Mahindra and Tata Motors sell over 500,000 vehicles, battle for No. 3 rank in FY2025

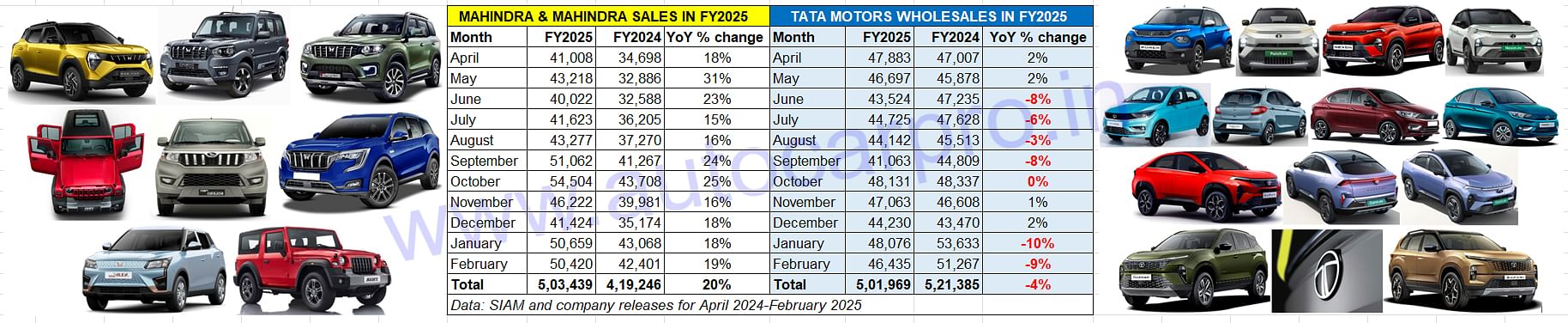

With just 1,470 units separating the two vehicle manufacturers, Mahindra & Mahindra, with dispatches of a record 503,439 units in the April 2024-February 2025 period, is the new challenger for the No. 3 passenger vehicle OEM position, after Maruti Suzuki and Hyundai Motor India. Tata Motors, ranked third in FY2024, has sold 501,969 units in the past 11 months. The two OEMs' sales in March will determine who wins in FY2025.

Even as passenger vehicle market leader Maruti Suzuki rules supreme and Hyundai Motor India will remain the No. 2 car and SUV manufacturer in India in FY2025, there’s a stiff battle underway for the next podium position between Tata Motors and Mahindra & Mahindra (M&M) in the current fiscal.

Separated by just 1,470 units at the end of February, the two Mumbai-headquartered automakers are now engaged in an intense battle for the No. 3 rank in the passenger vehicle market in FY2025. In FY2024, the top six PV OEMs were Maruti Suzuki (1.75 million vehicles), Hyundai Motor India (614,717 units), Tata Motors (582,915 units), Mahindra & Mahindra (459,877 units), Toyota Kirloskar Motor (245,676 units) and Kia India (245,634 units).

Both Mahindra & Mahindra and Tata Motors have sold over half-a-million vehicles in the past 11 months.

Both Mahindra & Mahindra and Tata Motors have sold over half-a-million vehicles in the past 11 months.

As per the wholesales figures released by Tata Motors and M&M for February 2025 and the computation of their past 11-month sales, both have registered dispatches of over 500,000 units to their dealers across the country. While Tata Motors has surpassed the half-a-million wholesales landmark for the third fiscal in a row, M&M has achieved it for the very first time in a fiscal.

As per SIAM and company press releases, Tata Motors has clocked cumulative vehicle dispatches of 501,969 units in the first 11 months of FY2025, down 4% YoY (April 2023-February 2024: 521,385 units). Mahindra & Mahindra has registered wholesales of 503,439 units, up 34% YoY (April 2023-February 2024: 376,845 units).

The Scorpio twins, XUV 3XO and XUV700 are the top three models for M&M in the current fiscal year.

The Scorpio twins, XUV 3XO and XUV700 are the top three models for M&M in the current fiscal year.

