CNG vehicle sales soar 33% in first-half 2024 to 550,000 units, cars and SUVs lead the charge

Over half-a-million CNG-fuelled passenger vehicles, three-wheelers, goods carriers, buses and van were sold between January-June. While Maruti Suzuki’s PV share is at 66%, a rollout of new CNG models sees Tata Motors’ share double to 22%; Bajaj Auto rules the 3W market with an 87% share, and Tata the goods carrier segment.

Today is when Bajaj Auto will take the covers off India’s and the world’s first CNG motorcycle – the Freedom 125 – clearly shining the spotlight on compressed natural gas as an alternative fuel for motoring. Demand for CNG-fuelled vehicles across the passenger vehicle, three-wheeler, goods carriers and buses in India continues to be on the upswing, as seen in the retails sales in the first six months of CY2024.

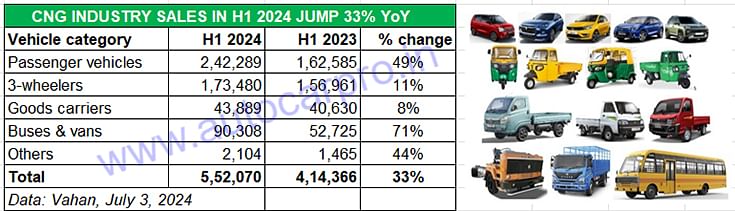

Latest Vahan-derived retail sales data reveals that between January 1 and June 30, 2024, a total of 552,070 CNG-powered vehicles were sold in India, which is a strong 33% year-on-year increase (H1 2023: 414,366 units). What’s more, in a display of democratised growth, all four vehicle segments have witnessed growth with three registering strong double-digit increases.

While all four vehicle sub-segments have seen growth in H1 2024, CNG cars and SUVs (up 49%) have a 44% share, while three-wheelers have 31 percent

While all four vehicle sub-segments have seen growth in H1 2024, CNG cars and SUVs (up 49%) have a 44% share, while three-wheelers have 31 percent

A look at the segment-wise retail sales data table reveals that CNG-powered passenger vehicles (cars, SUVs and MPVs) at 242,289 units registered handsome 49% YoY growth in H1 2024 (H1 2023: 162,585). They account for the bulk of the CNG industry’s sales at 44 percent.

The three-wheeler segment, where the fastest shift to electric mobility is underway and every second unit sold is an EV, saw a more muted 11% YoY increase to 173,480 units, and accounts for a 31% of the overall CNG market.

Goods carriers, which are classified as light, medium and heavy goods carriers, together sold a total of 43,889 units in the January-June 2024 period, up 8% YoY (H1 2023: 40,630 units).

The first six months of this year saw 90,308 CNG-powered buses and vans being sold, which makes for sterling 71% YoY increase (H1 2023: 52,725 units) and accounts for a 00% share of the market.

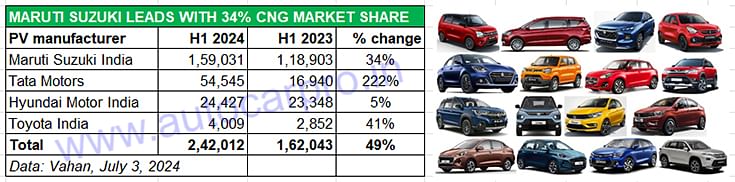

At present, there are only four CNG PV OEMs in India which retail 25 models. Let’s take a closer look at each segment’s players and how they have fared.

With a 13-strong portfolio, Maruti Suzuki maintains a strong lead over its rivals. New product rollouts have helped Tata Motors double its CNG market share to 22.51% in H1 2024 compared to the 10.41% share in H1 2023.

With a 13-strong portfolio, Maruti Suzuki maintains a strong lead over its rivals. New product rollouts have helped Tata Motors double its CNG market share to 22.51% in H1 2024 compared to the 10.41% share in H1 2023.

CNG PASSENGER VEHICLES: 242,289 units, up 34% YoY

Maruti Suzuki CNG share at 66%, Tata Motors well ahead of Hyundai

With a 44% contribution to overall CNG vehicle sales between January and June 2024, the passenger vehicle industry with 242,289 units and 34% YoY growth has the largest share of the CNG vehicle industry.

