Exclusive: UP, Maharashtra, Karnataka and Tamil Nadu drive double-digit EV sales growth in FY2025

The top seven states cornered 64% of record India EV retail sales of 1.96 million units with five registering high double-digit growth. While Uttar Pradesh remains No. 1 with a 19% share, Maharashtra tops sales of electric two-wheelers, passenger and commercial vehicles. Gujarat, however, witnessed a 22% YoY decline in EV sales. Here’s looking at the sales trend in states and Union Territories in the country.

If India’s electric vehicle (EV) industry came within an arm’s length of hitting the 2-million retail sales milestone with 1.96 million units and 17% growth in FY2025, it is thanks to the strong demand for zero-emission vehicles in its major EV-buying markets. The market scenario is similar to CY2024, which saw retail sales of 1.95 million units but higher 27% growth.

India EV Inc’s growth trajectory in FY2025, albeit slower than in FY2024, has its footprint across multiple states and Union territories in terms of EV ownership. With nearly all States and Union Territories wooing EV buyers with EV-ownership friendly policies and measures, finding out how they fare on the EV ownership / user chart is important.

Given the growing market size of the domestic EV industry, it is also interesting to delve into data to find out just how EV ownership / EV population stacks up across India. These numbers also provide EV manufacturers key analytics into exactly which States / Union Territories are faring in terms of retail sales. FY2025 is clearly an eye-opener, particularly in view of slowing retail sales in some key states across India.

A deep dive into the EV retail sales statistics of all the States and UTs, across vehicle segments, sourced from the Vahan portal, reveals plenty of insights and some surprising stats too. Vahan, however, does not provide the retail sales for the state of Telangana.

UTTAR PRADESH, MAHARASHTRA, KARNATAKA, TAMIL NADU, BIHAR, MADHYA PRADESH & RAJASTHAN COMMAND 64% OF INDIA SALES

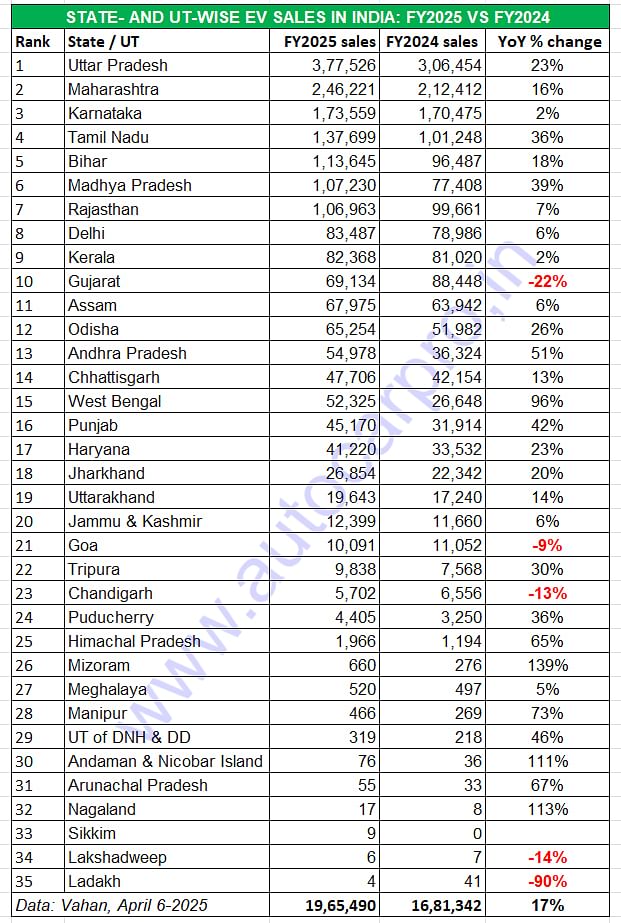

As per the Vahan-sourced data, of the total 19,65,490 EVs sold in India in F2025 (as per Vahan data sourced on April 6, 2025), the top seven states – Uttar Pradesh (377,526 units, up 23%), Maharashtra (246,221 units, up 16%), Karnataka (173,559 units, up 2%), Tamil Nadu (137,699 units, up 36%), Bihar (up 18%), Madhya Pradesh (100,314 units, up 39%) and Rajasthan (106,963 units, up 7%) – registered six-figure sales in excess of 100,000 EVs. Their cumulative sales of 12,62,843 or 1.12 million EVs, up 19% YoY (FY2024: 10,64,145 units) account for 64% of total EV sales in India in FY2025.

