Scooter industry on track for record sales of 6.75 million units in FY2025

Scooter makers in India need to sell another 453,181 units in March to surpass the segment’s best-ever sales of 6.71 million units in FY2018. While Honda remains No. 1 with a 42% market share, TVS has posted 24% growth with 1.65 million units, and Bajaj Auto has doubled its share to 4% even as Yamaha and Ather Energy register strong gains. EVs, with nearly 700,000 units and an 11% share of overall scooter sales, have helped accelerate overall scooter demand.

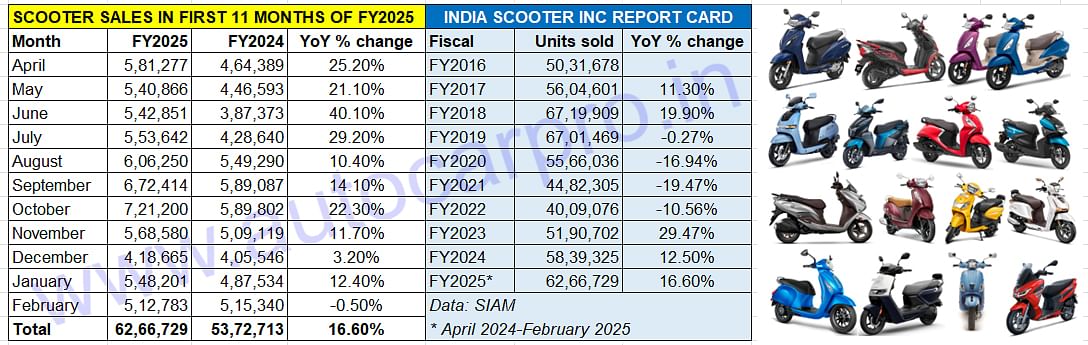

The Indian two-wheeler industry, which has clocked wholesales of 17.95 million units in the first 11 months of FY2025 and 9% YoY growth, it is also thanks to the robust demand for scooters. Between April 2024 and February 2025, scooter manufacturers have dispatched 6.26 million units to their dealers across India, which is a handsome 16.60% YoY increase over the year-ago 5.37 million units and an additional 894,016 scooters sold in the current fiscal.

India Scooter Inc’s best fiscal year performance was in FY2018 – 67,19,909 units (see 10-year sales data table below). The difference between that figure and the last 11 months’ sales is 453,180 units, which scooter manufacturers are bound to exceed in March 2025, the last month of FY2025.

FY2018 with 6.71 million units was the Indian scooter industry's best-ever fiscal. With 6.26 million units sold in the first 11 months of the current fiscal, sale of 453,181 scooters in March 2025 will see scooter OEMs surpass that.

FY2018 with 6.71 million units was the Indian scooter industry's best-ever fiscal. With 6.26 million units sold in the first 11 months of the current fiscal, sale of 453,181 scooters in March 2025 will see scooter OEMs surpass that.

Considering the scooter industry has averaged monthly sales of over 550,000 in each of the first three quarters (Q1 FY2025: 554,998 units, Q2 FY2025: 610,768 units, Q3 FY2025: 569,481 units) and 530,492 units in January-February 2025, it can be surmised that March 2025 should see total dispatches of around 555,000 units. This will be well over the 453,180 scooters required to be sold in March 2025 to surpass FY2018’s record 6.71 million units and set a new scooter industry fiscal year sales benchmark of over 6.75 million units in FY2025.

A quick look at the monthly dispatches over the past 11 months reveals that sales crossed 500,000 units seven times, 600,000 units twice and 700,000 units once. While the lowest monthly sales in the current fiscal were in December 2024 (418,665 units, up 3.20% YoY) as a result of buyers delaying purchase decisions into the new year, scooter OEMs clocked their best-ever monthly sales in October 2024 – 721,200 units, up 22% YoY – thanks to the festive season underway that month and in November. That’s not all – in nine of the past 11 months, the industry has registered high double-digit growth.

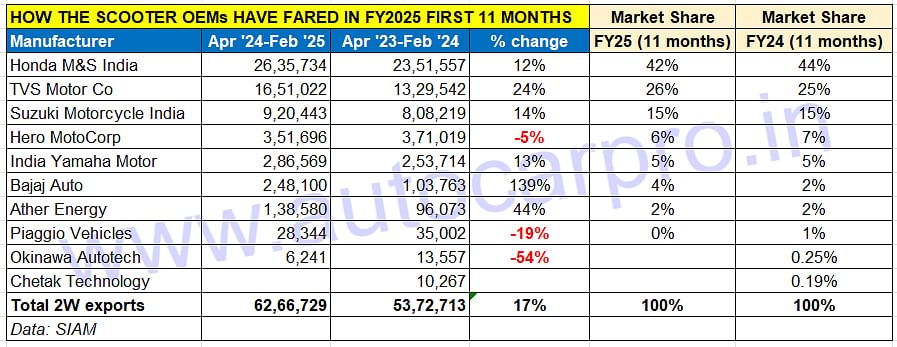

HONDA, TVS, SUZUKI HAVE 83% MARKET SHARE, BAJAJ SHARE DOUBLES TO 4%

HONDA, TVS, SUZUKI HAVE 83% MARKET SHARE, BAJAJ SHARE DOUBLES TO 4%

Honda Motorcycle & Scooter India, the ‘Maruti Suzuki’ of the scooter market and the world’s largest scooter maker, maintains its vice-like grip with a 42% share with sales of 2.63 million units in the past 11 months, up 12% YoY. Honda’s scooter portfolio comprises the Activa 110 and 125 and the Dio 110 and 125. However, year-on-year, Honda’s market share is down 2% from the 44% it had.

