Will EV sales in India hit 2 million units in FY2025?

Eleven months into the current fiscal, the Indian EV industry has sold a total of 1.76 million units and needs to sell 239,285 EVs more in March 2025 if it is to crack the 20,00,000 retail sales milestone for the first time. To achieve that, the Indian EV industry will have to improve upon its March 2024’s 213,107 sales. The key question is . . . will it?

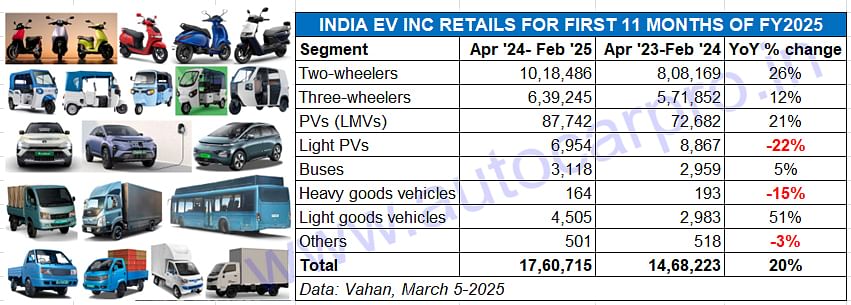

Having missed the 2-million retail sales milestone in in calendar year 2024 by a whisker – just 49,521 units – India EV Inc is once again in the reckoning for the big 20,00,000 number in FY2025. In the first 11 months of the fiscal from April 2024 to February 2025, as per sales data on the Vahan portal, the industry has sold 17,60,715 units, up 20% YoY. This means it will have to sell a record 239,285 units in March 2025, improving upon the best-ever March 2024’s 213,107 units.

India EV Inc will have to sell a record 239,285 units in March 2025, beating March 2024’s 213,107 units, if it is to achieve 2 million sales for the first time in a fiscal year.

India EV Inc will have to sell a record 239,285 units in March 2025, beating March 2024’s 213,107 units, if it is to achieve 2 million sales for the first time in a fiscal year.

To achieve this, the industry will need the two mega volume segments – electric two- and three-wheelers – to deliver very strong market performances in the last month of the current fiscal.

The electric two-wheeler segment, which comprises scooters, motorcycles and also mopeds, is currently in a good state of charge. With cumulative 11-month retail sales of 10,18,846 units, it has clocked over a million units for the first time in a fiscal year, 26% up YoY (April 2023-February 2024: 808,169 units) and is already 7% up on entire FY2024’s 948,511 units. There’s fierce competition amongst the top four players – Ola, TVS Motor Co, Bajaj Auto and Ather Energy – whose combined sales of over 838,000 units account for 82% of the industry’s total retails till end-February, leaving the remaining 18% share to another 120-odd OEMs.

In FY2024, India e2W Inc had sold a total of 948,511 units, up 30% YoY (FY2023: 728,213 units). With March 2025 being the last month of FY2025 and likely to see strong demand, this segment of the EV industry could be expected to achieve total sales in the region of 1.1 million units, up 17% YoY.

The electric three-wheeler segment too is in good nick. The 639,245 units sold in the first 11 months of FY2025 constitute good growth of 12% YoY (April 2023-February 2024: 571,852 units). Of the total 1.12 million (11,21,605) three-wheelers (across petrol, diesel, CNG, LPG and electric powertrains) sold in in the first 11 months of FY2025, electric three-wheelers – 691,323 units – account for 57% of the sales, effectively translating into every second three-wheeler sold in India being an EV.

This segment is dominated by seven to eight players – Mahindra Last Mile Mobility (MLMM), Bajaj Auto, YC Electric, Saera Electric Auto, Piaggio Vehicles, Dilli Electric Auto and Energy EV. However, the real battle is being fought at the podium level between Mahindra Last Mile Mobility, Bajaj Auto and YC Electric. There’s an intense battle for supremacy underway between market leader Mahindra Last Mile Mobility and new challenger Bajaj Auto, and the two OEMs were separated by just 125 units in January 2025.

In FY2024, this segment had sold 632,789 units, which means sales in the past 11 months have surpassed that total and have set a new record with March 2025 sales yet to be counted.

The next biggest contributor to India EV Inc sales is the electric passenger vehicle segment. At 94,696 units sold till end-February 2025, 11-month retails are up 16% (April 2023-February 2024: 81,549 units). With just a tad over 5,000 more electric cars, SUVs and MPVs needed to be sold in March 2025, this segment will hit the 100,000 sales milestone for the first time in FY2025, going ahead of FY2024’s 91,303 units.

With a number of new models entering the e-PV arena, Tata Motors’ market-leading share has dropped to 56% for the past 11 months while JSW MG Motor India’s has jumped to 27 percent.

The electric commercial vehicle segment has seen demand rise 27% YoY to 7,787 units versus 6,135 units a year ago. The light goods vehicles sub-segment, with 4,505 units and a 58% share of e-CV sales, has registered strong 51% YoY growth, reflective of the growing demand for emission-free last mile mobility in the country. Electric passenger buses, which are benefiting from orders from State Transport Undertakings, have sold 3,118 units and posted 5% YoY growth.

Will this month be a mega March?

Four days into March 2025 and, as per Vahan stats, total sales are 17,153 EVs across the e-two- and three-wheeler, e-PV and e-CV segments. This leaves India EV Inc a sales target of 222,133 units to be achieved in the next 27 days. Do the math – that works out to 8,227 EVs each day between March 5 and March 31.

The countdown to the 2-million milestone has begun. . . Stay plugged in to Autocar Professional for the latest industry sales analysis.

ALSO READ: India’s Top 15 States, UTs for electric 2W, 3W, PV and CV sales in CY2024

RELATED ARTICLES

Maruti-rebadged models account for 53% of Toyota India record sales in FY2025

With combined sales of 163,483 units, the Toyota Glanza hatchback, Urban Cruiser Hyryder midsize SUV, Urban Cruiser Tais...

Toyota Taisor sells 32,378 units in first year

Launched on April 3, 2024, the Urban Cruiser Taisor compact SUV has contributed to 10% of Toyota Kirloskar Motor’s recor...

Maruti Nexa sales cross 500,000 for second fiscal in a row, 6 of 8 models see decline in FY2025

In FY2025, Maruti Suzuki's premium Nexa channel sold 543,050 passenger vehicles compared to 561,050 units in FY2024. Of ...

06 Mar 2025

06 Mar 2025

8919 Views

8919 Views

Autocar Professional Bureau

Autocar Professional Bureau