TVS Apache sells 446,218 units in FY2025, grabs 40% share of 150-200cc bike market

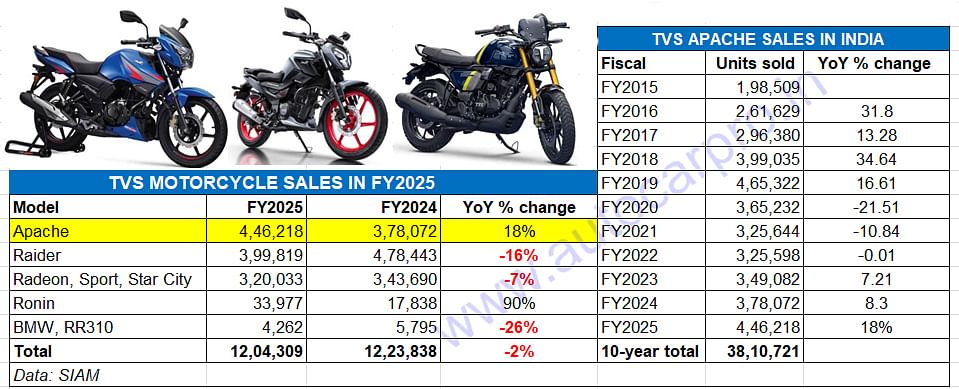

TVS Motor Co’s Apache series has hit its second best-ever fiscal sales of 446,218 units in FY2025 – 19,104 units less than the 465,322 units in FY2019. The strong 18% growth ensured that the Apache is the best-selling TVS motorcycle as well as the leader in the 150-200cc category with a commanding 40% share. Now in its 20th year, the Apache brand has sold over 6 million units including 3.81 million in the past decade.

TVS Motor Co, which registered total two-wheeler sales of 3.15 million units in FY2025, up 11% (FY2024: 3.15 million units), has sold 1.81 million scooters (up 25%), 1.20 million motorcycles (down 2%) and 501,813 mopeds (up 4%). In the motorcycle category, the product that shone from the TVS bike stable is the Apache series which straddles the 150-200cc segment through four models.

The company’s motorcycle market performance would have witnessed a higher rate of sales decline than 2% if it weren’t for the Apache series’ robust sales. The TVS Apache brand comprises four models of the Apache RTR Series – RTR 160, RTR 160 4V, RTR 180 and RTR 200.

With total wholesales of 446,218 units, Apache bikes have clocked strong 18% YoY growth (FY2024: 378,072 units). The Apache is also available in the higher RTR 310 and RR 310 avatars in two segments above 150-200cc.

The 446,218 Apaches have contributed 37% to TVS Motor Co's total bike dispatches of 1.20 million units in FY2025, and gone ahead of the Raider 125 which was TVS’s No. 1 bike in FY2024.

The 446,218 Apaches have contributed 37% to TVS Motor Co's total bike dispatches of 1.20 million units in FY2025, and gone ahead of the Raider 125 which was TVS’s No. 1 bike in FY2024.

APACHE SURPASSES 450,000 UNITS FOR THE SECOND TIME IN 20 YEARS

As accurately forecast in Autocar Professional’s analysis on March 14, the Apache’s sales crossed 440,000 units in FY2025 but below the record FY2019 total of 465,322 units. FY2025’s strong performance sees the TVS Apache brand surpass the 450,000-sales mark for the second time in its 20-year innings, which has seen over 6-million units sold, of which 3.81 million have been sold in the past decade.

The Apache brand, which is celebrating its 20th anniversary this year, has sold over 6 million units since 2005.

The Apache brand, which is celebrating its 20th anniversary this year, has sold over 6 million units since 2005.

Launched in 2005, the Apache first rode past 400,000 units in FY2019 (465,322 units, up 16.61% YoY). Sales were impacted in subsequent fiscals, mainly due to the dampened demand due to the Covid-19 pandemic (see 10-fiscal-year data table above). Sales have received a new charge from FY2023 onwards.

The Apache is the TVS’ best-selling motorcycle in FY2025 – the 446,218 units give it a 37% share of the company’s total motorcycle sales of 12,04,309 units. With this, it reclaims its crown lost to the TVS Raider 125 in FY2024. The Raider 125 has had a tough FY2025 – the 399,819 units are down by a substantial 16% YoY (FY2024: 478,443 units / Apache: 378,072 units).