EVs, at 1.96 million units, comprised 00% of the 26.22 million automobiles sold in India (Telangana data not available)

EV sales in CY2024 at 1.95 million units comprised 7.49% of India Auto Inc’s overall sales of 26.20 million automobiles across all powertrains. While electric two-wheelers (1.14 million units, up 21%) and a 58% share were the largest contributor to India EV Inc, electric three-wheelers (699,073 units, up 11%) accounted for a 35% share. Together, the e2W and e3W segments comprised 93% of India EV Inc’s total retails. Also hitting record sales last year was the electric passenger vehicle segment (over 107,000 units, up 18%) which had a 5% share of total EV industry sales. The electric commercial vehicle segment, which comprises zero-emission buses, light and heavy goods vehicles, sold 8,746 units, up 7% YoY, and had a 0.5% share of EV sales.

Uttar Pradesh (UP) tops the state-wise table with sale of 377,526 units, up 23% (FY2024: 306,454 units) and a 19% share of India sales. This is thanks to UP accounting for the largest number of electric three-wheelers – 266,819 units and a commanding 38% of the 699,066 e-3Ws sold last fiscal. In the other e-sub-segments, Uttar Pradesh ranks down the line – in e-two-wheelers, the state is in fourth place with 102,522 units (up 91%), fifth in e-passenger vehicles (7,842 units, up 35%) and e-buses (252 units, down 61%).

Maharashtra, which is ranked second overall on the all-India EV ownership scale with 246,221 units and a 12.52% share of India EV sales, has the bragging rights for being No. 1 in e-two-wheelers, electric cars and SUVs, and also e-CVs. Of the 11,49,641 e-two-wheelers sold in India in FY2025, Maharashtra with 211,880 units, up 15%, has the largest share of 18 percent. Likewise, in electric car and SUV sales, the state leads with 17,133 units, up 21%, and a 16% share of the 107,782 e-PVs sold. The western state, which is home to the country’s financial capital, is also No. 1 in e-buses with 2,104 units, up 24%, and a 24% market share.

Despite much slower 3% YoY growth, Karnataka, with 173,559 units, takes No. 3 position and an overall EV market share of 9 percent. The southern state is the No. 2 in e-2Ws (148,254 e2Ws, down 1%) as well and passenger vehicles (14,576 units, up 8%). Karnataka is ranked third in e-CVs: 1,209 units.

Tamil Nadu, which aims to become the EV hub of the country with its well-established ecosystem of both EV component and vehicle manufacturers, is ranked No. 4 on the all-India EV sales scale. The southern state registered retails of 137,699 units, which gives it a 7% share of the market. Tamil Nadu is the No. 3 in e2Ws (118,836 units, up 36% / 10% share), No. 4 in e-PVs (8,533 units, up 24% / 8% share) as well as e-CVs (905 units, up 17%, up / 10% share). It is low on the e3W scale though – the 9,419 units sold in FY2025 place it at No. 16 on the all-India e-3W ladder board.

Bihar is ranked No. 5 with total EV sales of 113,645 units, which gives it an all-India share of 6 percent. The bulk of Bihar sales come from e-3Ws (89,524 units / 13% share), followed by e-2Ws (23,064 units / 2% share), e-PVs (963 units / 1% share) and e-CVs (94 units).

Madhya Pradesh with 107,230 units has a 5% share of all-India EV sales. The bulk of its retails came from e-2Ws (73,405 units / 6% share), followed by e-3Ws (30,885 units / 4 % share), electric cars and SUVs (2,710 units / 2.51% share) and 230 electric CVs.

Rajasthan, with 106,963 units and a 5% share, takes sixth position in EV sales for FY2025, and is behind Madhya Pradesh by just 267 units. The bulk of its sales comprise e-two-wheelers (76,241 units / 7% share). While the state witnessed sales of 23,684 e-3Ws (3% share), its residents have also bought 6,652 e-PVs (6% share). The northern state saw sale of 376 electric CVs last fiscal.