In CY2023, India PV Inc had sold a record 400,016 CNG units, up 17.64% on FY2022’s 340,100 units. PV market leader Maruti Suzuki also held sway over this sub-segment with 278,699 units or 70% of the CNG PV market. The company, which has all of 13 models (Alto K10, Baleno, Brezza, Celerio, Dzire, Eeco, Ertiga, Grand Vitara, S-Presso, Swift, Wagon R, XL6, and the Fronx), understandably, has a vice-like grip on the market.

In the January-June 2024 period, Maruti Suzuki has sold 159,031 units, up 34% (H1 2023: 118,903 units) and 57% of its CY2023’s total. At present, the company has a vice-like 66% share of the CNG PV market. Maruti Suzuki, which completely pulled out of the diesel car market in April 2020, has seen the vacuum being filled by the consumer demand for its CNG models.

Tata Motors, the No. 3 PV OEM in overall sales after Maruti Suzuki and Hyundai Motor India, is the No. 2 in CNG-powered car and SUV sales. Tata Motors, which had sold a total of 63,993 CNG cars and SUVs in CY2023, has already achieved 85% of that total with its H1 2024 retails of 54,545 units, up 222% (H1 2023: 16,940 units). Its current CNG market share stands at 22.51% – more than double its 10.41% share in H1 2023.

The company, which entered the CNG market with the Tiago hatchback and Tigor sedan in January 2022, has gone on to hugely benefit from the rollout of new CNG models like the Tata Punch CNG compact SUV , which was Tata Motors’ response to the introduction of the Hyundai Exter CNG compact SUV. In early February 2024, Tata Motors launched the Tiago and Tigor CNG AMT which has added more ‘ammo’ to the CNG portfolio. Now, the company has confirmed plans to introduce the Nexon CNG, which was showcased at the Bharat Mobility Expo in January, this fiscal year.

Hyundai Motor India which has three models – Aura, Grand i10 Nios and Exter – has sold 24,427 units, up 5% on year-ago sales of 23,348 units. In CY2023, Hyundai had sold a total of 50,108 units.

Toyota Kirloskar Motor’s CNG passenger vehicle portfolio has recently expanded to four models with the Taisor joining the Glanza hatchback, Urban Cruiser Hyryder and the Rumion MPV). TKM, which had sold 6,553 units in CY2023, has retailed 4,009 units in H1 2024, up 49% year on year.

