates that, if the UK leaves the EU with a "favourable deal and substantial transition period", the decline in production will ease by the end of the year – although in this best-case scenario year-on-year output would still be around 10.5% down on 2018.

Also read: Brexit and diesel powertrain concerns lead to UK car sales dip

Brexit could be ‘opportunity’ for Vauxhall

RELATED ARTICLES

Hyundai unveils next−gen highly efficient hybrid system

The next-gen hybrid system is claimed to offer 45% better fuel efficiency and 19% more power compared with ICE powertrai...

Horse Powertrain reveals hybrid conversion for electric cars

Engine-making joint venture of Geely and the Renault Group announces new hybrid powertrain that fits into the same space...

Aisin to produce hybrid motor for Mitsubishi in Thailand

The hybrid drive motor and gearbox, will be produced at Aisin Powertrain (Thailand) Co for use in the Mitsubishi XForce ...

30 May 2019

30 May 2019

4066 Views

4066 Views

Autocar Professional Bureau

Autocar Professional Bureau