Can Revolt Motors retain first-mover advantage in India’s electric motorcycle market?

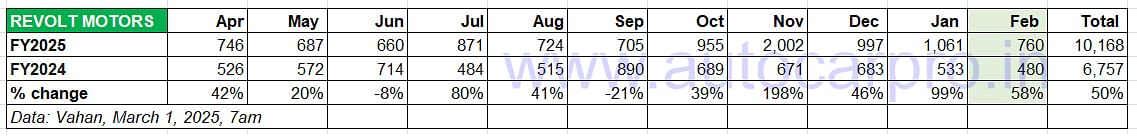

First to the electric motorcycle market in August 2019 and with scarce competition till date, Revolt Motors has sold over 40,000 zero-emission bikes in India including 10,168 units in the past 11 months. Now, with Ola Electric having launched its Roadster X entry level models and Hero MotoCorp set to enter this segment in collaboration with Zero Motorcycles, will the maker of the recently launched RV BlazeX and four other RV models hold onto its strategic advantage?

Revolt Motors, which was amongst the earliest to launch an electric motorcycle in India in CY2019, has expanded its portfolio to five products with the recent launch of the all-new RV BlazeX. Priced at Rs 114,990 (ex-showroom India), the high-on-connectivity RV BlazeX is powered by a 3.2 kWh lithium-ion battery pack along with a 4.1 kW mid-drive electric motor that empower a top speed of 85kph and a claimed 150km range on a single charge.

New Revolt RV BlazeX is powered by a 3.2 kWh lithium-ion battery pack and 4.1 kW mid-drive electric motor that deliver a top speed of 85kph and a claimed 150km range on a single charge.

New Revolt RV BlazeX is powered by a 3.2 kWh lithium-ion battery pack and 4.1 kW mid-drive electric motor that deliver a top speed of 85kph and a claimed 150km range on a single charge.

Keeping the RV BlazeX company in the Revolt stable are the RV1 (Rs 84,990, 2.2 kWh battery, 100km range), RV1+ (Rs 99,990, 3.24 kWh battery, 160km range), RV400 (Rs 136,950, 3.24 kWh battery, 150km range) and the RV400 BRZ (Rs 126,950, 3.24 kWh battery, 150km range). While the RV1 and RV1+ were launched in September 2024, the RV400 BRZ was introduced in the nascent electric motorcycle market in January 2024. The RV400, along with the now-discontinued RV300, were the first products from the company (called Revolt Intellicorp at the time) and launched in August 2019.

Revolt Intellicorp was a venture promoted by Rahul Sharma, co-founder of the giant consumer electronics company, Micromax. In January 2023, Rattan India Enterprises, the flagship company of the Rattan India Group which is engaged in tech-focussed, new-age businesses including e-commerce, EVs, fintech and drones, acquired 100% shareholding in Revolt Motors.  Strategy to target entry level ICE bikes pays off, new BlazeX guns for premium commuters

Strategy to target entry level ICE bikes pays off, new BlazeX guns for premium commuters

Motorcycles command two-third of the humungous two-wheeler market, leaving the rest to scooters and a minuscule percentage to the humble moped. Revolt Motors’ strategy to pit the RV1 and RV1+ against the volume-driven, fuel-sipping, price-sensitive, entry level petrol-engine commuter motorcycle segment seems to have clicked, the company receiving over 16,000 bookings in the first few weeks of bookings. And, as the FY2025 retail sales data reveals, monthly sales have taken off after these two models were introduced in September 2024.

According to the company, with up to 70% lower Total Cost of Ownership (TCO), Revolt motorcycles offer significant cost benefits compared to their petrol-engine counterparts.

Revolt Motors believes its electric motorcycles have the potential to disrupt the ICE commuter-motorcycle market with the promise of lower TCO (total cost of ownership), modern technology, and the convenience of a stress-free, gearless commute.

Revolt Motors believes its electric motorcycles have the potential to disrupt the ICE commuter-motorcycle market with the promise of lower TCO (total cost of ownership), modern technology, and the convenience of a stress-free, gearless commute.

Priced at Rs 114,990, the new Revolt RV BlazeX is built on the same second-generation platform that has spawned the RV1 and RV+ models.

Enthused by the success of the RV1 and RV1+ in the past six months, Revolt Motors has strategically priced the new RV BlazeX at Rs 114,990 (ex-showroom India), positioning it above the RV1 and RV1+ and below the higher-priced RV400 and RV400 BRZ siblings. It’s also no surprise that the new RV BlazeX is built on the same second-generation platform that has spawned the RV1 and RV+.

Interestingly, the RV BlazeX’s sticker price is the starting price for a number of the base variants in the premium 150-200cc IC engine commuter motorcycle, which is currently witnessing a sales decline. In fact, this 150cc-200cc ICE bike category is the only one among the 12 sub-segments to have seen a decline in the current fiscal, selling 932,332 units and accounting for a 9% share of the 1-million ICE motorcycles (up 7%) sold in the first 10 months of FY2025.

