Kia India Enters a Phase of Correction, Revenues and Profits fall in FY-24

Revenue and profit for FY-24 fall for the first time since COVID-19; tax and regulatory headwinds add pressure to core operations.

South Korean car major Kia India has reported its first year-on-year decline in profit and revenue since the COVID-19 pandemic, reflecting the impact of a slowing passenger vehicle market and intensifying competition in the Indian automotive sector.

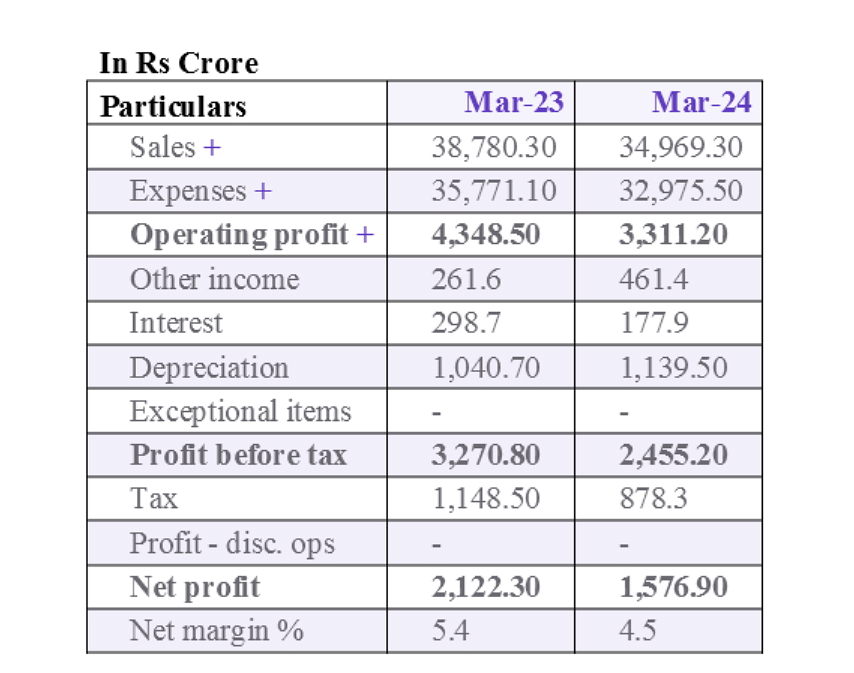

According to the company's financial filing with the Ministry of Corporate Affairs, for the financial year that ended March 2024, the company’s revenue decreased by 9.8% to Rs. 34,969.3 crore, down from Rs. 38,780.3 crore in FY23. This marks the first revenue contraction since the fiscal year 2020, when the industry grappled with pandemic-related disruptions.

The company’s net profit declined 25.7% year-on-year, from Rs. 2,122.3 crore in FY23 to Rs. 1,576.9 crore in FY24. Operating profit fell to Rs. 3,311.2 crore from Rs. 4,348.5 crore in the previous year, while the net profit margin slipped from 5.4% to 4.5%.

The net profit declined primarily due to lower operating leverage from volume compression and rising raw material costs that affected the company’s gross margin. The gross margin, which measures the impact of pricing and raw material costs on profitability, fell by 146 basis points to 22.06% from 23.32%, mainly due to higher raw material costs. The share of raw materials in total revenue increased to 77.94% in FY24 from 76.48% the previous year, resulting in a rise in raw material costs per vehicle to Rs 915,430—one of the highest levels since Kia set up operations in India.

Additionally, the increase in employee costs and other expenses as a percentage of sales further pressured the EBITDA margin, which decreased by 174 basis points to 9.47%. The EBIT margin, which reflects profitability – after all expenses and depreciation – dropped by 232 basis points to 6.21%, one of the lowest among carmakers, excluding Tata Motors. It’s important to note that the EBIT margin is typically the best measure of a carmaker’s profitability in the investment community. Kia India's EBIT per vehicle decreased to Rs 72,949 in FY24, which is 18% lower than Hyundai India’s and 16% higher than Maruti Suzuki's. Interestingly in FY23, Kia India’s EBIT per vehicle was nearly double that of Maruti Suzuki.

Reviewing the financial earnings, the directors' report noted, “During the year, the Company sold 245,634 units (compared to 269,229 units in the previous year) in the domestic market and 52,105 units (compared to 85,756 units in the previous year) in the export market. Your directors are confident of achieving higher sales growth in the ensuing years.”