TVS Motor Co, which has the Jupiter, NTorq and Zest in its scooter stable, has sold a total of 1.65 million units, up 24% YoY. This gives it a 26% market share, up 1% on the 25% it had in the April 2023-February 2024 period. While the three petrol-engined scooters have sold 14,04,490 units, up 22% YoY, the TVS iQube electric scooter with 246,532 units has clocked 40% YoY growth.

Suzuki Motorcycle India has also fared well. The 920,443 Suzuki scooters sold in the past 11 months are an increase of 14% YoY and help the two-wheeler arm of the Japanese major maintain its 15% scooter market share. While the Access 125 remains its best-selling product, what helps Suzuki is that its two other scooters – Avenis and Burgman Street – are also powered by the same 125cc engine and are benefiting from the consumer upgrade to the 125cc segment.

Hero MotoCorp, which has sold 351,696 units in the period under review, has seen a 5% YoY sales decline. Hero’s scooter range comprises the 110cc Pleasure and Xoom, 125cc Destini/Destini Prime and the 156cc Xoom 160. These together have sold 300,980 units, down 15% on the 353,454 units sold in the year-ago period. Hero though has achieved strong gains with its Vida 1 and 2 electric scooters – the 50,716 units are an 189% increase YoY on a low year-ago base of 17,565 EVs.

India Yamaha Motor, with 286,569 units, has posted 13% growth and thereby maintains its 5% share it had a year ago. The 125cc-engined Alpha, Fascino and Ray ZR have together sold 265,632 units, up 12% YoY. The 155cc Aerox scooter, with 20,937 units, has registered 25% growth.

Bajaj Auto, which has already clocked its best-ever scooter sales in a fiscal with March 2025 still to be counted, has sold 248,100 Chetak and Yulu electric scooters. This translates into an additional 144,337 units YoY and a doubling of market share to 4 percent.

Ather Energy, which is witnessing strong sales traction for its Rizta family e-scooter, has clocked total wholesales of 138,580 units, up 44%. This performance sees it maintain its year-ago market share of 2 percent.

With March 2025 sales yet to be counted, TVS, Bajaj Auto, Ather Energy and Hero MotoCorp have already notched their best-ever fiscal sales in FY2025.

EV SHARE OF SCOOTER SALES GROWS TO 11% WITH 690,169 UNITS

Of SIAM’s scooter-member companies, five – TVS, Bajaj Auto, Ather Energy, Hero MotoCorp and Okinawa Autotech – manufacture two-wheeled electric vehicles. Both Honda and Suzuki have recently announced their entry into the zero-emission scooter market but have yet to commence sales.

In the April 2024-February 2025 period, this sextet of OEMs has sold nearly 700,000 units or 690,169 units to be precise. While this gives them an 11% share of the total 6.26 million scooters sold to date in the fiscal, importantly, they have helped accelerate overall scooter industry numbers in FY2025.

The three legacy players – TVS Motor Co, Bajaj Auto and Hero MotoCorp – as well as smart e-scooter start-up have each registered best-ever fiscal year sales, with March 2025 numbers yet to join the party. While TVS has sold 248,100 iQubes, Bajaj Auto is just 1,568 units behind with 246,532 Chetaks and 17,050 Yulu e-bikes. Ather Energy has also hit a high note with 138,580 units as has Hero MotoCorp with its 50,716 units. Okinawa Autotech has sold 6,241 e-scooters till end-February 2025.

ALSO READ:

TVS iQube and Bajaj Chetak sales gap at 15,500 units in FY2025

RELATED ARTICLES

Skoda Sells 89,000 Kushaqs in Four Years

Launched on June 28, 2021, the Kushaq turns four years old today and has sold 88,913 unit till end-May 2025. The first m...

TVS NTorq 125 surpasses two million sales, NTorq 150 coming soon

Launched in February 2018, TVS Motor Co’s vehicle of entry into the 125cc scooter market registers new sales milestone i...

Murugappa Group’s Montra Electric sells over 10,000 3-wheelers, enters cargo market

The 125-year-old industrial conglomerate’s Electric Vehicle business arm sees growing demand for its passenger-transport...

24 Mar 2025

24 Mar 2025

11913 Views

11913 Views

Autocar Professional Bureau

Autocar Professional Bureau