Hyundai Motor India sells 598,666 vehicles in FY2025, Creta sells 194,871 units

Korean car and SUV manufacturer narrowly misses hitting the 600,000 sales milestone for the second year in a row. Hyundai’s best-selling model remains the Creta midsize SUV which, along with the Creta Electric, has sold 194,871 units. With demand for hatchbacks and sedans slowing, the SUV share of PV sales has risen to 68.5% or 410,086 units, up 5.5% YoY.

Hyundai Motor India, the second-ranked passenger vehicle manufacturer after Maruti Suzuki in volumes, has reported sales of 598,666 cars and SUVs in FY2025, down 3% year on year (FY2024: 614,717 units).

FY2025 has been tough fiscal for Hyundai and, like Maruti Suzuki, has seen the consumer shift towards SUVs impact demand for its clutch of hatchbacks and sedans. As can be seen in the 12-month sales split (see data table below), the company saw eight months of sales decline, three months of 1% growth and one month of flat sales. The company’s best month in FY2025 was the festival-laden October 2024 (55,568 units, up 1%). In CY2024, Hyundai sold 605,429 units and saw marginal 1% growth.

SUVs continue to provide the bulk of the sales for Hyundai Motor India which retails 10 models in India — two hatchbacks (Grand i10 Nios, i20), two sedans (Aura, Verna) and seven SUVs (Creta, Creta Electric, Venue, Alcazar, Exter, and Tucson along with the all-electric Ioniq 5). The company had, in mid-2024, pulled out the all-electric Kona from the market.

SUVs continue to provide the bulk of the sales for Hyundai Motor India which retails 10 models in India — two hatchbacks (Grand i10 Nios, i20), two sedans (Aura, Verna) and seven SUVs (Creta, Creta Electric, Venue, Alcazar, Exter, and Tucson along with the all-electric Ioniq 5). The company had, in mid-2024, pulled out the all-electric Kona from the market.

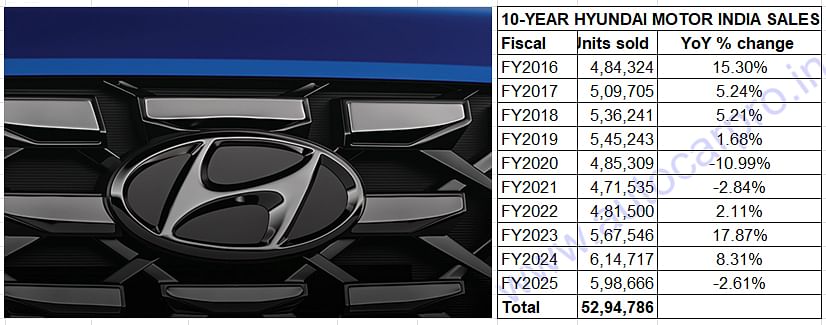

Ten-year wholesales data (see table above) reveals that, following the Covid-impacted FY2020 and FY2021, Hyundai had achieved a new high of 567,546 units and 18% growth in FY2023. Sales rose 8% in FY2024 to 614,717 units, the first time that the 600,000 milestone was achieved.

Ten-year wholesales data (see table above) reveals that, following the Covid-impacted FY2020 and FY2021, Hyundai had achieved a new high of 567,546 units and 18% growth in FY2023. Sales rose 8% in FY2024 to 614,717 units, the first time that the 600,000 milestone was achieved.

SUV SHARE OF HYUNDAI SALES GROWS TO 68.5%: 410,086 UNITS

As they are with other OEMs, SUVs continue to be key growth drivers for Hyundai. The new Creta, which is India’s best-selling midsize SUV, and the Venue and Exter compact SUVs continue to be the growth drivers. According to the company, SUVs contributed to 68.5% of its domestic market sales in FY2025. This works out to 410,086 units, which is a 5.5% increase over its FY2024’s UV sales of 388,725 units.

The Creta midsize SUV, which is currently India’s best-selling model in this segment, received a boost with the launch of the zero-emission avatar, the Creta Electric on January 17, 2025. It is estimated that the Creta and the Creta Electric together have sold a total of 194,871 units in FY2025. This marks strong 20% YoY growth (FY2024: 162,773 units).

The rapid pace of demand for the new Creta, launched in January 2024, has meant that the new Creta cruised to 100,000-unit sales in just six months. This makes it the fastest in its segment to hit the 100,000 milestone and in half the time the Maruti Grand Vitara took. In CY2024, the Creta with 186,919 units was the best-selling Hyundai product and accounted for 31% of overall PV sales for the company. In CY2024, the contribution of its SUV portfolio was the highest yet – 67.6% – which works out to around 409,270 units.

While the model-wise sales splits for March 2025 (other than the Creta) are not yet available, data for the first 11 months of FY2025 – which saw dispatches of 546,846 PVs – shows that the Creta, show that the Creta is the No. 1 model for Hyundai, followed by the Venue (108,672 units), Exter (71,511 units), Grand i10 (57,425 units), 120 Elite (51,061 units), Aura (49,871 units), Alcazar (15,701 units), Verna (14,229 units), Tucson (1,230 units), and Ioniq 5 (333 units).

If it is to retain its No. 2 position in the Indian market in FY2026, then Hyundai Motor India will have to consistently register a higher level of monthly sales in the new fiscal. That’s because an aggressive Mahindra & Mahindra, which has sold a record 551,487 units and clocked 20% growth, is hard on its heels and eyeing that slot. There’s Tata Motors, which has sold 553,585 cars and SUVs, in between Hyundai and Mahindra. Clearly, it looks like FY2026 will see a fair bit of action in the market share stakes.

RELATED ARTICLES

Exclusive: Maruti Nexa sells over a million SUVs

Ten years after the premium Nexa channel was launched, Nexa-branded premium Maruti Suzuki SUVs and two MPVs have clocked...

Maruti Grand Vitara is fastest midsize SUV to 300,000 sales

Launched on September 26, 2022, the Maruti Grand Vitara, which was the fastest among midsize SUVs to the 100,000, 200,00...

Ola Electric holds onto lead over TVS and Bajaj in first three weeks of April

Having taken the lead early in April, Ola has sold 12,546 units in the April 1-21 period, just 84 units ahead of TVS iQu...

01 Apr 2025

01 Apr 2025

3132 Views

3132 Views

Autocar Professional Bureau

Autocar Professional Bureau