‘India Auto Inc is opening up to new tech like giga stampings’: Antonio Lopez, CEO – Asia Division, Gestamp

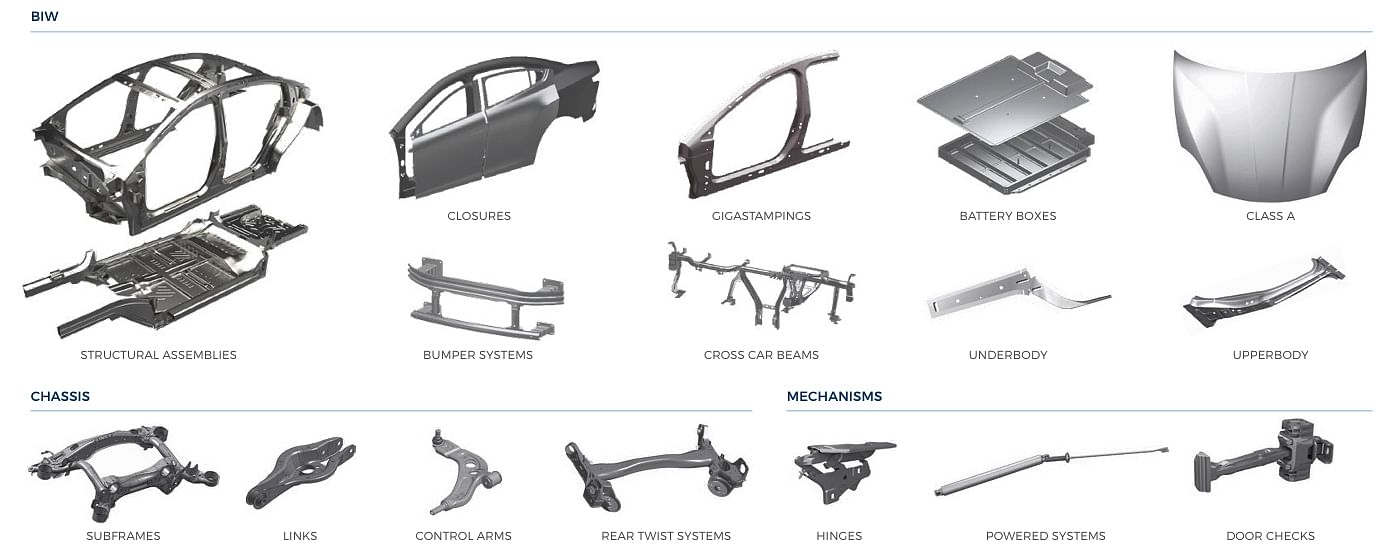

The Tier-1 supplier of vehicle body-in-white (BIW), chassis, and mechanisms, is getting OEM orders in India for its EV-specific battery boxes locally manufactured by the giga-stamping process. Gestamp is also enabling passenger vehicle OEMs in the country meet stringent requirements around safety and lightweighting.

Where does India stand in Gestamp’s automotive business in Asia? What are the company’s expectations from the Indian market?

We have been established in India since 2007 and, throughout all these years, we have been growing our business in the country steadily. The Indian market has been growing at a rapid pace in the recent years, and there are projections of a strong market growth in the future as well. Therefore, our strategy is to continue making investments in India based on the plans of our customers.

India is a very important market for Gestamp in terms of hardware development, and we will continue undertaking those activities like we have done in the past. We have been making investments in introducing new technologies in India to not just align with the market growth, but to also cater to the stringent requirements, particularly around quality, safety, and lightweighting that are now increasingly in demand.

Gestamp showcased its latest portfolio at the Bharat Mobility Global Expo in New Delhi last month.

Gestamp showcased its latest portfolio at the Bharat Mobility Global Expo in New Delhi last month.

What is Gestamp’s future product roadmap for the Indian market?

