BEV sales in Europe increase by 25% in February, Chinese EVs outsell Tesla

Demand for battery electric vehicles in Europe jumped by 25% to 164,148 units, which is the highest BEV volume on record for both the month of February and January-February, during which 329,700 units were registered, up by 31%. In February, Chinese-owned car brands registered sales of 19,800 new EVs in Europe, outpacing Tesla which sold a little over 15,700 units.

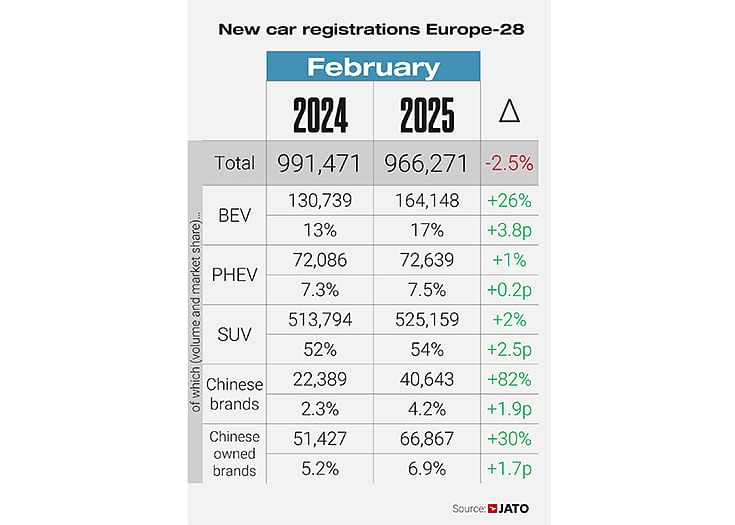

Demand for battery electric vehicles (BEVs) in Europe continues to be strong, as seen in the latest retail sales figures. This, even as overall demand for new passenger vehicles fell in February 2025 by 3% YoY to 966,300 units. According to JATO Dynamics data for 28 markets (EU-25 + UK, Norway, and Switzerland), decreases in Germany, Italy, Belgium, the Netherlands, Switzerland and Ireland were the main drivers of this trend. Year-to-date passenger vehicle registrations fell by 2% to a total of 1,962,850 units.

Commenting on the European market’s sales last month, Felipe Munoz, Global Analyst at JATO Dynamics, said: “There are still no clear signs of recovery in the European automotive industry. Uncertainty in the domestic market is being further complicated by challenges in both China and the US.”

BEV demand jumped by 26% to 164,148 units, which is the highest BEV volume on record for both the month of February and January-February (329,700 units, up 31%).

BEV demand jumped by 26% to 164,148 units, which is the highest BEV volume on record for both the month of February and January-February (329,700 units, up 31%).

Tesla registrations plunge

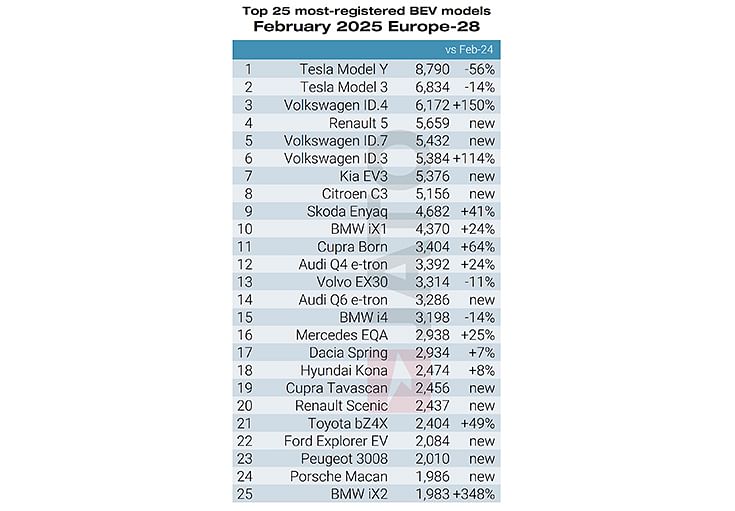

Against the positive backdrop of BEV sales rising in strong double digits, Tesla’s market share fell to 9.6% – the lowest it has been during the month of February over the last five years. The brand’s year-to-date market share fell from 18.4% in 2024 to 7.7% this year.

According to Munoz, “Tesla is experiencing a period of immense change. In addition to Elon Musk’s increasingly active role in politics and the increased competition it is facing within the EV market, the brand is phasing out the existing version the Model Y – its best-selling vehicle – in anticipation of the introduction of a new refreshed version.

“During this process, brands often experience a drop in sales before they return to normal levels, once the updated model becomes widely available. Brands like Tesla, which have a relatively limited model lineup, are particularly vulnerable to registration declines when undertaking a model changeover.”

In February, registrations of the Model Y fell by 56% to 8,800 units, while registrations of the Model 3 fell by 14% to 6,800 units. “The difference in volume drops between these two vehicles suggests that the decline in the brand’s overall sales is more firmly rooted in the Model Y changeover than Musk’s political activity. However, it will be interesting to see to what extent demand rebounds once the new Model Y hits markets across the region.”

Chinese brands outpace Tesla in BEV sales

The difficulties that Tesla is currently facing have created opportunities for some of its competitors. In February, Chinese-owned car brands registered 19,800 new electric vehicles in Europe, outpacing Tesla which registered just over 15,700 units. In the same month last year, the former registered 23,182 units compared to the 28,131 registered by Tesla.

The best-selling Chinese-owned car brands were Volvo, BYD and Polestar. While Volvo recorded a 30% drop in BEV registrations, BYD and Polestar made substantial gains, with increases of 94% and 84% respectively. Xpeng also performed well with more than 1,000 units, closely followed by Leapmotor with almost 900 units.

