Rural India trumps urban markets in FY2025

The strong performance of rural markets has helped a resilient India Auto Inc register retail sales of 26.14 million units in FY2025, up 6.46%. Rural India sales clocked 7.55% YoY growth to outpace urban India’s 5.14% with strong benefits accruing to the two-wheeler, three-wheeler and passenger vehicle segments, reveals FADA .

The real-world verdict for automobile sales in India is out. As per apex dealer body, the Federation of Automobile Dealers Associations of India (FADA), a total of 2,61,43,943 or 26.14 million vehicles, across five vehicle segments, were sold in FY2025, up 6.46% YoY (FY2024: 2,45,58,437 units).

As compared to wholesales numbers, which are essentially a function of automobile manufacturers' vehicle despatches from their factories to their dealers across India, retail sales numbers paint the real-world market scenario and are far more accurate when it comes to industry trends.

According to FADA's FY2025 retail sales statistics for India Auto Inc, two-wheelers – the most affordable and the largest volume segment – clocked retail sales of 1,88,77,812 units, up 7.71% YoY, and accounted for 72% of India Auto Inc’s sales, compared to 71% in FY2024.

Three-wheelers, which are transitioning the fastest to electric mobility and saw record retails of nearly 700,000 e-3Ws in FY2025, sold a total of 12,20,981 units across all powertrains to register 4.54% YoY growth (FY2024: 11,67,986 units). The 3W share of all-India auto retails in FY2025 was 4.67% versus 4.75% in FY2024.

The passenger vehicle segment hit record retails of 41,53,432 units, up 4.87% YoY (FY2024: 39,60,602 units). This translates into 192,830 additional vehicles being sold in FY2025, which saw the PV share of overall auto retails at 15.88% compared to 16.12% in FY2024.

The commercial vehicle segment registered total sales of over a million units: 10,08,623, down 0.17% YoY (FY2024: 10,10,324 units). In FY2025, the CV share of India auto retails was 3.85% versus 4.11% in FY2025.

Tractor sales in FY2025, at 883,095 units, were down 1.04% YoY (FY2024: 892,410). Their share of India Auto Inc’s sales was 3.37% versus 3.63%in FY2024.

RESILIENT RURAL INDIA'S GROWTH BETTER THAN URBAN INDIA

The fair amount of the credit for the YoY growth in sales of 2Ws, 3Ws and passenger vehicles in FY2025 needs to be attributed to demand from rural India.

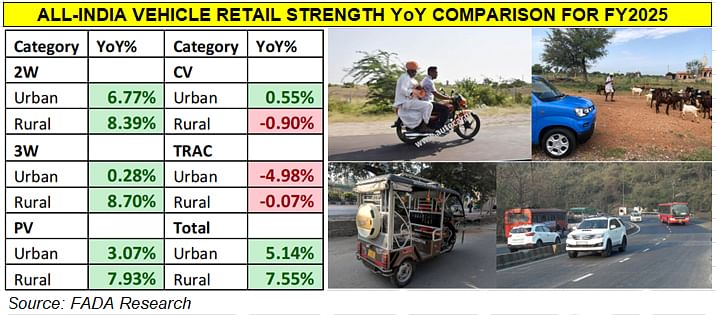

According to FADA Research, rural India-driven auto retail sales registered 7.55% YoY growth in FY2025 to outpace urban India’s 5.14% YoY growth, with strong benefits accruing to the two-wheeler, three-wheeler and passenger vehicle segments.

The statistics reveal that consumer demand from rural India was a key driving force for three segments. Sales of motorcycles, scooters and mopeds in rural markets rose by 8.39% versus 6.77% in urban areas.

The difference in three-wheeler sales is even more – 3W sales in rural India jumped by 8.70% to significantly outpace the tepid 0.28% growth in cities. And, demand for passenger vehicles (cars, SUVs and MPVs, was better in rural belts of India with 7.93% growth compared to 3.07% in urban markets.

SHIFTING CONSUMER DYNAMICS

The automobile market is a reflection of the perceptible change in consumer dynamics where a resilient rural India is displaying spending power as compared to a slowing urban India. This can be attributed to multiple factors including ample monsoon, improved incomes, favourable and enhanced government schemes and the advance of digitalisation, which has helped bridge distances.

Industry trends reveal that as a result of higher purchasing power, rural India is spending more on vehicle upgrades. The shift from fuel-sipping 100cc commuter motorcycles to higher-powered 125cc bikes is one example as is the growing demand for SUVs in town and country.

Demand for CNG passenger vehicles has also risen strongly, which is also helped by the spread of the CNG filling network across the country.

Passenger vehicle market leader Maruti Suzuki is also witnessing growing demand from rural India. Earlier this year, after the company’s Q3 FY2025 results were announced, Rahul Bharti, executive director of Corporate Affairs, Maruti Suzuki India, had said: “Rural has been growing better than urban and we’re seeing that increasingly rural trends are coming closer to urban. It serves as a derisking measure for India’s consumption, not just for cars but for all commodities.”

FADA CAUTIOUSLY OPTIMISTIC ABOUT GROWTH IN FY2026

FADA, which remains cautiously optimistic about its growth outlook for FY2026, expects mid- to high single-digit growth in two-wheelers, and low single-digit growth in passenger vehicles and commercial vehicles. New model launches, EV expansion and improved rural market incomes are key supportive factors for this perspective.

According to the apex dealer association, many dealers are pinning their hopes on a combination of upcoming model launches and renewed interest in electric vehicles. Yet, significant headwinds dampen overall optimism. Financing remains a persistent challenge—dealers note that credit norms have tightened in recent months, and the need for further rate cuts by the RBI to bring down borrowing costs. Meanwhile, extended price hikes from OBD-2B norms weigh on consumers’ budgets, potentially impacting vehicle sales.

Adding to the uncertainty is the looming spectre of a global tariff war, which could spark stock market turbulence and erode returns on mutual fund SIPs. If investors see their disposable incomes shrink in tandem with market volatility, discretionary spending — like auto purchases — may well suffer. Overall, despite the prospect of incremental growth, lingering caution colours the outlook for FY2026, states FADA, as the health of the auto sector will hinge on how effectively stakeholders manage financing challenges, adapt to a shifting global trade environment and better inventory management.

ALSO READ:

Bajaj Freedom 125 CNG hits 50,000 sales, Maharashtra top buyer

RELATED ARTICLES

Maruti Nexa sales cross 500,000 for second fiscal in a row, 6 of 8 models see decline in FY2025

In FY2025, Maruti Suzuki's premium Nexa channel sold 543,050 passenger vehicles compared to 561,050 units in FY2024. Of ...

Nexa models sell 3.1 million units in 10 years, take 31% share of Maruti Suzuki sales in FY2025

From a 5% share of Maruti Suzuki’s passenger vehicle sales in FY2015 to 31% in FY2025, the Nexa premium channel continue...

Exclusive: Maruti Fronx is first Nexa SUV to hit 300,000 sales

Baleno-based Maruti Fronx becomes the first premium SUV from the Nexa channel to achieve cumulative sales of 300,000 uni...

08 Apr 2025

08 Apr 2025

2131 Views

2131 Views

Autocar Professional Bureau

Autocar Professional Bureau