Gestamp has a strong expertise in manufacturing as well as design, wherein we work with our customers to help them achieve their targets. In the changing era towards electrification and sustainable mobility, we are seeing additional requirements for lightweighting and higher safety, and we are fully prepared to support our customers.

In India, we have been doing so through our four manufacturing sites – two each in Pune and Chennai -- as well as our R&D centre located in Pune, through which we are introducing our latest technologies in the country. As the market develops further, our local competencies will help us introduce newer products which are cost-effective – a key demand from the Indian customers. Therefore, we are bringing new technologies which are highly-advanced as well as cost-effective.

In this regard, we have been working on several body-in-white (BIW) products related to giga stampings – extremely large stamping parts produced with lower cost of manufacturing – that also help simplify assembly at our customers’ end by reducing the number of individual parts. Furthermore, we are leveraging newer materials, and new concepts that help us meet their requirements. We have multi-material offerings depending on the customer needs, and as efficiency is a key requirement for both these vehicle propulsion systems, we have products which are suitable for both ICE and EVs.

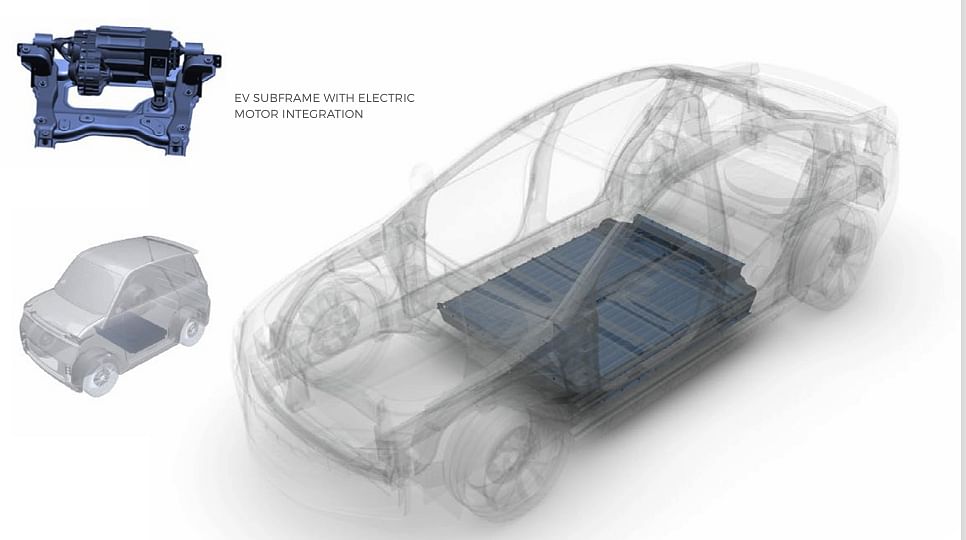

Gestamp's EV subframe with electric motor integration.

Gestamp's EV subframe with electric motor integration.

Which are the new products focussed on vehicle electrification?

Particularly for EVs, we are introducing battery cases and battery boxes to support our customers in India. Gestamp is leading the way when it comes to the development and introduction of these technologies in the country. We are working with all the prominent passenger vehicle (PV) OEMs in the country on different projects, and supporting them through our plants in Chennai and Pune.

Lately, we have been very active in this product category, and are realising new supply awards based on battery boxes developed by the giga-stamping process. We have some of them in the pipeline for a couple of our customers.

The Indian automotive industry is becoming more open to adopt new technologies, given the recent changes in regulations. At the same time, the local regulations, with respect to safety, are becoming more stringent, and we can support on that front as well. Our partners in India are seeing the value these advanced solutions are offering.

Gestamp's R&D teams are offering various solutions such as the new electric battery box and chassis components integrating the new electric motors.

Gestamp's R&D teams are offering various solutions such as the new electric battery box and chassis components integrating the new electric motors.

