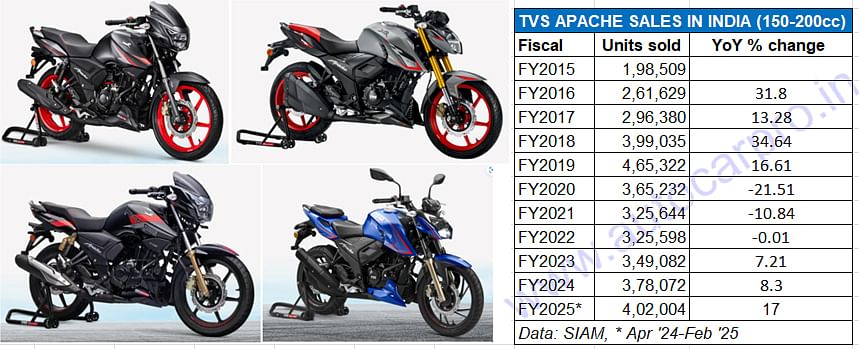

TVS Apache rules 150-200cc segment, clocks 400,000 sales after six years in FY2025

At 402,004 units sold in the first 11 months of FY2025 and 17% growth, the TVS Apache has surpassed the 400,000 milestone for the second time after FY2019’s 465,322 units. The robust sales in the current fiscal also mean the Apache Series is the best-selling TVS motorcycle as well as the leader in the 150-200cc segment with a commanding 40% share.

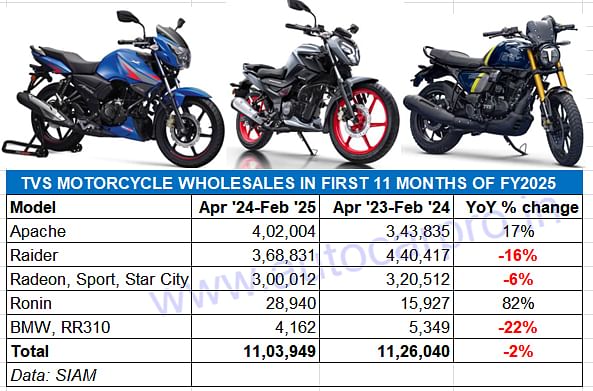

TVS Motor Co is having a strong FY2025 and its cumulative 11-month two-wheeler wholesales comprising scooters, motorcycles and mopeds at 3.22 million units (32,21,603) are up 11% YoY (April 2023- February 2024: 28,96,518 units). While TVS scooter sales (1.65 million units) are up 24% YoY and account for a 51% share, motorcycles (1.10 million units) are down 2% YoY and have a 34% share. The humble TVS moped continues to see demand – the 466,632 units are up 6% YoY and contribute to a 14.48% share of overall two-wheeler sales.

Apache 150-200cc wholesales of 402,004 units have contributed 36% to TVS Motor Co's total bike dispatches of 1.10 million units in the first 11 months of FY2025.

Apache 150-200cc wholesales of 402,004 units have contributed 36% to TVS Motor Co's total bike dispatches of 1.10 million units in the first 11 months of FY2025.

TVS’ motorcycle segment market performance would have witnessed a higher rate of sales decline than 2% in the April 2024-February 2025 period if it weren’t for the TVS Apache series’ robust market performance in the 150-200cc segment. The TVS Apache brand comprises four models of the Apache RTR Series – RTR 160, RTR 160 4V, RTR 180 and RTR 200 – in the 150-200cc bike category. With total wholesales of 402,004 units, Apache bikes have clocked 17% YoY growth (April 2023- February 2024: 343,835 units). The Apache is also available in the higher RTR 310 and RR 310 avatars in two segments above 150-200cc.

RIDING TOWARDS 440,000-450,000 SALES IN FY2025

With this, the TVS Apache brand, in this segment, has surpassed the 400,000-sales mark for the second time in its 20-year innings. It had missed the mark in FY2018 (399,035 units) by just 965 units. Launched in 2005, the Apache first rode past 400,000 units in FY2019 (465,322 units, up 16.61% YoY). Sales were impacted in subsequent fiscals, mainly due to the dampened demand due to the Covid-19 pandemic (see 11-fiscal-year data table above). With March 2025 wholesales yet to be counted, expect TVS to clock a total of around 440,000-445,000 Apaches in FY2025 albeit that figure will still be short of the record FY2019 total.