The company has attempted to sustain excitement in the marketplace with updated Seltos and Carnival models over the last 12–18 months and has brought in Syros to drive incremental sales. The company aims to return to double-digit growth in 2025, which could reflect positively in FY-26 earnings, but the financials of FY-25 too is expected to remain under stress due to overall volume pressure amid tough demand environment.

The company ended FY-25 with a growth of 4% in the domestic market led by improved volumes in Q4 helped by additional sales of Syros. With the all-new Carens, Carens EV, and Syros EV lined up, and the next-generation Seltos expected within the next 12–24 months, the younger sibling of the Hyundai Motor Group is poised to make a strong comeback.

To be sure, Kia was seen as a shining example of how to launch a brand in India, which has seen the exits of global brands like Ford and GM. The South Korean carmaker was the fastest to cross Rs. 30,000 crores in turnover and Rs. 2,000 crores in profits in India.

In a short period, the brand not only broke into the top five carmakers, thanks to the successful launch of the Seltos and Sonet, but also climbed into the top 3–5 markets for Kia globally.

The volume challenges in both the domestic and export markets have weighed on the volume expansion of Kia India, a wholly-owned subsidiary of Kia Corporation from South Korea, in fiscal year FY24. This has resulted in contrasting outcomes across the overall volume segments.

Kia Motor India's total volume fell by 16%, reaching 297,739 units in FY24. Of this, domestic market volume declined by 8.78% to 245,634 units, while exports plummeted by 39% to 52,105 units, reducing export volume contribution to 17.5% from the historical average of around 20%.

However, revenue realization remained strong in both domestic and international markets, with the average realization per vehicle rising by 8% year-on-year (YoY), from Rs 10,64,599 in the previous year to Rs 11,74,495 in FY24. The export realization of Kia India is approximately 33% higher than domestic realization.

Therefore, any drop in the export share negatively impacts on overall revenue growth. The domestic market realization per car increased by 9.5% to Rs 11,08,600, while export realization rose by 10.28% to Rs 14,84,943 YoY. This helped mitigate the revenue impact of the sharp volume decline, with total revenue falling by 10% YoY. As a result, the company’s share of total India’s passenger car revenue dropped to around 7.6% in FY24, from 10% in the previous fiscal year.

However, during the financial year 2023–24, Kia slipped out of the top five positions in the highly competitive Indian passenger vehicle market, as growth slowed to single digits — ceding ground to Toyota Kirloskar, which posted strong sales on the back of growing demand for its hybrids and incremental volumes from Suzuki-badged products.

Despite the decline, FY24 remains Kia India’s third consecutive profitable year, following its turnaround in FY21. The company’s performance will now be closely watched as it navigates a more competitive landscape, two straight years of single-digit growth, and evolving consumer preferences, particularly in the shift toward electric mobility.

Kia maintained tight control over its cost structure, with total expenses declining from Rs. 35,771.1 crore to Rs. 32,975.5 crores. However, rising depreciation costs and growing reliance on non-operating income rose to Rs. 461.4 crore from Rs. 261.6 crore — indicate emerging pressure on core operations.

The company held cash and cash equivalents of Rs 4,961 crore at the end of FY24, compared to Rs 5,401 crore in the previous year. Other income rose to Rs 461 crore in FY24 from Rs 261 crore in FY23, accounting for nearly 18.79% of the profit before tax. This helped cushion the impact on profits from lower operating margins and reduced volume. The profit per car decreased by 11% to Rs 52,976 in FY24, from Rs 59,790 the previous year

Kia India Faces Multiple Tax and Duty Challenges Amid Regulatory Scrutiny

Kia India is currently facing a series of tax and customs-related issues, as regulatory authorities have raised multiple concerns regarding import classifications, GST audits, and income tax assessments.

While the company maintains that it has complied with all applicable laws, the financial impact of these disputes is significant, with several matters still pending resolution.

The most substantial exposure comes from customs-related matters. During the year ending March 31, 2024, the company received demand notices totaling Rs. 179.60 crore from the Commissioner of Customs, revealed the MCA filing. The notices allege that Kia incorrectly classified the import of certain parts, resulting in the payment of lower customs duties. To mitigate potential interest and penalties, Kia had already deposited Rs. 35.32 crore under protest in earlier years.

In a separate and more material case, the Directorate of Revenue Intelligence (DRI) alleged that Kia misclassified Completely Knocked Down (CKD) kits of its Carnival model as parts. In response to this ongoing inquiry, the company paid Rs. 278.34 crore under protest. Following the close of the financial year, Kia received an additional demand notice of Rs. 1,351.20 crore from the Commissioner of Customs in Chennai related to the same matter.