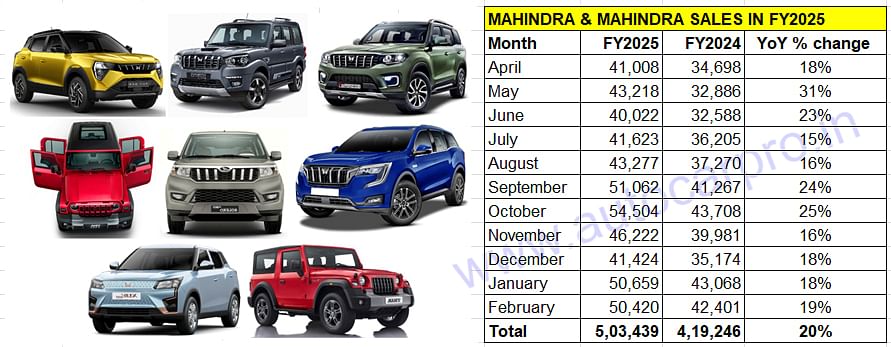

MAHINDRA & MAHINDRA: 503,439 UNITS, UP 20%

With the utility vehicle segment’s share of passenger vehicle sales rising to 65% from 59% a year ago, it’s no surprise that M&M with its portfolio of 12 SUVs (Bolero, Bolero Neo, Bolero Neo+, Scorpio N, Scorpio Classic, Thar, Thar Roxx, XUV3XO, XUV700, XUV400, BE 6 and XEV 9e) is benefiting from a wave of surging demand for most of its models. The 503,439 SUVs it has sold in the past 11 months are up 20% YoY, having sold an additional 84,193 units in the April 2024 to February 2025 period.

M&M has recorded robust double-digit growth right through the fiscal and over 50,000 sales in four of the past 11 months.

M&M has recorded robust double-digit growth right through the fiscal and over 50,000 sales in four of the past 11 months.

As the 11-month wholesales data table for FY2025 (shown above) reveals, the SUV manufacturer has recorded robust double-digit growth right through the fiscal. February 2025 (50,420 units, up 19%) is the fourth month in the current fiscal year that M&M has registered over 50,000-unit sales in a month. The company clocked 50,000 monthly sales for the first time in September 2024 (51,062 units, up 24%), followed it up with best-ever 54,504 units in the festival-laden October (up 25%) and opened CY2025 with January’s 50,659 units (up 18%)

While the model-wise sales split for the Mahindra SUV portfolio for February 2025 is not yet available, the wholesales numbers for the first 10 months of the fiscal (April 2024-January 2025) give a good indication of the key growth driving models. The Mahindra Scorpio, available as the Scorpio N and Scorpio Classic, tops with 137,311 units, followed by the XUV 3XO (85,990 units), XUV700 (78,763 units), Bolero (78,029 units), and Thar and Thar Roxx (66,650 units).

Mahindra & Mahindra, which clocked sales of a record 528,460 units in CY2024, up 22% YoY and hitting the half-a-million milestone for the first time in a calendar year, will better that score in the current fiscal. The rollout of the two new born-electric EVs – the BE 6 and XEV 9e will further accelerate demand for Mahindra which will achieve total dispatches of over 550,000 SUVs in FY2025, an increase of 20% YoY (FY2024: 459,877 units).

The Punch compact SUV, sold with petrol, electric and CNG powertrains, is Tata Motors' best-selling product and also the No. 1 PV in the fiscal to date.

The Punch compact SUV, sold with petrol, electric and CNG powertrains, is Tata Motors' best-selling product and also the No. 1 PV in the fiscal to date.

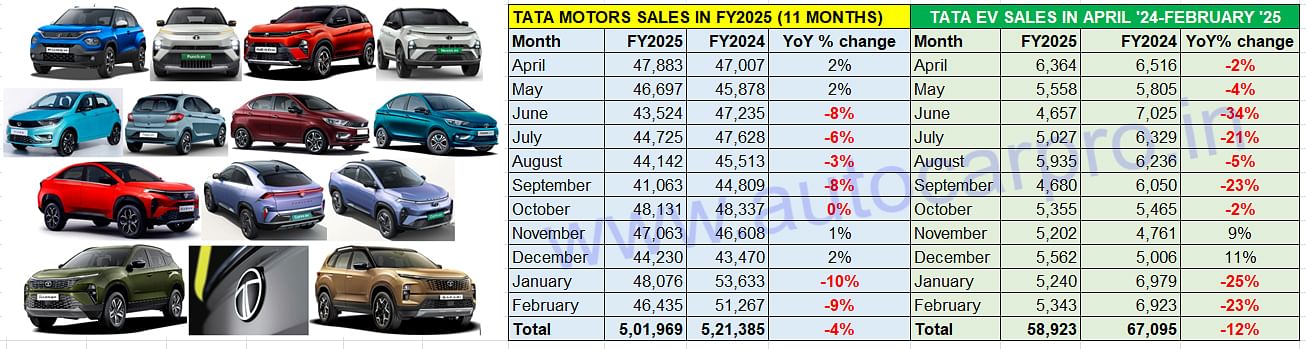

TATA MOTORS: 501,969 UNITS, DOWN 4%

Will Tata Motors, the No. 3 passenger vehicle OEM in FY2024 (582,915 units), FY2023 (544,391 units) as well as FY2022 (373,138 units) and FY2021 (224,109 units), hold onto its podium position in FY2025? Cumulative 11-month sales in the current fiscal year 2025 at 501,969 units for the car and SUV manufacturer, down 4% on year-ago dispatches of 521,385 units. At end-February 2025, Tata Motors is 80,946 units behind its record FY2024 wholesales of 582,915 units.