Nevertheless, the TVS Apache remains the company’s best-selling motorcycle in FY2025. In the first 11 months of this fiscal, with 402,004 units and up 17%, it has a 36% share of TVS’ total motorcycle sales and is ahead of the TVS Raider (368,831 units, down 16% YoY, 33% share). In FY2024, the Raider was TVS best-selling motorcycle with 478,443 units compared to the Apache’s 378,072 units.

TVS APACHE BEST-SELLING BIKE IN 150-200cc CATEGORY

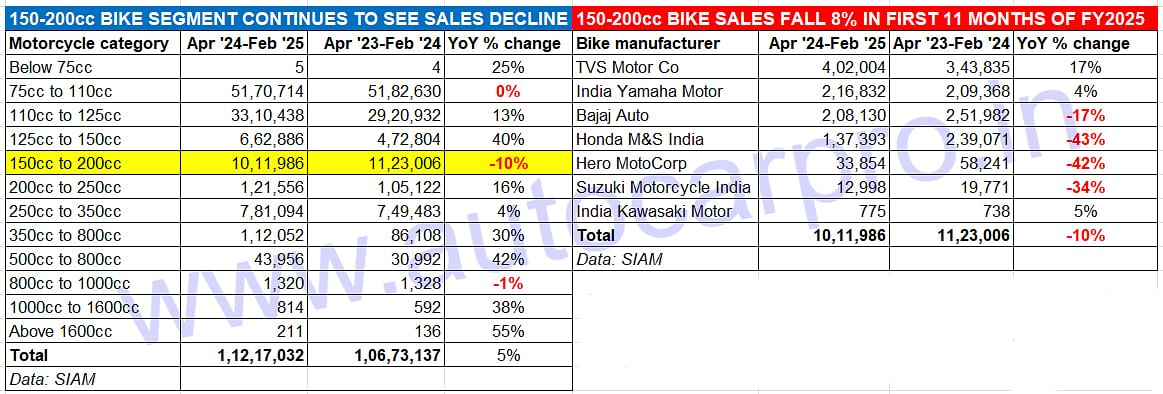

Of the 12 categories in the motorcycle segment, the 150-200cc category remains in the negative zone as it did a month ago. At 1.01 million units sold in the past 11 months, sales are down 10% YoY (see data table above).

TVS Motor Co is well positioned to capture demand in this category with four Apaches – the RTR 160, RTR 165, RTR 180 and RTR 200 – each catering to a different buyer, thereby widening the target audience. The Apache bikes’ pricing starts at Rs 120,400 for the RTR 160 2V, rises to 133,200 for the RTR 180 and Rs 147,800 for the top-end RTR 200 4V.

At 402,004 units sold, the TVS Apache range has a commanding 40% share of this segment’s total sales and is followed by India Yamaha Motor (216,832 units, up 4% and a 21% share). The next four OEMs – Bajaj Auto, Honda Motorcycle & Scooter India, Hero MotoCorp and Suzuki Motorcycle India – have all seen their sales decline YoY as the SIAM-sourced data depicts.

ARE 150-200cc MOTORCYCLE BUYERS MIGRATING?

The 150-200cc premium commuter segment, the third largest in the overall motorcycle market, faces pressure from both the 125-150cc category and the segments above it. The 125-150cc bikes have experienced a notable 40% growth, with a rise in market share from 4.42% to 6%, suggesting a shift towards more fuel-efficient options as buyers opt for affordability over performance.

However, the Union Budget’s promise of increased disposable income could shift this trend. Meanwhile, the 200-250cc (up 16% to 121,556 units) and 250-350cc (up 4% to 781,094 units) segments have gained traction. This is probably down to buyers moving from the 150-200cc segment towards more premium, feature-rich options. This shift is aided by the narrowing price gap between these bikes and the high-spec 150-200cc models, attracting first-time buyers seeking a balance of style, performance and value.

RELATED ARTICLES

Maruti Nexa sales cross 500,000 for second fiscal in a row, 6 of 8 models see decline in FY2025

In FY2025, Maruti Suzuki's premium Nexa channel sold 543,050 passenger vehicles compared to 561,050 units in FY2024. Of ...

Nexa models sell 3.1 million units in 10 years, take 31% share of Maruti Suzuki sales in FY2025

From a 5% share of Maruti Suzuki’s passenger vehicle sales in FY2015 to 31% in FY2025, the Nexa premium channel continue...

Exclusive: Maruti Fronx is first Nexa SUV to hit 300,000 sales

Baleno-based Maruti Fronx becomes the first premium SUV from the Nexa channel to achieve cumulative sales of 300,000 uni...

14 Mar 2025

14 Mar 2025

19152 Views

19152 Views

Autocar Professional Bureau

Autocar Professional Bureau