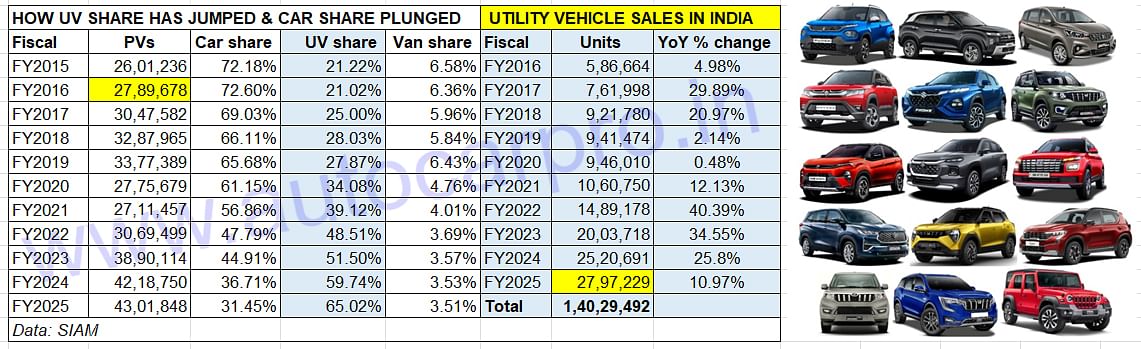

SUVs power UV share of PVs to 65% in FY2025, car and sedan share plunges to 31%

Utility vehicles once again were a vital buffer to plunging sales of passenger cars in FY2025. At 2.79 million units, SUVs and MPVs accounted for 65% of the 4.30 million passenger vehicle dispatches, a big jump from the 21% share a decade ago. In stark contrast, the share of passenger car sales has nosedived to 31% from 72% in FY2016. And the 27,97,229 UVs sold in FY2025 are 7,551 units more than the entire PV sales of 27,89,678 units in FY2016.

FY2025 is done and dusted and a resilient India Auto Inc has moved into FY2026 on a cautiously optimistic note, with total sales of 25.60 million units, up 7% YoY but 658,000 units short of the 26.26 million vehicles sold in FY2019. In FY2025, the passenger vehicle (PV) and three-wheeler segments clocked their best-ever fiscal numbers and were the key growth drivers.

FY2019 had seen all four vehicle segments – passenger vehicles, commercial vehicles, two- and three-wheelers – hit record highs. Of these four, the PV segment is the only one to have bettered its FY2019 performance of 3.37 million units. . . thrice – in FY2023 (3.89 million units), in FY2024 (4.21 million units) and now once again in FY2025 (4.30 million units), which sets a new benchmark.

What’s common to FY2025, FY2024 and FY2023 is the surging demand for utility vehicles (UVs), primarily SUVs. Having raced past the 2-million mark for the first time in FY2023 (2.03 million units), sales only got better in FY2024 (2.52 million units) and FY2025 (2.79 million units). Interestingly, the UV sales of 27,97,229 units in FY2025 are 7,551 units more than the entire PV sales of 27,89,678 units in FY2016 when the UV share was only 21% (586,664 UVs).

SUVs & MPVs CONTINUE THEIR HEROIC BUFFERING ACT

If the PV industry was able to register marginal 2% growth on a large year-ago base of 4.21 million units in FY2025, then it is solely thanks to the demand for SUVs and MPVs which have, once again, saved the blushes for the overall PV sector.

Of the 4.30 million PVs sold in FY2025, the UV sub-segment accounted for 27,97,229 units (up 11% YoY) or a 65% share, considerably improving upon the 60% share it had in FY2024 or the 51.50% share in FY2023. Importantly, as they have been doing for the past five years, UV sales have buffered the sharp 13% decline in passenger car and sedan sales to 1.35 million units from 1.54 million units in FY2024.

Trading places: While UVs have dramatically increased their share of PV sales to 65% from 21% a decade ago, the share of hatchbacks and sedans has plunged to 31% in FY2025 from 72% in FY2016. And UV sales in FY2025 are 7,551 units more than entire PV sales of 27,89,678 units in FY2016.

Trading places: While UVs have dramatically increased their share of PV sales to 65% from 21% a decade ago, the share of hatchbacks and sedans has plunged to 31% in FY2025 from 72% in FY2016. And UV sales in FY2025 are 7,551 units more than entire PV sales of 27,89,678 units in FY2016.

Compare the two vehicle categories’ market performance – while hatchback and sedan manufacturers sold 195,660 fewer vehicles in FY2025, SUV and MPV OEMs sold 276,538 units more last fiscal. According to SIAM, attractive discounts and promotional offers supported the growth momentum and helped sustain volumes. What also accelerated demand for SUVs is a good number of new models being launched. Electric vehicle retails also hit a new high of over 107,500 units in FY2025.