ELECTRIC 2-WHEELERS

ELECTRIC 2-WHEELERS

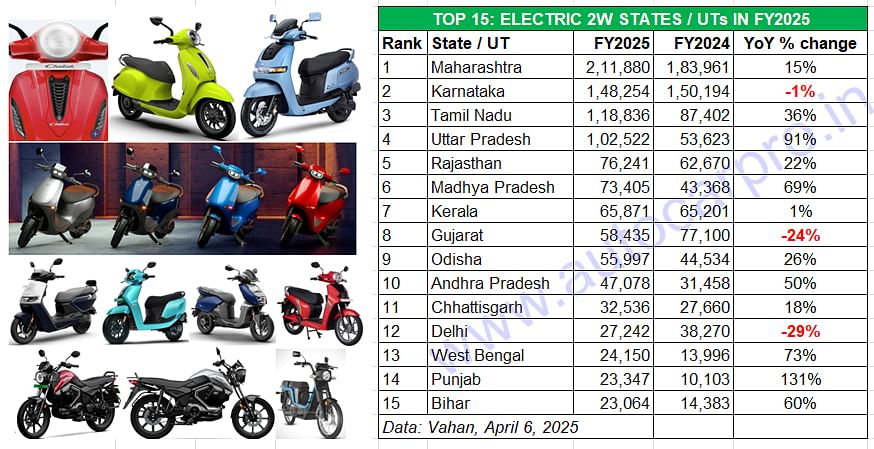

12 of Top 15 states shine, sales down in Karnataka, Gujarat, Delhi

The most affordable EV segment is understandably also the largest volume segment. In FY2025, it crossed the million sales milestone for the first time and hit 1.14 million units, up 21% YoY. This saw its share of India EV Inc’s sales rise to 58% from 56% in FY2024.

As the Top 15 sales region data table above reveals, 12 states registered growth. Maharashtra, the overall No. 2 state for EV sales, accounted for 211,880 e-2Ws, up 15% YoY and 86% of its total EV retails as well as 18% of all e2W sales. The Pune-based Bajaj Auto has had a stellar fiscal and closed FY2025 with best-ever sales of 230,808 units, up 116% YoY with a good number of that likely to be in Maharashtra.

Karnataka, which is home to smart e-scooter OEM Ather Energy, is the No. 2 state with 148,254 units and a 13% share of the 1.14 million e2Ws sold. Thirty thousand e2Ws after Karnataka is Tamil Nadu, another Southern state, which is home to the manufacturing plants of market leader Ola Electric, No. 2 OEM TVS Motor Co, and also Greaves Electric Mobility. Tamil clocked sales of 118,836 units, up 36% for a 10% share.

Of the remaining 12 states in the Top 15 list, other than Gujarat (down 24%), Delhi (down 29%) and Kerala (down 1%), all the other states fared very well. Uttar Pradesh (102,522 units, up 91%), Madhya Pradesh (73,405 units, up 69%), Odisha (55,997 units, up 26%), and Andhra Pradesh (47,078 units, up 50%) stood out as did West Bengal, Punjab and Bihar.