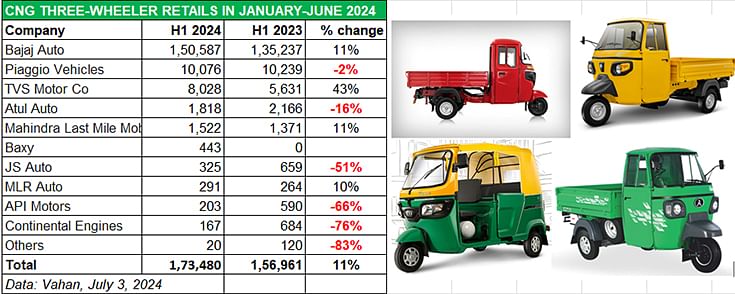

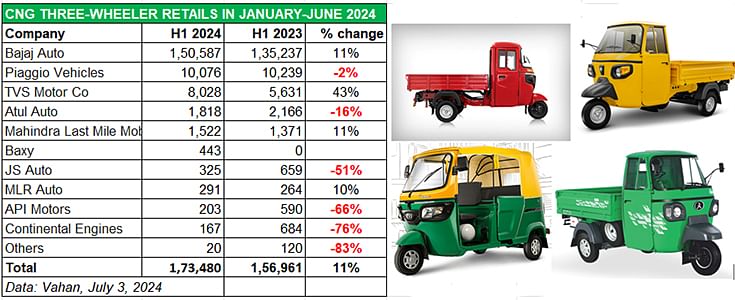

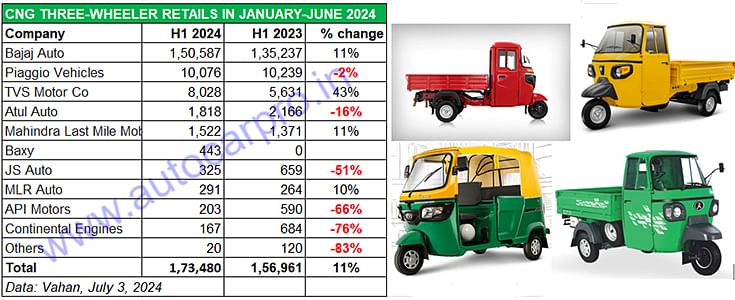

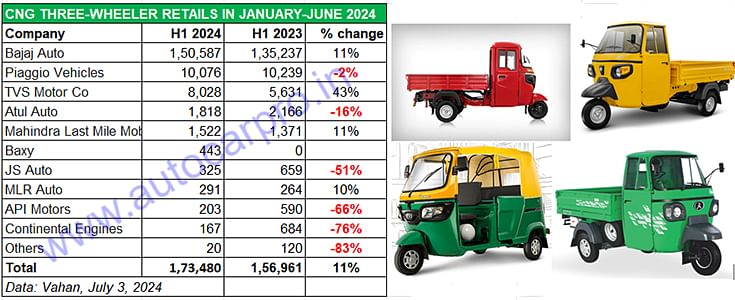

Bajaj Auto, TVS Motor Co, Mahindra Last Mile Mobility and MLR Auto are the only OEMs to record growth in the first six months of 2024.

Bajaj Auto, TVS Motor Co, Mahindra Last Mile Mobility and MLR Auto are the only OEMs to record growth in the first six months of 2024.

CNG THREE-WHEELERS: 173,480 units, up 11%

Bajaj Auto expands market share to 87%, rivals battle for 13%

Compared to the blistering 50% YoY growth it had recorded in FY2023 (344,510 units), the growth in H1 2024 in this sub-segment is more muted. Sales of 173,480 units are up 11% (H1 2023: 156,961 units). This is most likely attributable to. the speedier demand for electric three-wheelers – 313,967 units in H1 2024, up 27% YoY

Overall market leader Bajaj Auto also lords over the competition in the CNG segment: its 150,587 units, up 11%, give it an 87% market share, leaving the others to battle it out for the remaining 13% share of the pie.

As per the latest Vahan data, along with Bajaj Auto, TVS Motor Co, Mahindra Last Mile Mobility and MLR Auto are the only OEMs to record growth (see data table above).

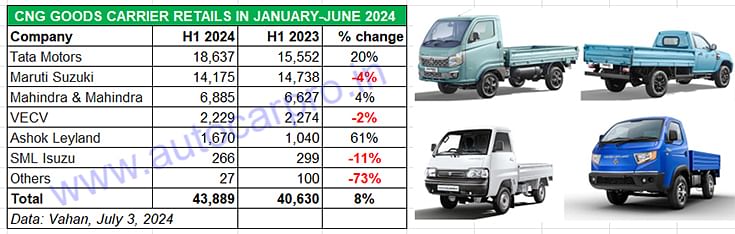

Demand, particularly for light goods carriers, seems to have been impacted by the transition to electric vehicles

Demand, particularly for light goods carriers, seems to have been impacted by the transition to electric vehicles

CNG GOODS CARRIERS: 43,889 units, up 8%

Tata Motors maintains leadership

The CNG goods carrier market, comprising light, medium and heavy goods carriers, is the one with the slowest growth, in single digits. Demand, particularly for light goods carriers, seems to have been impacted by the transition to electric vehicles, where the lower cost of ownership, compared to CNG, is driving demand from last-mile mobility and logistics operators.

A year ago, CNG-powered goods carriers across categories (small, medium and large), accounted for 10% of the overall CNG vehicle market – that has now reduced to 8% in the January-June 2024 period with sale of 43,889 units, up 8% on year-ago H1 2023 sales of 40,630 units.

As per Vahan data, four OEMs have seen their sales decline year on year. Tata Motors, which has a fairly large range of commercial vehicles ranging from the Ace through to the Ultra, remains the market leader with a 42% market share with 18,637 units, and has increased its share from the 38% it had in H1 2023.