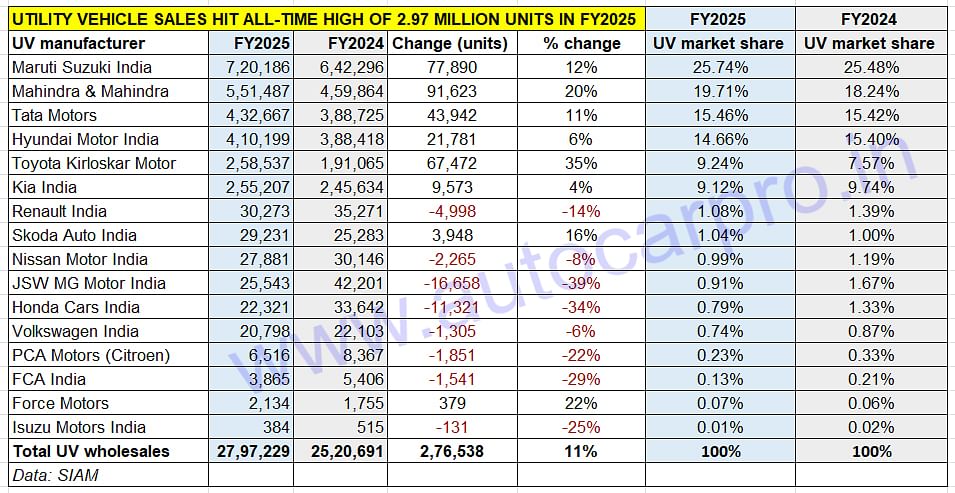

MARUTI SUZUKI LEADS UV MARKET FOR EIGHTH YEAR IN A ROW, MAHINDRA AND TOYOTA SHINE

Given the strong shift to UVs in past six-odd years, it is not surprising that every OEM worth its wheel wants to have SUVs in its portfolio. The Top 6 PV OEMs – Maruti Suzuki (1.76 million PVs), Hyundai Motor India (598,666 PVs), Tata Motors (569,245 PVs), Mahindra & Mahindra (551,487 PVs/SUVs), Toyota Kirloskar Motor (309,230 PVs) and Kia India (255,207 PVs/UVs) – have all benefited from having a strong UV/SUV portfolio.

Maruti Suzuki (720,186 units) accounts for a market-leading 26% share of the 2.79 million UV sales in FY2024. Mahindra (551,487 units, 20% UV share) takes second position and Tata Motors is third (432,667 UVs, 15.46% share). Hyundai Motor India (410,199 units, 15.42% UV share) is followed by a resurgent Toyota Kirloskar Motor (258,537 units, 9% UV share). And, Kia India (255,207 units) has a 9% UV share (see data table below).

While Maruti Suzuki maintained its UV leader status, Mahindra, with best-ever sales of 551,487 SUVs, increased its UV share to 20%. Toyota too was an outperformer with 258,537 UVs and a 9% UV market share.

While Maruti Suzuki maintained its UV leader status, Mahindra, with best-ever sales of 551,487 SUVs, increased its UV share to 20%. Toyota too was an outperformer with 258,537 UVs and a 9% UV market share.

The consumer in this segment, particularly for SUVs, is truly spoilt – including the 16 SIAM member companies and 14 luxury OEMs there are 30 OEMs with an estimated 115 UV models and a mind-boggling 1,000-plus variants!

Of the Top 6 players, Mahindra leads with 13 SUVs, followed by Toyota with nine UVs and Maruti Suzuki and Hyundai with seven UVs each. Kia India has six models and Tata Motors five. Given the ongoing transition to electric mobility, Mahindra, Hyundai, Tata Motors and Kia already have electric vehicles in their UV stable, while Maruti Suzuki and Toyota India are slated to plug into this segment later this year.

While Maruti Suzuki and Mahindra & Mahindra have retained their top two rankings, there have been some shifts in the UV rankings table as a result of strong sales by some OEMs. Tata Motors, which was ranked fourth in FY2024 is now at No. 3, pushing a slower-selling Hyundai down to fourth place in FY2025. Likewise, Toyota Kirloskar Motor, ranked sixth in FY2025, is now No. 5, ahead of Kia India which has dropped one rank to sixth place. Skoda India, thanks to the new Kylaq compact SUV selling 10,205 units in three months since launch, has jumped three ranks to No. 8 from No. 11 in FY2024.

ALSO READ:

Tata Punch outpunches rivals to be SUV No. 1 in FY2025

Scorpio and 3XO command 48% share of record Mahindra SUV sales in FY2025

Maruti-rebadged models account for 53% of Toyota India record sales in FY2025

RELATED ARTICLES

TVS Apache sells 446,218 units in FY2025, grabs 40% share of 150-200cc bike market

TVS Motor Co’s Apache series has hit its second best-ever fiscal sales of 446,218 units in FY2025 – 19,104 units less th...

Maruti Ertiga turns 13, sells 1.21 million units since launch

Launched on April 16, 2012, Maruti Suzuki’s and India’s best-selling MPV for the past six years has clocked its highest ...

Scooter sales hit record levels of 6.85 million units in FY2025

While Honda with its Activa remains the market leader with a 42% market share, TVS sold 1.81 million scooters to increas...

17 Apr 2025

17 Apr 2025

1299 Views

1299 Views

Autocar Professional Bureau

Autocar Professional Bureau