Two-wheelers and SUVs power India Auto Inc’s sales of 25.49 million units in CY2024

While two-wheeler wholesales of 19.54 million units saw their share of overall auto sales rise to 77% from 75% in CY2023, best-ever annual passenger vehicle sales of 4.27 million were enabled by SUVs and MPVs, which at 2.74 million units increased their share of PV sales to 64% from 57% a year ago and helped buffer the 14% decline in car and sedan demand. CVs the sole segment in the red.

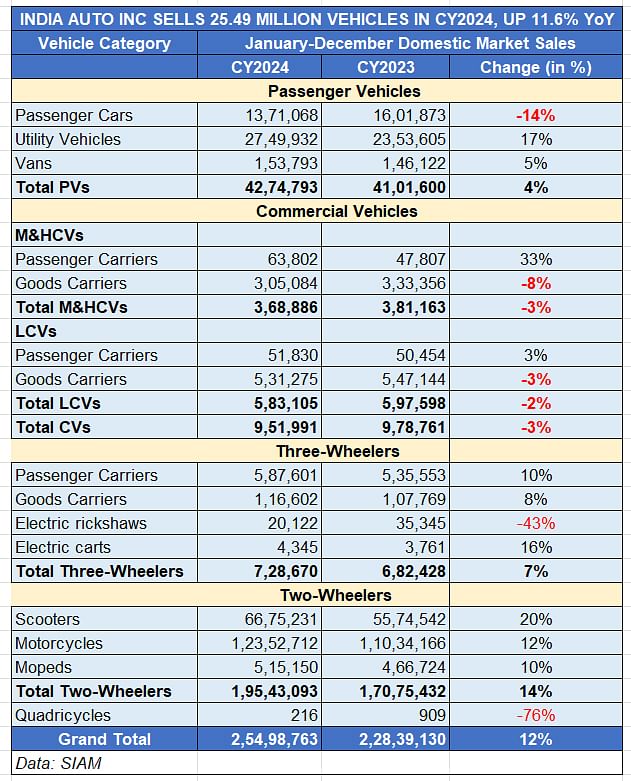

The Indian automobile industry has entered CY2025 on a resilient note. As per the wholesales (vehicle dispatches to dealers) numbers released by apex industry body SIAM today, a total of 2,54,98,763 vehicles were sold in CY2024, up 11.6% year on year (CY2023: 2,28,39,130 units). The movers and shakers of the industry last year were the two biggest volume segments – two-wheelers and passenger vehicles.

The two-wheeler segment, which comprises scooters, motorcycles and mopeds, delivered a stellar show with sales of 19.54 million units and strong 14% YoY growth (CY2023: 17.07 million units). This segment contributed to 76.64% of total India Auto Inc’s sales, up from the 74.75% share it had in CY2023. However, it has yet to go past its previous highest wholesales of CY2019. Importantly, all three sub-categories registered double-digit growth – scooters (6.67 million units / 20% growth), motorcycles (12.35 million units / 12% growth, and mopeds (515,150 units / 10% growth).

The passenger vehicle (PV) segment, which comprises hatchbacks and sedans, utility vehicles (SUVs and MPVs) and vans, registered wholesales of 4.27 million units, up 4% YoY (CY2023: 4.10 million units). This is the PV segment’s best-ever annual sales performance.

The UV sub-segment continues to be the shining star and helped buffer the sizeable 14% decline in sales of hatchbacks and sedans. With sales of 27,49,932 units, the UV segment not only achieved handsome 17% YoY growth (CY2023: 23,53,605 units), but also increased its share of overall PV sales to 64% from 57.38% in CY2023.

The decline in demand for hatchbacks and sedans continues and the 1.37 million units sold in CY2024 were down 14% YoY (CY2023: 1.60 million units). This sees passenger car share of total PV dispatches drop to 32% from 39% in CY2023. The van segment witnessed modest growth at 5% with sales of 153,793 units, an additional of 7,671 units over 12 months.

The three-wheeler segment, like the PV segment, also notched its best-ever annual market performance. At 728,670 units, wholesales in CY2024 were up 7% YoY (CY2023: 682,428 units). This segment is witnessing the fastest transition from ICE to electric mobility.

The commercial vehicle segment is the sole one to be in the red, as depicted in the data table below. Both the medium and heavy commercial vehicle and the light commercial vehicle segments saw a decline in sales, which meant that overall wholesales at 951,991 units were down 3% on year-ago sales of 978,761 units.

Commenting on sales data of 2024 calendar year, Shailesh Chandra, President, SIAM said, “2024 has been reasonably good for the auto industry. Positive consumer sentiments and the country’s macroeconomic stability, helped in propelling reasonable growth for the sector across vehicle segments. This year growth has been primarily driven by the two-wheeler segment which grew by 14.5% in 2024. In addition, passenger vehicles and three-wheelers posted their highest ever sales in a calendar year. However, commercial vehicles posted a slight degrowth of (-) 2.7% in 2024 as compared to last year, posting sales of 950,000 units, though signs of growth are visible in Q3 of 2024-25. The stable policy ecosystem of the government of India in 2024, carrying on from the previous years, has helped the industry. As the new year commences with a positive sentiment being created through the Bharat Mobility Global Expo, this momentum would further propel growth in 2025.”

RELATED ARTICLES

Maruti Ertiga to Toyota Vellfire: Top 10 MPVs in FY2025

Demand for multi-purpose vehicles (MPVs) has been on the upswing and the segment accounted for around 11% of India UV In...

Hyundai Creta to Alcazar: Top 15 midsize SUVs in FY2025

At a little over 990,000 units, total sales of the 15 best-selling midsize SUVs in FY2025 were up 5% YoY. Like compact S...

Exclusive! Suzuki Hayabusa sales in India hit highest level in FY2025: 511 units

Demand for the 1340cc Suzuki Hayabusa, which represents cutting-edge engineering at its very best and is one of the most...

14 Jan 2025

14 Jan 2025

5346 Views

5346 Views

Autocar Professional Bureau

Autocar Professional Bureau