Electric 2W sales in first-half 2024 cross 525,000 units, already 61% of record 2023

Given the current pace of demand for electric scooters, motorcycles and mopeds, this EV segment will cross a million units for a first time in CY2024. Ola Electric with 228,161 units and 81% growth sees its share rise to 44% while TVS Motor Co and Bajaj Auto also notch gains

The Indian electric two-wheeler industry, which delivers the maximum volumes for India EV Inc and sold a record 860,365 units in CY2023, is well on its way to sell over a million units for the first time in a calendar year in CY2024.

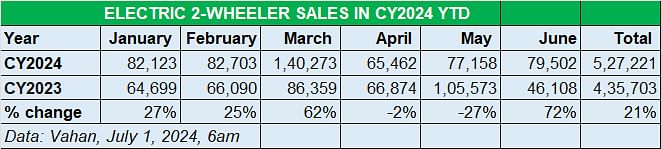

As per the retail sales data available on the government’s Vahan website as of July 1 (6am), between January 1 and June 30, 2024, a total of 527,221 electric scooters, motorcycles and mopeds have been sold in India. This constitutes 21% year-on-year growth (January-June 2023: 435,703 units). And given that CY2023 saw this segment register record sales of 860,365 units, H1 2024 retail sales are already 61% of that total.

Given the current pace of demand for electric scooters, motorcycles and mopeds, this EV segment will cross a million units for a first time in CY2024.

Given the current pace of demand for electric scooters, motorcycles and mopeds, this EV segment will cross a million units for a first time in CY2024.

A look at the six-month retail sales data table above reveals that the lowest monthly sales in the year to date were in April 2024 – 65,462 units – following the closure of the FAME II subsidy scheme on March 31. This also explains why March 2024 with 140,273 units was the month with the highest-ever e-two-wheeler sales.

The FAME II subsidy scheme, which closed on March 31, 2024, has been replaced by the Electric Mobility Promotion Scheme (EMPS). Valid for a four-month period from April 1 to July 31, 2024, EMPS has a total outlay of Rs 500 crore and aims to support the purchase of 372,000 EVs including 333,000 two-wheelers and 38,828 three-wheelers (L5 category). While e-two-wheelers get a subsidy of Rs 5,000 per kWh with a maximum limit of Rs 10,000 per unit under EMPS, e-three-wheelers can avail a subsidy of Rs 5,000 per kWh with a maximum limit twice that of two-wheelers at Rs 10,000 per unit.

While EMPS has helped improve sales numbers in May and June, July 2024 should see a similar spike in EV sales as in March 2024, with consumers likely to take the non-subsidy and increased product prices (for e2Ws and e3Ws) in their stride albeit the growth rate will reduce substantially compared to the strong double-digit growth seen consistently in CY2023. Let’s take a closer look at the top six movers and shakers of the industry in June and for the first six months of CY2024.

Ola Electric: June 2024: 36,716 units

Ola Electric: June 2024: 36,716 units

Jan-June 2024: 228,161 units, up 81% YoY (Jan-June 2023: 126,068)

H1 2024 market share: 44% / H1 2023 market share: 30.50%

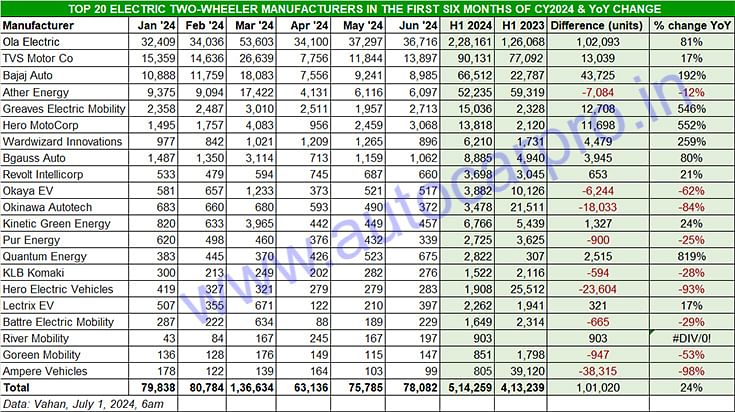

Ola Electric continues to maintain its stranglehold over the market. The company opened CY2024 with retails of 32,409 units, hit a high of 53,603 units in March and has clocked 36,716 units in June. This gives Ola cumulative six-month sales of 228,161 units, which are 102,093 additional EVs sold and a handsome 81% YoY growth (H1 2023: 126,068 units). This robust performance is amply reflected in the company’s market share which has jumped to 44% from 30.50% a year ago.

