Scooter sales hit record levels of 6.85 million units in FY2025

While Honda with its Activa remains the market leader with a 42% market share, TVS sold 1.81 million scooters to increase its share to 26 percent. A stellar year for Bajaj Auto sees it double its share to 4% even as Yamaha and Ather Energy register strong gains. EVs, with 773,000 units and an 11% share of overall scooter sales, helped accelerate scooter industry demand.

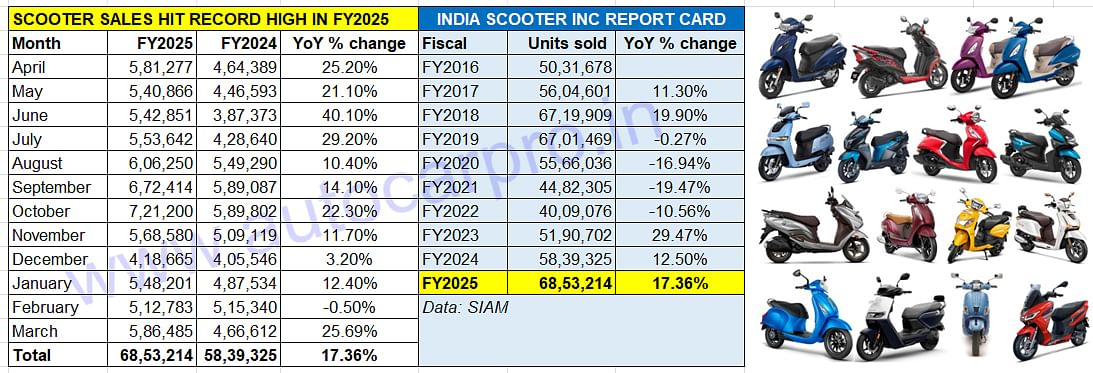

The Indian scooter industry has achieved record wholesales of 6.85 million units (68,53,214 units) in FY2025, up 17% year-on-year (FY2024: 58,39,325 units). This confirms Autocar Professional’s forecast that this segment of the two-wheeler vehicle category would register its best-ever fiscal year. What helped drive scooter sales was OEMs rolling out refreshed as well as new models, revival of demand from rural India and semi-urban regions of the country, and sale of over 770,000 electric scooters.

India Scooter Inc’s best fiscal year performance was in FY2018 – 67,19,909 units or 6.71 million units (see 11-year sales data table below). FY2025 scooter sales have exceeded that total by 133,305 units, averaging monthly sales of 571,101 units or registering sale of 18,775 scooters every day!

In FY2025, scooter sales surpassed 700,000 units once, 600,000 units twice, over-500,000 units eight times, and 400,000 once with the lowest monthly score being 418,665 in December 2024.

In FY2025, scooter sales surpassed 700,000 units once, 600,000 units twice, over-500,000 units eight times, and 400,000 once with the lowest monthly score being 418,665 in December 2024.

A glance at the 12-month sales data above reveals that the industry hit a monthly high of 721,200 units in festive October 2024, surpassed 600,000 units twice (August and September 2024) and over 500,000 units eight times, with the lowest monthly score being December 2024 (418,665 units) when buyers prefer to defer their purchase decisions to the new year.

That’s not all – in 10 of the past 12 months, the scooter industry has registered high double-digit growth, reflective of the strong demand coming its way. HONDA NO. 1 BUT TVS, BAJAJ AUTO AND ATHER ENERGY INCREASE THEIR MARKET SHARE

HONDA NO. 1 BUT TVS, BAJAJ AUTO AND ATHER ENERGY INCREASE THEIR MARKET SHARE

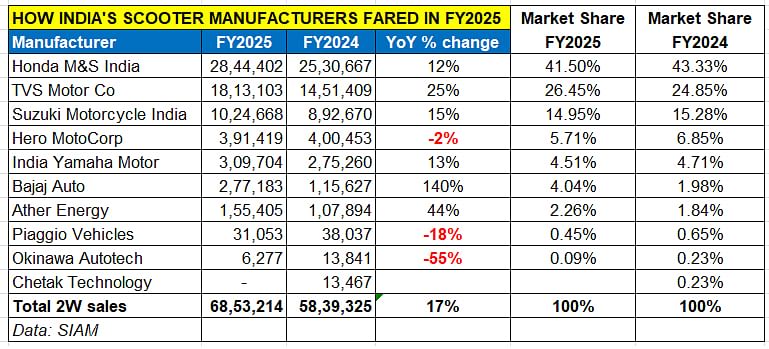

Honda Motorcycle & Scooter India, the ‘Maruti Suzuki’ of the scooter market and the world’s largest scooter maker, maintains its vice-like grip with a 41.50% share with sales of 2.84 million units in FY2025, up 12% (FY2024: 2.53 million units). Honda’s scooter portfolio comprises the Activa 110 and 125 and the Dio 110 and 125. However, year-on-year, Honda’s market share is down 2% from the 43.33% it had in FY2024.