ELECTRIC 3-WHEELERS

ELECTRIC 3-WHEELERS

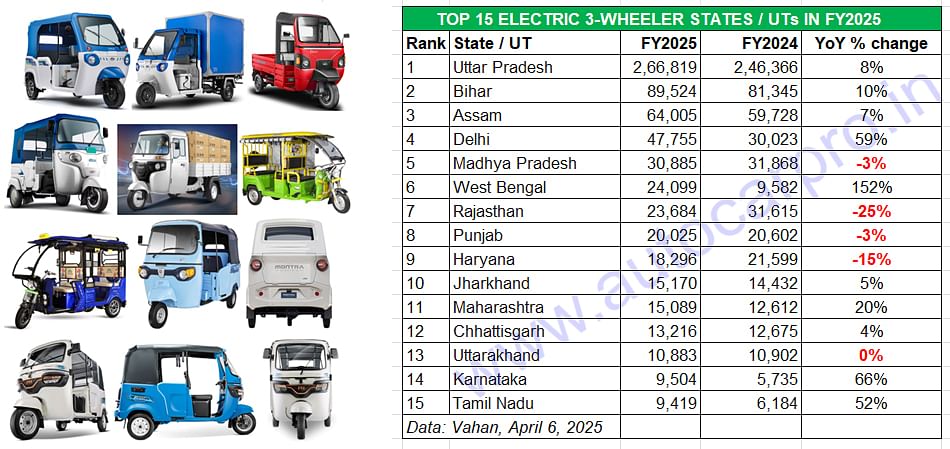

Uttar Pradesh commands 38% share of 699,703 units

In FY2025, the e-3W segment fell short of the 700,000-units milestone by just 927 units. At 699,073 units sold, year-on-year growth was 11% (FY2024: 632,642 units) and accounted for a commanding 57% share of the total 12,20,979 three-wheelers (across all powertrains) sold in India in FY2025. The e-3W segment is also the one which has, for the past three years, witnessed the highest level of transition from ICE to e-mobility with every second unit being a zero-emission model.

Uttar Pradesh is the topper here with 266,819 units, accounting for a strong 38% share of total e3W retails and way ahead of the other states. This has also helped UP go ahead of Maharashtra in the overall EV stakes. This powers it ahead of Maharashtra, which is the No. 1 in e-2Ws, e-passenger vehicles and e-commercial vehicles but No. 11 for e-3Ws with 15,089 units. Meanwhile, four states in the Top 15 – Madhya Pradesh, Rajasthan, Punjab and Haryana – have seen their e-3W sales decline (see data table above).

Bihar, with 89,524 units and a 13% share, is the No. 2 state in this segment, followed by Assam (64,005 units and 9% share).

This e-3W segment also has the distinction of having the largest number of players – nearly 600 companies as per Vahan data. Like the e-two-wheeler industry, there’s fierce competition, albeit amongst the Top 6 players – Mahindra Last Mile Mobility (MLMM), Bajaj Auto, YC Electric, Saera Electric Auto, Dilli Electric Auto and Piaggio Vehicles. And TVS Motor Co, with its King EV Max, is the latest legacy OEM to have entered the arena.

Interestingly, with the entry of legacy players in this segment, there is a shakeout happening and a good number of start-ups have seen a YoY decline in their FY2025 numbers.

ELECTRIC PASSENGER VEHICLES

ELECTRIC PASSENGER VEHICLES

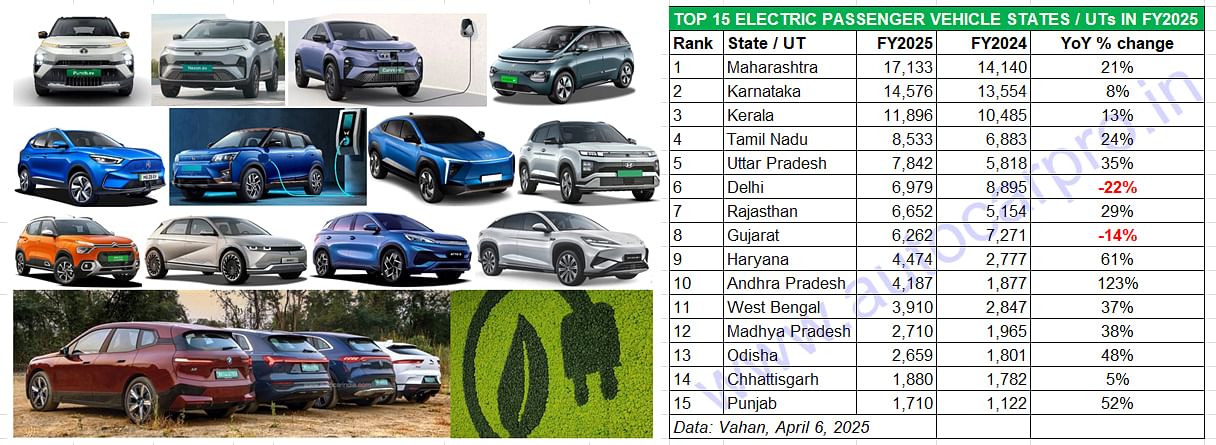

Maharashtra packs a punch, sales down in Delhi and Gujarat

The Indian electric passenger vehicle segment, in tandem with the electric two- and three-wheeler segments which notched their best-ever fiscal sales in FY2025, also registered its best-ever performance in FY2025: 107,000-plus units, up 18% YoY.