While most of our vehicle chassis solutions are multipurpose and agnostic to ICE or EV, the battery box is something that is more EV-specific. At the same time, we can offer different solutions, depending on the powertrain – ICE, hybrid, or EV – by focusing on certain differentiated requirements for each of them with our specific products.

The EV market in India is only in its beginning stages, and the predominant portion of the demand is still driven by combustion-engine-powered vehicles. Having said that, the introduction of our new combustion-engine products in India will eventually transition to EV applications in the future as the EV market grows. As a key supplier, we are supporting the electrification trend in India by following our customers’ plans.

What level of growth do you expect from the Indian market in the future?

Since India is one of our key markets, and with our well-established footprint in the country, we will grow in tandem with the market growth. Today, India is within the Top-5 vehicle manufacturers in the world and ,therefore, the relevance of the market has increased significantly. Like what we have done in other markets, we will continue expanding in the Indian market, and continue supporting our customers.

Today, our installed capacity allows us to grow rapidly, compared to the past. We have made some investments related to EVs – with the battery boxes – and are geared with the advanced technologies and quality to supply to the market.

Is it challenging to locally source raw materials such as high-strength steel for advanced chassis solutions?

The availability of raw materials for advanced chassis solutions is starting to now improve in India, and as the demand grows further, even material suppliers will augment their localisation initiatives. Our suppliers are understanding that India is a growing market and they are paying attention to that.

Therefore, we expect that the availability of localised raw materials will improve further in the coming years. Having said that, there are certain limitations, particularly around finding the right sources for aluminium, but in Gestamp, we always find a solution, depending upon the need, cost, and material availability – to offer the best solution to our customers.

Globally, Gestamp has tied up with ArcelorMittal to develop low-carbon steel. What are the plans to introduce it in the Indian market?

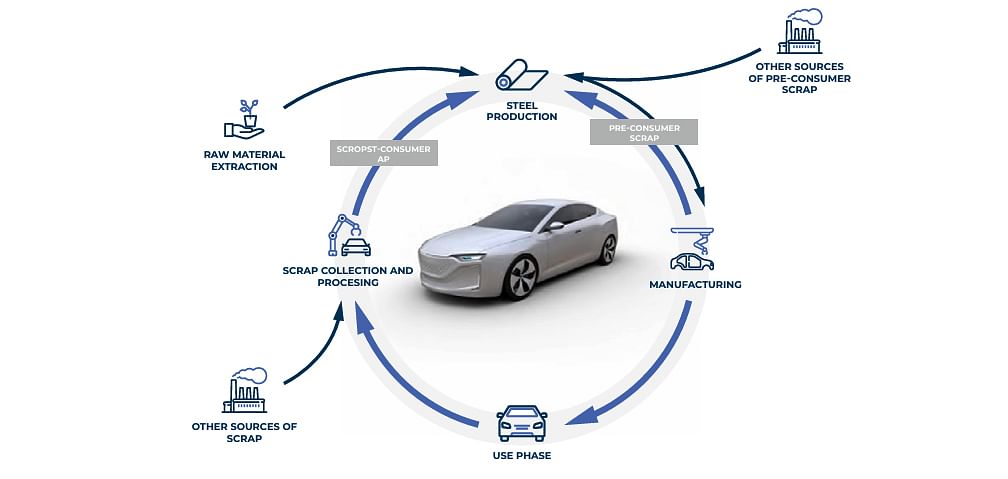

Gestamp is increasingly focused on driving sustainability and in several markets, we have been selected as an industry mover that is introducing greener technologies. When it comes to sustainability, the entire supply chain must come together, and not just steel, other materials in a vehicle need to be more sustainable as well.

There must be a critical mass for us to introduce sustainable materials such as green steel, and our agreement with ArcelorMittal is applicable globally. So, whenever there is enough demand, we can introduce these materials in India. Moreover, we have several other partnerships with other material suppliers, and we are quite proactive when it comes to sustainability.  On similar lines, we are also implementing solar energy sources in our facilities in India, and regardless of our customers’ roadmap, we are also voluntarily trying to lead on the sustainability front. Through Gescrap, which is involved in circularity, we aim to tap into high-value scrap recycling. Therefore, we believe that there must be a joint effort among all stakeholders to ensure tangible outcomes with respect to sustainability.