In addition to these, other customs disputes—currently at various stages of appeal—amount to an outstanding demand of Rs. 3.13 crore. Beyond customs, Kia is also addressing a show cause notice (SCN) received from the Goods and Services Tax (GST) department. Issued on August 5, 2024, the SCN relates to audit observations for the fiscal years 2017 to 2022. The department has requested detailed documentation and explanations, and the company is currently preparing its formal response.

On the income tax front, the company received an assessment order on July 26, 2024, from the National Faceless Assessment Centre (NFAC) for the Assessment Year 2020–21. The order involves a disputed variation in income arising from transfer pricing and disallowance of certain advertising and marketing expenses. As a result, tax losses amounting to Rs. 192.18 crore have been reversed, with a corresponding tax impact of Rs. 67.15 crore. Kia has appealed against the order which is currently pending before the Commissioner of Income Tax (Appeals).

In a separate case for Assessment Year 2018–19, the Assessing Officer denied Kia’s claim of tax losses amounting to Rs. 39.38 crore, citing disagreement over the date the business was considered operational for tax purposes. The tax impact of this disallowance is Rs. 13.76 crore, and a formal tax demand has been raised.

Despite these developments, Kia India has maintained that it has a reasonable basis for its positions in each case and is confident in pursuing appropriate legal remedies. However, the cumulative tax and duty exposures, both paid and under dispute, represent a considerable compliance burden that the company must continue to manage in the near term.

A. Customs Duty Issues

• The Directorate of Revenue Intelligence (DRI) and Commissioner of Customs have raised concerns over how Kia India classified certain imported parts. Authorities believe the company underpaid customs duty by wrongly categorizing parts.

• So far:

- Demand notices totaling Rs. 179.60 crore have been received.

- Kia has already paid Rs. 35.32 crore under protest in earlier years to avoid future penalties or interest.

• In a separate case, related to the import of CKD (Completely Knocked Down) kits for the Carnival model:

- Kia has paid Rs. 278.34 crore under protest.

- After the financial year ended, the company received another demand of Rs. 1,351.20 crore from Chennai Customs.

• In other smaller customs-related disputes, there is an outstanding demand of Rs. 3.13 crore, which is still under appeal.

• Despite these issues, Kia believes it has followed the law and is in the process of responding to the authorities.

B. GST Matters

• After the financial year closed, on August 5, 2024, the GST Department sent Kia a Show Cause Notice (SCN) related to GST audits for the years 2017 to 2022.

• The GST authorities have requested that Kia submit detailed documents and explanations. The company is currently working on a comprehensive response.

C. Income Tax Issues

1. Assessment Year 2020–21

• Tax authorities disallowed certain expenses related to:

- Transfer pricing in international transactions.

- Marketing and advertisement costs.

• This resulted in the reversal of Rs.192.18 crore in carried-forward tax losses, leading to a tax impact of Rs. 67.15 crore.

• Kia has appealed against this order, and the case is with the Commissioner of Income Tax (Appeals).

2. Assessment Year 2018–19

• Tax authorities disputed the date when Kia started its business, which led them to deny Rs. 39.38 crore in tax losses.

• This results in a tax impact of Rs. 13.76 crore.

• The authorities have raised a formal tax demand.

Kia India is facing multiple tax and duty-related challenges

Source - Tofler

Source - Tofler

• Customs disputes totaling over Rs. 1,569 crore (Rs. 35.32 + Rs. 179.60 + Rs. 278.34 + Rs. 1,351.20 + Rs. 3.13 crore).

• A fresh GST audit notice is being responded to.

• Income tax disputes for prior years with a total tax impact of over Rs. 80.91 crore (Rs. 67.15 + Rs. 13.76 crore).

Kia is contesting most of these and believes it has a strong case in its favor.

RELATED ARTICLES

Trump, Tesla And Tariffs

Can the auto components industry cope with lower tariffs and new competition in the Trump era?

Corning Sees Steady Demand For Filtration Substrates

Despite electrification, the American giant that specialises in material science is bullish about the demand for its fil...

Bajaj GOGO: New Brand, New Strategy

Bajaj Auto, which has a 65% share in the three-wheeler market, has unveiled a new brand, GoGo, hoping to end M&M’s domin...

06 Apr 2025

06 Apr 2025

2182 Views

2182 Views

Shahkar Abidi

Shahkar Abidi

Mayank Dhingra

Mayank Dhingra