At No. 2 is Maruti Suzuki India, which sold 14,175 Super Carrys, 0000 units fewer than it did a year ago, for its current market share of 32%, saw its sales decline 4% YoY.

Mahindra & Mahindra, with 6,885 units, has recorded 4% growth and has a 16% share of the goods carrier market. While VE Commercial Vehicles, with 2,229 units, sees its numbers down 2% year on year, Ashok Leyland, which has the Dost CNG, Dost Plus CNG and Bada Dost CNG, sold 1,670 units and saw demand jump 61% YoY. SML Isuzu with 266 units versus 299 units a year ago sees sales down sharply by 73% year on year.

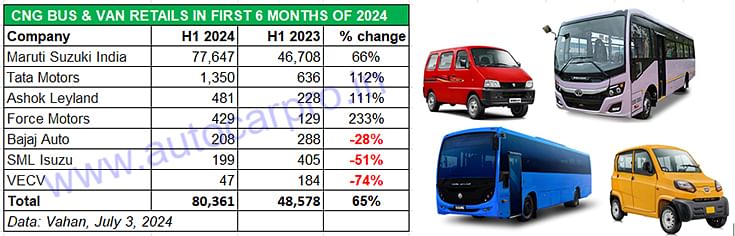

CNG BUSES AND VANS: 90,308 units, up 71% YoY

Eeco gives Maruti an 86% share

Maruti Suzuki, which has the Eeco van, has an overwhelming 86% share of the market in H1 2024, albeit this is a a tad less than the 88% share it had in H1 2023.

Both Tata Motors and Ashok Leyland have recorded similar growth rates of 111% YoY. While Tata Motors sold 1,350 buses and vans, Ashok Leyland clocked sales of 481 units. Force Motors, with 429 units, saw 233% growth on a low year-ago base. Meanwhile, Bajaj Auto sold 208 CNG-powered Qute quadricycles, 80 fewer than it did a year ago.

A concerted effort on the part of the government is driving the rapid expansion of CNG-filling stations across India, with the number of outlets projected to increase to 12,400 by end-FY2030.

A concerted effort on the part of the government is driving the rapid expansion of CNG-filling stations across India, with the number of outlets projected to increase to 12,400 by end-FY2030.

Improving CNG infrastructure fuels growing demand for CNG vehicles

Overall, the demand for CNG vehicles continues to be driven by the lower cost of ownership mantra that the greener fuel offers in the face of high petrol and diesel prices. As of July 4, 2024, in Mumbai, CNG is priced at Rs 73.50 compared per kg to diesel (Rs 89.97 per litre) or petrol (Rs 103.44 per litre).

Vehicle users, be they personal or commercial operators, are always keen on a fuel which is wallet-friendly and compared to conventional petrol and diesel fossil fuels, the option of buying cheaper CNG, which is a carbon-based fuel but with much less carbon content and comparatively to diesel or petrol more eco-friendly, is gradually finding favour among motorists.

Compressed natural gas is slowly emerging as a strong fuel option for both intra-city and inter-city runs, which is also thanks to the continuously growing CNG filling infrastructure across India. It is estimated that the number of CNG filling stations across the country are projected to increase to 8,750 by end-FY2025, 10,200 by end-FY2026, 11,800 by end-FY2027 and 12,400 by end-FY2030.

ALSO READ:

EV sales at 842,000 units in H1 2024 grow 16% but June is lowest in 12 months

RELATED ARTICLES

Auto sales grow 7% to 25.60 million in FY2025, 658,000 units short of record FY2019

Driven by record sales of passenger vehicles and three-wheelers, India Auto Inc clocked wholesales of 2,56,07,391 units ...

Maruti-rebadged models account for 53% of Toyota India record sales in FY2025

With combined sales of 163,483 units, the Toyota Glanza hatchback, Urban Cruiser Hyryder midsize SUV, Urban Cruiser Tais...

Toyota Taisor sells 32,378 units in first year

Launched on April 3, 2024, the Urban Cruiser Taisor compact SUV has contributed to 10% of Toyota Kirloskar Motor’s recor...

05 Jul 2024

05 Jul 2024

17599 Views

17599 Views

Autocar Professional Bureau

Autocar Professional Bureau