On similar lines, we are also implementing solar energy sources in our facilities in India, and regardless of our customers’ roadmap, we are also voluntarily trying to lead on the sustainability front. Through Gescrap, which is involved in circularity, we aim to tap into high-value scrap recycling. Therefore, we believe that there must be a joint effort among all stakeholders to ensure tangible outcomes with respect to sustainability.

Where do you foresee the Indian market in Gestamp’s global rankings in the mid-term future?

Within Asia, India is a key market for Gestamp that is increasingly becoming more relevant. And we are expanding our management teams in the country to fulfil the requirements of our customers. More importantly, we are also trying to enhance our localisation to be closer to our customers.

While we do not have a specific target for India, today, in terms of the market share, India’s contribution to Gestamp globally is not that high as we are much more well established in other mature markets. But we have been steadily growing in India, and in the past two years, we have been making inroads in the country by working with more customers who are now relying on our technology and expertise to make a mark in the EV era by building safer and lighter cars.

Our biggest market is Europe; we have a significant presence in the US, and we are growing our presence in China and other emerging markets such as Mexico as well. We see growth in these pockets globally and we are locally supplying to OEMs to tap into the growth potential offered by these markets. We are quite optimistic that India will continue to grow in the future. We see a strong opportunity to support the OEMs in the country and make a difference in the market with our products.

Does Gestamp aim to diversify into segments beyond passenger vehicles?

While we do have some business in the commercial vehicle (CV) segment – particularly LCVs – we do not see them being significantly different from PVs when it comes to the requirements for lightweighting, and safety. As CV OEMs introduce electrification in their products, there is going to be a higher requirement for lightweighting, and thus, our solutions can find application there.

Furthermore, if we look outside the automotive space, there are applications such as energy storage systems that also require similar product characteristics like the EV battery boxes in terms of their design and durability. This could be a potential area of diversification for Gestamp in the future.

What is your demand outlook for the global automotive industry in 2025? What would be the key challenges ahead for the industry?

2025 is going to be a year when the global automobile demand will not be as dynamic as it used to be in the past. The Indian market, however, is different as it promises higher GDP growth, which would translate into good growth in its automobile market as well. Generally, 2025 is going to be challenging not only in terms of the varying demand from different geographies, but also due to the geo-political challenges around the world.

Furthermore, there could be challenges due to increasing competition at the customer and supplier ends. But as Gestamp, we always embrace competition, which strengthens our business by pushing us to reinvent ourselves by offering newer products, and continue improving them. This benefits the end consumer. We would also continue to work towards achieving sustainability goals and realising the net-zero carbon emissions goal.

ALSO WATCH:

Interview | Glyn Jones, Country Manager & President, Gestamp India

RELATED ARTICLES

"Connectivity and ADAS will drive the next wave of disruption": Sundar Ganpathi

Tata Elxsi's CTO Sundar Ganapathi on how connectivity, ADAS, and data will define the next wave of automotive disruption...

INTERVIEW- Renault CEO Cambolive: 'India Is Renault' — Targets 3–5% Market Share by 2030

Renault is pursuing a fundamental reset of its India strategy, says brand CEO and Chief Growth Officer Fabrice Cambolive...

INTERVIEW: "EV Demand is Rebounding both in India and Around the Globe" - JLR's Rajan Amba

Jaguar Land Rover India MD Rajan Amba discusses the India–UK FTA, the company’s manufacturing plans, the upcoming Panapa...

13 Feb 2025

13 Feb 2025

14490 Views

14490 Views

Darshan Nakhwa

Darshan Nakhwa

Hormazd Sorabjee

Hormazd Sorabjee

Prerna Lidhoo

Prerna Lidhoo