The difference in the current fiscal compared to its performance in FY2024 is that Tata Motors’ overall passenger vehicle wholesales continue to be dragged down by the decline in demand for its EVs, which have been impacted by the increased competition and product choice in the marketplace. The company, which retails eight passenger vehicles – Altroz, Tigor, Tiago, Nexon, Punch, Harrier, the Safari and the Curvv – in the domestic market, has been under pressure in most of the past 11 months.

Tata Motors’ overall passenger vehicle wholesales continue to be dragged down by the decline in demand for its EVs, which have been impacted by the increased competition and product choice in the marketplace

Tata Motors’ overall passenger vehicle wholesales continue to be dragged down by the decline in demand for its EVs, which have been impacted by the increased competition and product choice in the marketplace

As the 11-month wholesales data (see passenger vehicle and EV sales data above) reveals, the company’s market performance in the current fiscal has been impacted considerably by the slowed-down sales in the first two quarters of FY2025.

Q1 FY2025’s (April-June 2024) dispatches of 138,104 PVs were down 1% YoY and Q2 (July-September 2024) at 129,930 units were down 6% YoY. Sales returned to the black in Q3 (October-December 2024) at 139,424 units, up 1%, as a result of demand picking up in the festival months of October and November last year. Sales are down 10% at 94,511 units in first two months of Q4 FY2025 (January-February 2025). Will the fiscal year-ending month of March 2025 spring a positive surprise?

Tata Motors is faring well on the CNG front and is ranked No. 2 in CNG-powered car and SUV sales. The company, which had first introduced its innovative twin-CNG-cylinder technology in the Altroz hatchback, has now standardised the technology in its entire CNG line-up which comprises the Tiago CNG, Punch CNG, Altroz CNG, Tigor CNG and the Nexon CNG launched in September 2024. In CY2024, with retail sales of 115,432 vehicles, the company increased its CNG share to 16 percent.

Tata Motors’ accelerated growth over the past few years has been a result of its first-mover advantage in the electric vehicle market, where it once had an over 70% market share albeit that has dropped to around 65 percent. Of the mainstream PV OEMs, the company continues to have the largest e-PV portfolio in India comprising the Nexon EV, Tigor EV, Tiago EV, Xpres-T (for fleet buyers), Punch EV and the recently launched Curvv EV.

Tata Motors’ cumulative 11-month EV wholesales at 58,923 units are down 12% YoY (April 2023- February 2024: 67,095 units), having seen nine months of sales decline in the current fiscal. November and December 2024 were the only months where it registered EV sales growth. Clearly, the drop in EV sales is dragging overall PV sales numbers for the company and also resulting in reduced EV penetration level.

For the first 11 months of FY2025, Tata Motors’ EV penetration level stands at 12% compared to 13% in the year-ago period. According to the company, fleet volumes had declined in the October-December 2024 quarter due to the expiry of the FAME 2 subsidy.

The company’s share of the electric PV market, which was not too long ago upwards of 75%, has been continually reducing, reflecting the heightened competition from rival EV OEMs and increased product choice for buyers.

WILL THERE BE A NEW NO. 3 PASSENGER VEHICLE OEM IN FY2025?

The last month of FY2025 has begun and the 31 days of March 2025 will decide who ranks third in the overall passenger vehicle market. Maruti Suzuki with 1.61 million units (flat growth YoY) in the first 11 months of the fiscal remains a yawning distance away from Hyundai Motor India (546,846 units, down 3% YoY), which will surpass 600,000 sales for the second fiscal in a row after its 614,717 units in FY2024.

Tata Motors, which had hit a record 582,915 units in FY2024, could find it difficult to go past that figure in FY2025, with 11-month sales down 4% YoY. If it does achieve wholesales of 50,000 units in March 2025 – which would make it the only month in FY2025 with that figure – it will surpass 550,000 units albeit that will still be 30,000-odd vehicles below its FY2024's score.

March 2025, as it will be for other OEMs, bids fair to be a newsmaking month. Stay tuned in for more industry news reports and sales analyses.

RELATED ARTICLES

Maruti-rebadged models account for 53% of Toyota India record sales in FY2025

With combined sales of 163,483 units, the Toyota Glanza hatchback, Urban Cruiser Hyryder midsize SUV, Urban Cruiser Tais...

Toyota Taisor sells 32,378 units in first year

Launched on April 3, 2024, the Urban Cruiser Taisor compact SUV has contributed to 10% of Toyota Kirloskar Motor’s recor...

Maruti Nexa sales cross 500,000 for second fiscal in a row, 6 of 8 models see decline in FY2025

In FY2025, Maruti Suzuki's premium Nexa channel sold 543,050 passenger vehicles compared to 561,050 units in FY2024. Of ...

02 Mar 2025

02 Mar 2025

10542 Views

10542 Views

Autocar Professional Bureau

Autocar Professional Bureau