With rising petrol prices (currently at Rs 103.49 per litre in Mumbai), and a growing transition to electric two-wheelers in India, Revolt Motors believes its electric motorcycles have the potential to disrupt the commuter-motorcycle market with the promise of lower TCO (total cost of ownership), modern technology, and the convenience of a stress-free, gearless commute.

While it can be surmised that some 150-200cc ICE bike buyers could be migrating to higher-power performance bikes, some of them keen on a two-wheeler electric motorcycle could constitute a target audience for the RV BlazeX.

Cumulative 11-month retail sales have crossed the 10,000-unit mark with demand picking up following the launch of the RV1 and RV1+ models in September 2024.

Cumulative 11-month retail sales have crossed the 10,000-unit mark with demand picking up following the launch of the RV1 and RV1+ models in September 2024.

Revolt Motors moves up the EV OEM rankings, readies to meet new rivals

With retail sales of 9,951 units in CY2024, Revolt Motors registered strong 43% YoY growth (CY2023: 6,977 units). This performance, which gave it a 0.86% share of the overall e2W market, ensured that the company has moved up in the e2W OEM rankings to No. 10 from No. 14 in CY2023. However, it is to be noted that CY2024’s retails are not its best annual sales numbers. That was in CY2022 (14,910 units) when it had a 2.36% market share of the 631,397 electric two-wheelers sold that year.

In the current fiscal year’s first 11 months, Revolt Motors has clocked retail sales of 10,168 units, up 50% YoY (April 2023-February 2025: 6,757 units). In February 2025, it has sold 760 units, up 58% YoY and is ranked 10th in the Top 10 electric two-wheeler manufacturers in India.

As a result of being in the e-motorcycle market for over five years now, Revolt Motors has benefited from a first-mover advantage. The TVS Motor-backed Ultraviolette, which unveiled its F77 performance e-motorcycle in November 2019, launched it a year later for Rs 380,000 and followed it up with the F77 Mach 2 priced at Rs 299,000 in April 2024, remains at the top-end of the price spectrum. It is learnt that Ultraviolette plans to expand its portfolio to cater to different rider needs. Details on the future product line-up are to be announced on March 5.

Compared to a large number of e-scooter OEMs including legacy players like Bajaj Auto, TVS Motor Co and Hero MotoCorp and leading startups like Ola Electric and Ather Energy, there are only a handful of e-motorcycle OEMs – Oben EV, KLB Komaki, Matter Motor Works, Okaya EV, Orxa Energies and Wardwizard Innovations. TVS Motor Co has one product – the X – which has gone on sale recently. However, of these e-motorcycle players, Revolt is the only one to register strong monthly retail numbers.

Now, there’s fresh competition in the market in the form of Ola Electric, which has recently forayed into the electric motorcycle market with its entry level Ola Roadster X series comprising five variants priced from Rs 74,999 to Rs 154,999. While the base variant has a top speed of 105kph, the higher-end models can achieve 125kph. The entry-level 2.5kWh variant accelerates from 0 to 40 km/h in 3.4 seconds, with higher variants improving this to 2.7 seconds.

Ola CEO Bhavish Aggarwal is extremely bullish on demand for the Roadster X series. In a recent investor call, he said: “Motorcycles, as we all know, is about 2x the scooter market. We are actually very, very encouraged by the response and interest we are getting on our motorbikes, and we actually feel this is going to be the real inflection point for the EV 2-wheeler, 3-wheeler industry in India, which is motorbikes gaining EV penetration, and it's all going to happen in the next couple of quarters.” Ola also has other electric motorcycle launches planned later this year including the sporty midsized Sportster and Arrowhead bikes, followed by premium segment bikes.

That’s not the sole new competition to contend with. Revolt will also have to take on new competition from Hero MotoCorp, which has confirmed plans to enter the e-motorcycle market albeit in FY2026-27. Hero MotoCorp and its partner Zero Motorcycles will launch their middleweight electric bike albeit it is a premium model. The collaboration essentially combines the expertise of Zero Motorcycles in developing powertrains and electric motorcycles with the scale of manufacturing, sourcing and marketing prowess of Hero MotoCorp. The Hero-Zero EV platform will spawn four products – two high-performance motorcycles and two mid- to high-performance green bikes.

Meanwhile, Ather Energy, in which Hero MotoCorp has an equity stake, is also working on an electric motorcycle platform called ‘Zenith’ which will spawn products to target ICE motorcycles in the 125-300cc segments. There will also be a new scooter platform named ‘EL’. The new EVs born off the Zenith and EL platforms will roll out of the startup’s upcoming plant in Aurangabad, Maharashtra, in mid-2026.

L-R: Anjali Rattan, chairperson of RattanIndia Enterprises and Rajiv Rattan, chairman of RattanIndia Enterprises, at the launch of the Revolt RV BlazeX.

L-R: Anjali Rattan, chairperson of RattanIndia Enterprises and Rajiv Rattan, chairman of RattanIndia Enterprises, at the launch of the Revolt RV BlazeX.

Getting battle-ready with new products, R&D and manufacturing

Cognizant of the fact that the nascent e-motorcycle segment is soon to draw new competition, Revolt Motors is getting battle ready with plans covering new products, R&D and manufacturing. At present, the company has ample capacity on hand at its Manesar plant: 180,000 units per annum.