In FY2025, three states sold over 10,000 e-PVs each, together accounting for 40% of total retails. Of this Maharashtra maintained its dominance with 17,133 units, up 21% YoY, and a 16% share. Karnataka, with 14,576 units and 8% growth, was second and Kerala, with 11,896 units and 13% growth was third. Tamil Nadu (8,533 units, up 24%) and Uttar Pradesh (7,842 units, up 35%) were ranked fourth and fifth, respectively.

The next two ranked states saw their electric car and SUV sales decline. While sixth-ranked Delhi, with 6,979 units, saw demand fall by 22%, Gujarat with 6,282 units, witnessed a 14% fall in the e-PV retail sales.

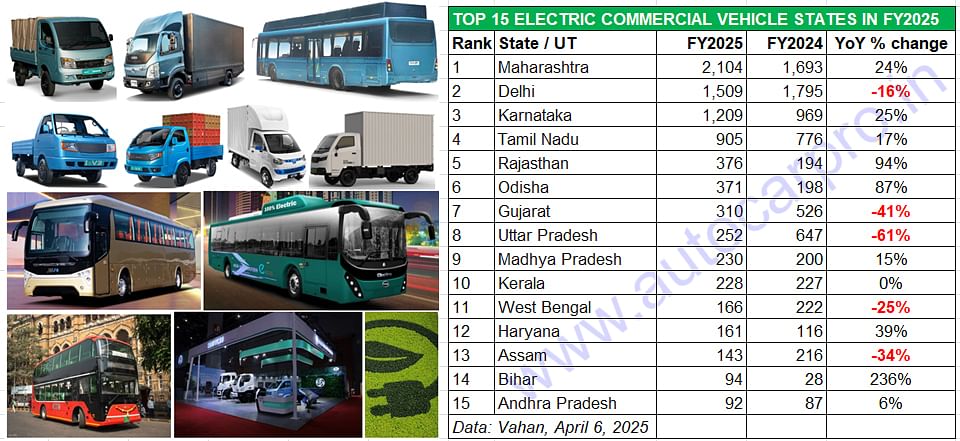

ELECTRIC COMMERCIAL VEHICLES

ELECTRIC COMMERCIAL VEHICLES

Maharashtra tops with 24% share

The electric CV sector essentially comprises light-, medium- and heavy-duty goods carriers and passenger-transporting buses. As compared to personal electric mobility in the form of e-two-wheelers and passenger vehicles, the CV industry is where electric mobility makes wallet-friendly TCO sense given the much larger number of kilometres driven every day. The sharp rise in demand for zero emission last-mile mobility and logistics operations has led to a marked increase in sale of e-LCVs and SCVs. Demand for electric passenger-transporting buses through STUs is also on the rise.

As per Vahan data for CY2024, Maharashtra tops the list with total retails of 2,104 units and a 24% share of the all-India total of 8,746 e-CVs. It is followed by Delhi (1,509 units, down 16% / 17% share), Karnataka (1,209 units, up 25% / 14% share) and Tamil Nadu (905 units, up 17% / 10% share). Rajasthan (376 units, up 94%) and Odisha (371 units, up 87%) both registered good growth albeit on a low year-ago base and were ranked No. 5 and No. 6, respectively. Seventh-ranked Gujarat (310 units, down 41%), No. 8 Uttar Pradesh (252 units, down 61%), and No. 11 West Bengal (166 units, down 25%) were, along with Delhi, the five to see their e-CV sales decline YoY.

RELATED ARTICLES

Mahindra Thar Roxx and Tata Curvv best-selling new SUVs in FY2025

With over 125 models and a mind-boggling 1,000-plus variants, utility vehicle buyers in India are spoilt for choice. Whi...

Honda Unicorn outsells Bajaj Pulsar in 125-150cc segment in FY2025

With total sales of 282,536 units in FY2025, the Honda Unicorn 150 has gone ahead of Bajaj Auto, the segment leader in F...

Bajaj Qute exports jump 54% to 6,422 units in best-ever fiscal year

Overseas shipments of the Bajaj Qute have recorded their best-ever fiscal year numbers. FY2025 saw 6,422 units of the qu...

07 Apr 2025

07 Apr 2025

4144 Views

4144 Views

Autocar Professional Bureau

Autocar Professional Bureau