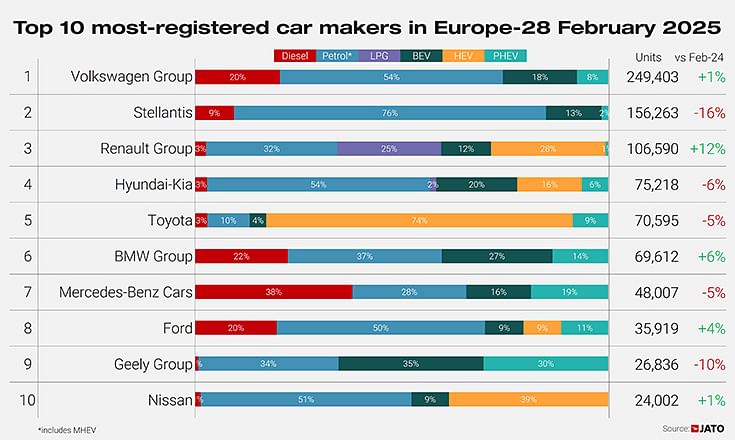

The Volkswagen Group registered sales of 249,403 vehicles and marginal 1% YoY growth in February 2025. Renault Group was the month’s top performer, with a 12% increase in volumes and a market share gain of 1.5 points.

The Volkswagen Group registered sales of 249,403 vehicles and marginal 1% YoY growth in February 2025. Renault Group was the month’s top performer, with a 12% increase in volumes and a market share gain of 1.5 points.

Volkswagen Group leads overall PV sales, Renault Group shines

While the Volkswagen Group continued to lead the market with share of 25.8%, Stellantis followed in second position but lost 2.6 points of share when compared to February 2024 due to double-digit drops at Citroen, Opel / Vauxhall and Fiat. The Renault Group was the month’s top performer, with a 12% increase in volumes and a market share gain of 1.5 points. The group’s strong performance in February can be attributed to positive results posted by the Renault Clio, Dacia Duster and the new Renault Symbioz and Renault 5.

Much of Renault’s success is to be found in the BEV segment, with 9,400 BEVs registered in February, up by 96%. The French manufacturer was only outperformed by Volkswagen, which recorded a 108% increase in BEV sales. Other strong increases within the BEV segment include Audi (+67%), Kia (+56%), Skoda (+63%), Citroen (+190%), Cupra (+179%), Mini (+804%), and Ford (+146%). In contrast, Tesla, Volvo, MG, Fiat, Jeep and Smart all recorded declines.

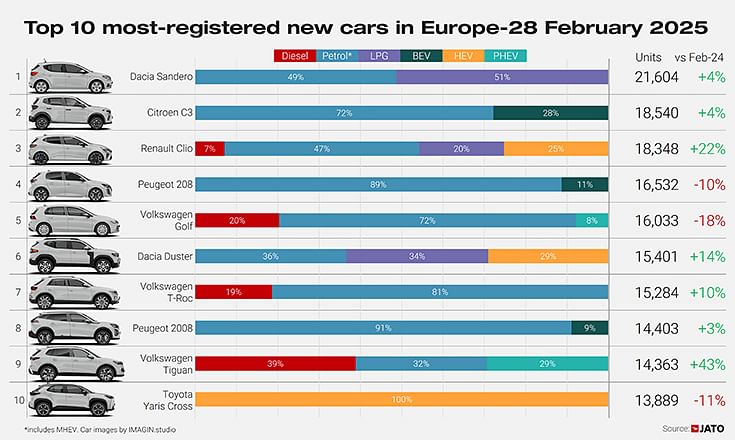

With 21,604 units sold, up 4% YoY, the Dacia Sandero was the best-selling model in February 2025.

With 21,604 units sold, up 4% YoY, the Dacia Sandero was the best-selling model in February 2025.

Dacia Sandero is best-selling model in February 2025

The Dacia Sandero once again led in the ranking by model as Europe’s most registered new vehicle during the month. Meanwhile, second position was occupied by the Citroen C3, with the new generation already being widely available. The Renault Clio followed closely in third thanks to a 22% increase in volumes – the second best within the top 10, only outperformed by the Volkswagen Tiguan, in ninth position, which recorded a 43% increase in registrations.

The Tesla Model Y and Skoda Octavia have dropped out of the top ten model rankings, making way for the Dacia Duster and Volkswagen Tiguan. The best-performing models in the top 100 include: the Peugeot 3008 (+40%), MG ZS (+47%), Skoda Kodiaq (+32%), Jeep Avenger (+40%), Volkswagen ID.4 (+150%), Volkswagen ID.3 (+114%), Skoda Enyaq (+41%), Mini Countryman (+109%), BMW 5 Series (+54%), Fiat 600 (+369%), Audi A5 (+181%), Audi A6 (+74%), Mercedes E-Class (+49%) and Cupra Born (+64%).

Data tables and charts: JATO Dynamics

ALSO READ:

Electric car and SUV sales in India to scale new high in FY2025

RELATED ARTICLES

Aisin to produce hybrid motor for Mitsubishi in Thailand

The hybrid drive motor and gearbox, will be produced at Aisin Powertrain (Thailand) Co for use in the Mitsubishi XForce ...

GM reports strong Q1 sales in China, demand for EVs and hybrids surges 53%

General Motors and its joint ventures in China have sold more than 442,000 units between January and March 2025.

Volkswagen to invest $580 million in Argentina, plots new pick-up truck for South America

Volkswagen is paving the way for the next generation of mid-size pick-up truck as a successor to the Amarok. The new mod...

25 Mar 2025

25 Mar 2025

3060 Views

3060 Views

Autocar Professional Bureau

Autocar Professional Bureau