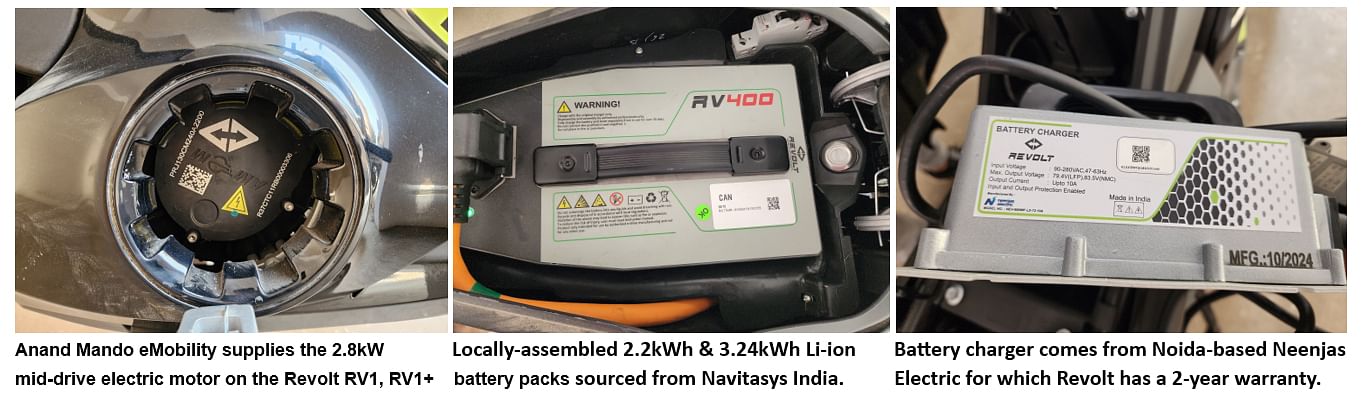

Given the current sales momentum which should see it clock retails of over 14,000 units in FY2025, the company has outlined an ambitious sales target of 40,000 to 45,000 e-motorcycles in FY2026. The company, which has an aggressive localization programme and currently uses EV components from Sona Comstar, Uno Minda, Rockman, FIEM and JBM, is also upping the ante on R&D.

Revolt Motors is upping the ante on R&D and a higher level of localisation using made-in-India EV components.

Revolt Motors is upping the ante on R&D and a higher level of localisation using made-in-India EV components.

Since it acquired Revolt Motors two years ago, Rattan India Enterprises has invested close to Rs 500 crore in the company which has a full-fledged R&D and manufacturing setup. Speaking to Autocar Professional at the BlazeX launch on February 25, Anjali Rattan, chairperson, RattanIndia Enterprises, pointed out that company remains fully committed to infusing capital into the venture as per the growth requirements in the future. From the current monthly sales volume of around 2,000 units, Revolt Motors is targeting sales of 5,000-7,000 e-bikes a month in the near term.

Interestingly, although it already has 180,000 units per annum capacity in Manesar, Revolt is also exploring manufacturing capacity expansion through an integrated greenfield facility and R&D Centre in South India. This move could be bolstered by the fact that some of its key suppliers like Sona Comstar have a manufacturing presence in the region.

Furthermore, it plans to aggressively expand its sales and service network from the existing 200 touchpoints across India, including semi-urban and rural town and country, to 500 outlets by 2026.

Revolt Motors’ chairperson, who is aware of the incoming competition, says: “We see the foray of competitors into the electric motorcycle segment as an opportunity that will open up and expand the market.”

The five-product company, which has begun exporting its e-motorcycles to Sri Lanka, aims to also tap commuter motorcycle-driven markets such as Latin America, Africa, and South East Asia. It is currently working on three new products including a premium commuter motorcycle as well as an electric motorcycle catering to young buyers. According to Rattan, the aim is to launch two new products every year over the next few years. “While one of these could be a refreshed product, the other one will be a brand-new model,” she said.

All this means that finally, in a market populated with electric scooters, there’s going to be a good deal of action on the zero-emission motorcycle front. Stay firmly plugged in for more analyses and updates on this segment of the Indian EV industry.

(With inputs from Mayank Dhingra)

RELATED ARTICLES

Record scooter sales power TVS to best-ever 3.51 million two-wheelers in FY2025

A record 1.81 million scooters with strong 25% growth have powered TVS Motor Co to its best-ever fiscal year sales of 3....

Tata Punch to Toyota Taisor: Top 10 compact SUVs in FY2025

With 1.38 million units sold in FY2025, less-than-4,000mm-long or compact SUVs registered 10% growth and accounted for n...

TVS Apache sells 446,218 units in FY2025, grabs 40% share of 150-200cc bike market

TVS Motor Co’s Apache series has hit its second best-ever fiscal sales of 446,218 units in FY2025 – 19,104 units less th...

01 Mar 2025

01 Mar 2025

8430 Views

8430 Views

Autocar Professional Bureau

Autocar Professional Bureau