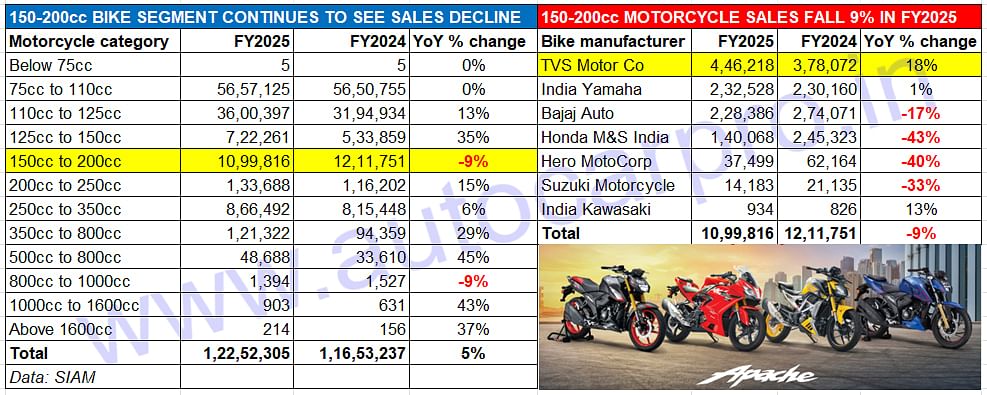

At 446,218 units of the 10,99,816 bikes in the 150-200cc category, the TVS Apache model range has a commanding 40% share in FY2025.

At 446,218 units of the 10,99,816 bikes in the 150-200cc category, the TVS Apache model range has a commanding 40% share in FY2025.

APACHE BEST-SELLING BIKE IN 150-200cc CATEGORY

Of the 12 motorcycle segments, the 150-200cc category and the much smaller 800-1000cc segment have seen their sales decline in FY2025. At a cumulative 1.09 million units from seven manufacturers, sales are down 9% (FY2024: 12,11,751 units), which translates into 111,935 fewer motorcycles sold last fiscal (see data table above).

With four Apaches – the RTR 160, RTR 165, RTR 180 and RTR 200 – each catering to a different buyer, TVS is well placed to capture demand in this this segment. The Apache bikes’ pricing starts at Rs 120,400 for the RTR 160 2V, rises to 133,200 for the RTR 180 and Rs 147,800 for the top-end RTR 200 4V.

At 446,218 units sold, the TVS Apache range has a commanding 40% share of this segment in FY2025. It is followed by India Yamaha Motor (232,528 units, up 1%, 21% share). Bajaj Auto (228,386 units, down 17%, 21% share), Honda Motorcycle & Scooter India (140,068 units, down 43%, 13% share), Hero MotoCorp (37,499 units, down 40%) and Suzuki Motorcycle India (14,183 units, down 33%) – have all seen their sales decline YoY as the SIAM-sourced data depicts. India Kawasaki sold 934 bikes – 108 more than in FY2024 – to register 13% growth.

As far as OEM rankings at the top are concerned, other than TVS which retains its 150-200cc crown with ease in FY2025, Bajaj Auto has dropped one rank to No. 3, and Honda also one rank to No. 4. Yamaha has, with a better showing than both Bajaj and Honda, has moved up two ranks to be the new No. 2 from No. 4 in FY2024. Hero MotoCorp, Suzuki Motorcycle India and India Kawasaki Motor maintain their fifth, sixth and seventh rank, respectively.

ARE 150-200cc MOTORCYCLE BUYERS MIGRATING TO HIGHER SEGMENTS?

The 150-200cc premium commuter segment, the third largest in the overall motorcycle market, faces pressure from both the 125-150cc category and the segments above it.

The 125-150cc bike segment has witnessed robust 35% growth, with a rise in market share from 4.58% to 6%, suggesting a shift towards more fuel-efficient options as buyers opt for affordability over performance.

However, the FY2026 Union Budget, which facilitates increased disposable income, could see motorcycle buyers gravitating towards the 150-200cc segment. This shift will be aided by the narrowing price gap between these bikes and the high-spec 150-200cc models, attracting first-time buyers seeking a balance of style, performance and value.

Meanwhile, the 200-250cc (up 15% to 133,688 units) and 250-350cc (up 6% to 866,492 units) segments have both gained traction. This is probably down to buyers shifting gear from the 150-200cc segment towards more premium, feature-rich models.

RELATED ARTICLES

Tata Punch to Toyota Taisor: Top 10 compact SUVs in FY2025

With 1.38 million units sold in FY2025, less-than-4,000mm-long or compact SUVs registered 10% growth and accounted for n...

Maruti Ertiga turns 13, sells 1.21 million units since launch

Launched on April 16, 2012, Maruti Suzuki’s and India’s best-selling MPV for the past six years has clocked its highest ...

SUVs power UV share of PVs to 65% in FY2025, car and sedan share plunges to 31%

Utility vehicles once again were a vital buffer to plunging sales of passenger cars in FY2025. At 2.79 million units, SU...

18 Apr 2025

18 Apr 2025

3457 Views

3457 Views

Autocar Professional Bureau

Autocar Professional Bureau