TVS Motor Co, which has the Jupiter, NTorq and Zest in its scooter stable, sold a total of 1.83 million scooters, up 25% YoY. This gives it a 26% market share, up 1% on the 25% it had in FY2024. While the three petrol-engined scooters have sold 15,40,040 units, up 22% YoY, the TVS iQube electric scooter with 273,063 units has clocked 44% YoY growth (FY2024: 189,896 iQubes).

Suzuki Motorcycle India has also fared well. The 10,24,668 Suzuki scooters sold make for a YoY increase of 15% YoY and help the two-wheeler arm of the Japanese major maintain its 15% scooter market share. While the Access 125 remains its best-selling product, what helps Suzuki is that its two other scooters – Avenis and Burgman Street – are also powered by the same 125cc engine and are benefiting from the consumer upgrade to the 125cc segment.

Hero MotoCorp, which sold 391,419 scooters in FY2025, has posted a 2% YoY decline (FY2024: 400,453 units). Hero’s scooter range comprises the 110cc Pleasure and Xoom, 125cc Destini/Destini Prime and the 156cc Xoom 160. These together have sold 332,916 units, down 12% YoY (FY2024: 380,648 units). The company however has achieved strong gains with its Vida 1 and 2 electric scooters – the 58,503 EVs are a 195% increase YoY on a low year-ago base of 19,805 Vida 1s.

India Yamaha Motor, with 309,704 units, has posted 13% growth but sees its scooter market share reduce marginally to 4.51% from 4.71% a year ago. The 125cc-engined Alpha, Fascino and Ray ZR have together sold 286,776 units, up 12% YoY. The 155cc Aerox scooter, with 22,928 units, has registered 24% growth (FY2024: 18,449 Aerox).

Bajaj Auto, just like TVS and Ather Energy, is among the three OEMs to have increased their scooter market share. The Pune-based company sold a total of 277,183 scooters in FY2025, comprising 260,033 Chetaks and 17,150 Yulu electric scooters. This is a handsome YoY increase of 140% (FY2024: 115,627 units), translates into an additional 161,556 units YoY, and resultantly a doubling of market share to 4 percent.

Ather Energy, which is witnessing strong sales traction for its Rizta family e-scooter, clocked total wholesales of 155,405 units, up 44%. This performance sees it increase its market share to 2.26% from 1.85% in FY2024.

EV SHARE OF SCOOTER SALES GROWS TO 11% WITH 773,093 UNITS

EV SHARE OF SCOOTER SALES GROWS TO 11% WITH 773,093 UNITS

Of SIAM’s scooter-member companies, five – TVS, Bajaj Auto, Ather Energy, Hero MotoCorp and Okinawa Autotech – have been manufacturing zero-emission scooters for some time now. Both Honda and Suzuki have recently announced their entry into the zero-emission scooter market. Honda produced a total of 6,432 electric scooters, comprising the QC1 and Activa e, and sold 2,662 units. Having begun sales just two months ago, HMSI sold 560 EVs in February and 2,102 units in March 2025.

In FY2025, this six-pack of 2W OEMs sold a total of 773,093 units, up 68% YoY (FY2024: 460,530 e-2Ws). While this gives them an 11% share of the total 6.85 million scooters sold last fiscal versus 8% in FY2024, importantly, they have helped accelerate overall scooter industry numbers in FY2025.

The three legacy players – TVS Motor Co, Bajaj Auto and Hero MotoCorp – as well as smart e-scooter start-up Ather Energy have each registered best-ever fiscal year sales. Interestingly, Bajaj Auto has beaten TVS Motor Co in cumulative e2W wholesales. While Bajaj Auto sold a total of 277,183 e-2Ws (comprising 260,033 Chetaks and 17,150 Yulu e-bikes), TVS sold 273,063 EVs comprising the iQube and

Ather Energy also hit a high note with 155,405 units as has Hero MotoCorp with its 58,503 Vida V1 and V2 e-scooters.

ALSO READ:

Bajaj Auto goes ahead of TVS in electric two-wheeler sales in FY2025

Honda sells 2,662 Activa e and QC1 electric scooters in two months

RELATED ARTICLES

TVS Apache sells 446,218 units in FY2025, grabs 40% share of 150-200cc bike market

TVS Motor Co’s Apache series has hit its second best-ever fiscal sales of 446,218 units in FY2025 – 19,104 units less th...

Maruti Ertiga turns 13, sells 1.21 million units since launch

Launched on April 16, 2012, Maruti Suzuki’s and India’s best-selling MPV for the past six years has clocked its highest ...

SUVs power UV share of PVs to 65% in FY2025, car and sedan share plunges to 31%

Utility vehicles once again were a vital buffer to plunging sales of passenger cars in FY2025. At 2.79 million units, SU...

16 Apr 2025

16 Apr 2025

4767 Views

4767 Views

Autocar Professional Bureau

Autocar Professional Bureau