Ola Electric has recently entered the mass-market segment with the S1 X portfolio, a move which has paid dividends. Available in three battery configurations (2 kWh, 3 kWh, and 4 kWh), the scooters are priced at Rs 74,999, Rs 84,999, and Rs 99,999, respectively. The company has also recently revised the prices of its S1 Pro, S1 Air, and S1 X+ to Rs 129,999, Rs 1,04,999, and Rs 89,999, respectively.

TVS Motor Co: June 2024: 13,897 units

TVS Motor Co: June 2024: 13,897 units

Jan-June 2024: 90,131 units, up 17% YoY (Jan-June 2023: 77,092)

H1 2024 market share: 17.52% / H1 2023 market share: 18.65%

TVS Motor Co, the longstanding No. 2 player, sold 13,897 iQubes units last month, improving 51% on its May 2024 sales of 11,844 units. However, after a blistering CY2023, sales seem to be slowing – cumulative January-June 2024 sales at 90,131 units were up 18% YoY for a 17.52% market share in the year to date but down on the 18.65% in H1 2023.

On May 13, two years after the iQube got its first refresh, TVS launched more variants, both at the lower and upper end of the spectrum. The iQube line-up now starts with a base variant with a 2.2kWh battery, 75km real-world range, charging time of 2 hours from 0-80 percent with a 950W charger and a slightly smaller than the rest 30-litre underseat storage area. This base variant is now the most affordable iQube at Rs 94,999. There is also a larger variant with a 3.4kWh battery. Both these models get a 5-inch TFT display with tow and theft alerts and turn-by-turn navigation.

The iQube ST line-up has expanded to include variants with two capacities – 3.4kWh and 5.1kWh. The iQube ST 3.4 variant (Rs 155,555) has a claimed real-world range of 100km. The range-topping ST 5.1 variant has the largest battery capacity of any Indian electric scooter and TVS claims a real-world range of 150km on a single charge. The iQube ST 5.1 also has a higher 82kph top speed, and the claimed charging time is 4hr 18min from 0 to 80 percent. The ST 5.1 gets all the same features as the ST 3.4, but at Rs 185,373, it's the most expensive model in the line-up. TVS says that customers who had pre-booked the ST variant before July 15, 2022, will be able to purchase either the 5.1 kWh or 3.4 kWh variant with an introductory loyalty bonus of Rs 10,000.

On June 9, TVS issued a first-ever voluntary recall for the iQube for the units manufactured between July 10, 2023 and September 09, 2023 to sort out an issue related to the bridge tube component in the iQube's chassis. While the specific number of recalled iQubes was not revealed, sales data for that period show that around 45,000 units were sold.

June also saw the iQube being showcased for the first time in Indonesia, at the Jakarta Fair by PT TVS Motor, a subsidiary of TVS Motor Company.

The company, which expects two-wheeler EV sales in India to reach 30% market penetration by CY2025, is targeting a big jump in the contribution of EV sales to its overall volumes over the next two years.  Bajaj Auto: June 2024: 8,985 units

Bajaj Auto: June 2024: 8,985 units

Jan-June 2024: 66,512 units, up 192% YoY (Jan-June 2023: 22,787)

H1 2024 market share: 13% / H1 2023 market share: 5.51%

A glance at Bajaj Auto’s first-half 2024 performance and the 192% YoY increase reveals just how strongly the company has performed. Bajaj Auto maintains its No. 3 ranking with 8,985 Chetaks sold in June and 66,512 units in H1 CY2024. Its January-June retails give the Pune-based company a market share of 13%, more than doubling its 5.51% share in H1 2023..

Bajaj Auto, which markets the two Chetak variants – Urbane (Rs 123,319) and Premium (Rs 147,243) – continues to see strong demand. This is thanks to a ramped-up production and a growing dealer network, which is to be expanded from its existing presence in 164 cities and 200 touchpoints to around 600 showrooms in the next three to four months. Bajaj Auto is also soon to further up the ante with the launch of a new mass-market e-scooter under the Chetak brand umbrella.

