Infra projects, e-commerce drive December CV sales December

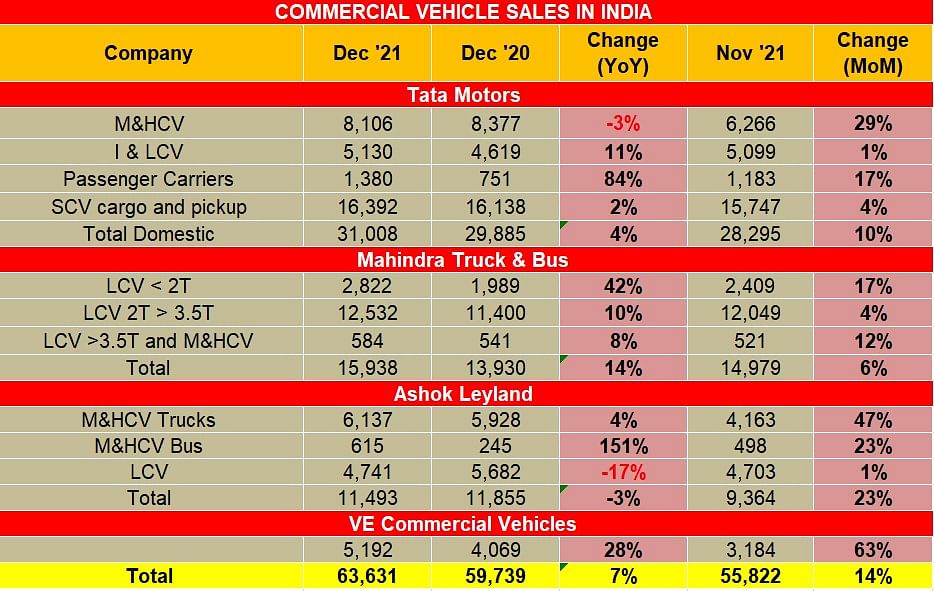

Though Covid-led challenges and semi-conductor crunch continues, the CV segment clocked 7 percent higher sales YoY at 63,631 units.

The December sales numbers indicate slight improvement in the demand for commercial vehicles in the country. Though Covid-led challenges and semi-conductor crunch continues, the CV segment clocked 7 percent higher sales YoY at 63,631 units. Even on a month-on-month comparison, the December sales are 14 percent higher compared to November, 2021.

Tata Motors’ reported wholesale of 31,008 units in December, compared to 29,885 units for the same period last year. On a quarterly basis, Tata Motors’ commercial vehicle domestic sale in Q3 FY2022 at 90,529 units was around 15% higher than the previous quarter (Q2 FY22) and 10% higher than the same quarter last year (Q3 FY2021).

Girish Wagh, executive director, Tata Motors pointed out that the “retail sales were ahead of wholesale by almost 15 percent in December, which enabled inventory alignment. The SCV and ILCV segments continued to benefit from the growth in e-commerce and the increasing need for last-mile delivery. Construction and infrastructure spending by central and state governments along with rising activity in sectors such as mining, petroleum-oil-lubricants and allied industries facilitated the demand for M&HCVs.”

Tata Motors’ international business too continued its recovery momentum and grew by around 10 percent over the previous quarter (Q2 FY2022) and 33% over the same quarter last year (Q3 FY2021). “Going forward, we expect the situation to remain fluid as the semiconductor shortage continues, instances of Covid begin to rise and underlying demand continues to remain under pressure. We are keeping a close watch on the evolving situation and sharpening our agile, multi-pronged approach to fulfil customer orders,” added Wagh.

Mahindra & Mahindra reported an uptick of 14 percent YoY, selling 15,938 units in December. The sales were primarily driven by the ILCV segment or the 2-tonne to 3.5-tonne segment. Veejay Nakra, CEO – Automotive Division, Mahindra & Mahindra said, “We have seen growth in business segments including Passenger Vehicles, Commercial Vehicles and International Operations, owing to continued strong demand across the product portfolio. The issues around semi-conductor related parts continue to be a challenge for the industry and remains a major focus area for us.”

Ashok Leyland reported sales of 11,493 units in down 3 percent YoY but 23 percent higher compared to the previous month.

VE Commercial Vehicles (VECV) registered a growth of 7 percent YoY, with sales of 5,192 units, compared to 4,069 units for the same period last year.

Overall the CV companies showcased strong demand across the product portfolio but the semi-conductor crunch could impact retail sales and continues to be a major overhang for the auto industry.

RELATED ARTICLES

Exclusive: Maruti Fronx is first Nexa SUV to hit 300,000 sales

Baleno-based Maruti Fronx becomes the first premium SUV from the Nexa channel to achieve cumulative sales of 300,000 uni...

Scorpio and 3XO command 48% share of record Mahindra SUV sales in FY2025

While the Scorpio N and Classic sold 164,842 units and an additional 23,380 units YoY for a 30% share of M&M’s record sa...

Mahindra produces 8,303 electric-origin SUVs in Q4 FY25, dispatches 8,047 units to dealers

The all-electric XEV 9e and BE 6 accounted for 5% of Mahindra & Mahindra’s wholesales of 149,127 SUVs in January-March 2...

03 Jan 2022

03 Jan 2022

8233 Views

8233 Views

Autocar Professional Bureau

Autocar Professional Bureau