Top 5 two-wheeler OEMs target festive fervour, dispatch 1.85 million units to dealers in September

Hero MotoCorp, Honda, TVS, Bajaj Auto and Suzuki look to tap consumer sentiment in 32-day festive period which has begun on October 3 and also are targeting buyers from the key rural India market which is a big buyer of fuel-sipping commuter motorcycles.

The Indian two-wheeler industry is going all out to tap demand in the ongoing festive season. The top five manufacturers for September 2024, as per their company releases, have dispatched a total 18,58,831 units to their dealers in September 2024, up 16.46% YoY (April-September 2023: 15,96,095 units).

As per wholesales data from apex industry body, the industry is currently in good nick – in April-August 2024 period, a total of 8.13 million two-wheelers were sold, up 16.4% YoY with the scooter segment witnessing 24.1% YoY growth (28,24,886 units), motorcycles 12.7% growth (51,09,277 units) and mopeds also up by 15% YoY (204,824 units).

Market leader Hero MotoCorp dispatched a total of 616,706 motorcycles and scooters in September 2024, up 18.64% YoY (September 2023: 519,789 units). This takes its first six-month FY2025 total to 2.94 million units, up 10% YoY. The company states that it “continues to experience strong demand across the 100cc, 125cc, and premium segments” and that it has a strong pipeline of bookings and is experiencing increased customer footfall leading up to the festive season. It expects healthy growth during the 32-day period starting from October 3.

Market leader Hero MotoCorp dispatched a total of 616,706 motorcycles and scooters in September 2024, up 18.64% YoY (September 2023: 519,789 units). This takes its first six-month FY2025 total to 2.94 million units, up 10% YoY. The company states that it “continues to experience strong demand across the 100cc, 125cc, and premium segments” and that it has a strong pipeline of bookings and is experiencing increased customer footfall leading up to the festive season. It expects healthy growth during the 32-day period starting from October 3.

Honda Motorcycle & Scooter India dispatched 536,391 units in September, up 9% YoY (September 2023: 536,391 units), typically with the Activa, India’s best-selling scooter, comprising the bulk of wholesales. HMSI’s April-September 2024 total is 28,81,419 units, up 30.61% YoY (H1 FY2024: 22,06,064 units), which is proof enough of the company targeting aggressive growth. Halfway into FY2025, HMSI is 59,247 two-wheelers behind Hero MotoCorp.

TVS Motor Co, the No. 3 OEM, dispatched 369,138 units in September 2024, up 23% YoY (September 2023: 300,493 units), which gets its first-half FY2025 total to 1.74 million units, up 15% YoY (H1 FY2024: 15,13,821 units).

Bajaj Auto, which has been in the news for going ahead of TVS Motor Co on the electric scooter retail sales front for the first time in September, dispatched 2,59,333 motorcycles and Chetaks, up 29.56% YoY (September 2023: 200,155 units). The Pune-based manufacturer’s total wholesales in the April-September 2024 period at 12,19,298 units are up 16.68% YoY (H1 FY2024: 10,44,957 units). Bajaj Auto has announce an offer of Rs 10 000 on the ex-showroom price of its sporty Pulsar motorcycle range. Additional offers are available to Pulsar buyers who make their purchases from Bajaj’s e-commerce partners, Amazon and Flipkart.

Suzuki Motorcycle India, which also sells scooters, is ranked fifth on the two-wheeler OEM ladder-board. In September 2024, the company dispatched 77,263 units, down 7.86% YoY (September 2023: 83,856 units) and is the sole manufacturer amongst the top 5 to see a YoY decline in its September sales.

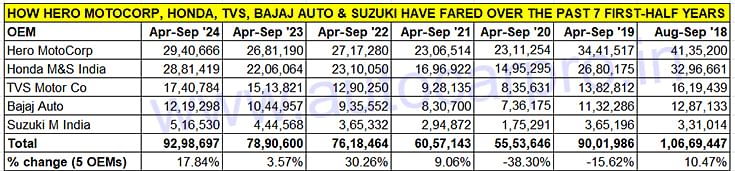

H1 FY2025 9.29 MILLION UNITS STILL WAY BELOW H1 FY2019's 10.6 MILLION

A quick analysis of the first half-yearly wholesales of these five OEMs (see data table below) reveals interesting findings. The H1 FY2025 total at 9.29 million units is 18% up on year-ago dispatches of 7.89 million units albeit still 1.37 million units below their best-ever cumulative 10.6 million sales in H1 FY2019, which was the best year for India Two-Wheeler Inc with 21.18 million units sold.

Hero MotoCorp, Honda, TVS, Bajaj Auto and Suzuki look to tap consumer sentiment in 32-day festive period which begun on October 3 as also the improving demand from rural India which is a big buyer of fuel-sipping commuter motorcycles.

What augurs well for October and November 2024 are that demand from the key rural market, which accounts for a large share of fuel-sipping commuter motorcycles, is bouncing back. Rural India is most part of the country is also benefiting from the ample monsoon which would have enhanced purchasing power. Meanwhile, with most OEMs offering discounts and favourable new product purchase deals, demand in urban India is also on the upswing adding tailwind to the overall growth story.

RELATED ARTICLES

Mahindra XUV 3XO sells over 100,000 units to be M&M’s second best-selling SUV in FY2025

Launched exactly a year ago, the face-lifted version of the XUV300 with sales of 100,905 units turned out be Mahindra & ...

Mahindra Thar Roxx and Tata Curvv best-selling new SUVs in FY2025

With over 125 models and a mind-boggling 1,000-plus variants, utility vehicle buyers in India are spoilt for choice. Whi...

Honda Unicorn outsells Bajaj Pulsar in 125-150cc segment in FY2025

With total sales of 282,536 units in FY2025, the Honda Unicorn 150 has gone ahead of Bajaj Auto, the segment leader in F...

06 Oct 2024

06 Oct 2024

8707 Views

8707 Views

Autocar Professional Bureau

Autocar Professional Bureau