Ather Energy: June 2024: 6,097 units

Ather Energy: June 2024: 6,097 units

Jan-June 2024: 52,235 units, down 12% YoY (Jan-June 2023: 59,319)

H1 2024 market share: 10% / H1 2023 market share: 14%

Bengaluru-based smart EV OEM Ather Energy recorded sales of 6,097 units in June 2024 and a market share of 7.66 percent. Its cumulative January-June sales at 52,235 units are down 12% (January-June 2023: 59,319 units), which means it has some catching up to do. And the company is doing just that with a brand-new product.

On April 6, Ather launched the new Rizta at a starting price of Rs 109,999 (Rizta S) through to Rs 149,999 (Rizta Z). While the S version is equipped with a 2.9 kwH battery and has a 123km range, the Z variant with a 3.7 kWH battery has a 160km range. Key highlights for the family EV include the largest two-wheeler seat in India and storage space aplenty.

Ather was among the newsmakers last month for its announcement of setting up its third India plant in Maharashtra. The facility, which will come up Aurangabad Industrial City (AURIC), calls for an investment of over Rs 2,000 crore and will annually produce up to a million units of both EVs and battery packs.

Greaves Electric Mobility: June 2024: 2,713 units

Greaves Electric Mobility: June 2024: 2,713 units

Jan-June 2024: 15,036 units, up 546% YoY (Jan-June 2023: 2,328)

H1 2024 market share: 3% / H1 2023 market share: 0.56%

Having launched its new Ampere Nexus e-scooter, Greaves Electric Mobility saw a smart rise in its June sales. Compared to May retails of 1,957 units, June sales at 2,713 units were up 39% month on month. The company has averaged monthly sales of 2,506 units in first-half 2024 and its cumulative six-month sales at 15,036 units are a huge jump over the 2,328 units of H1 2023, albeit a low year-ago base. Nevertheless, this performance is reflected in market share which has risen to 3% from 0.56% a year ago.

Targeted at families, the Ampere Nexus has been designed and developed in-house at the Ranipet facility in Tamil Nadu. Equipped with a 3 kWH LFP battery, the Nexus has a claimed top speed of 93kph and a certified range of 136km. Sold in two variants, prices start at Rs 110,000 (ex-showroom) and go up to Rs 120,000.

Hero MotoCorp: June 2024: 3,068 units

Hero MotoCorp: June 2024: 3,068 units

Jan-June 2024: 13,818 units, up 552% YoY (Jan-June 2023: 2,120)

H1 2024 market share: 2.68% / H1 2023 market share: 0.51%

The world’s largest two-wheeler manufacturer and the last of the big legacy players to enter the EV market is seeing demand pick up for its Vida brand of e-scooters. The company, which sold 3,068 units in June, has averaged monthly sales of 2,303 units in H1 2024, a big improvement over the 353 units it averaged in H1 2023. Market share has risen to 2.68% from 0.51% in G1 2023.

Last month saw Hero MotoCorp, which is an early investor in Ather Energy and has been a part of the Bengaluru-based smart electric scooter manufacturer's growth story since 2016, hike its stake by 2.2% and is banking on demand growing rapidly for Ather products.

A look at the sales performance and a YoY comparison of the remaining 14 of the Top 20 e-two-wheeler OEMs in first-half 2024 reveals that barring only a few, all have registered strong growth.

RELATED ARTICLES

Maruti Nexa sales cross 500,000 for second fiscal in a row, 6 of 8 models see decline in FY2025

In FY2025, Maruti Suzuki's premium Nexa channel sold 543,050 passenger vehicles compared to 561,050 units in FY2024. Of ...

Nexa models sell 3.1 million units in 10 years, take 31% share of Maruti Suzuki sales in FY2025

From a 5% share of Maruti Suzuki’s passenger vehicle sales in FY2015 to 31% in FY2025, the Nexa premium channel continue...

Exclusive: Maruti Fronx is first Nexa SUV to hit 300,000 sales

Baleno-based Maruti Fronx becomes the first premium SUV from the Nexa channel to achieve cumulative sales of 300,000 uni...

01 Jul 2024

01 Jul 2024

34744 Views

34744 Views

Autocar Professional Bureau

Autocar Professional Bureau