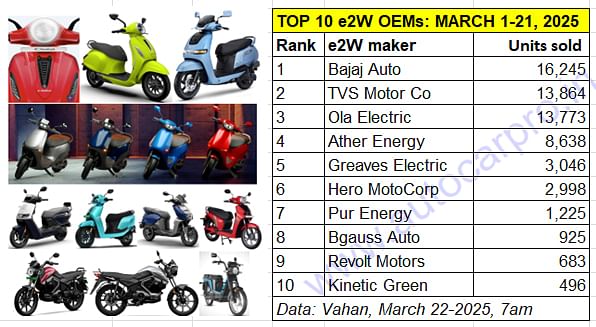

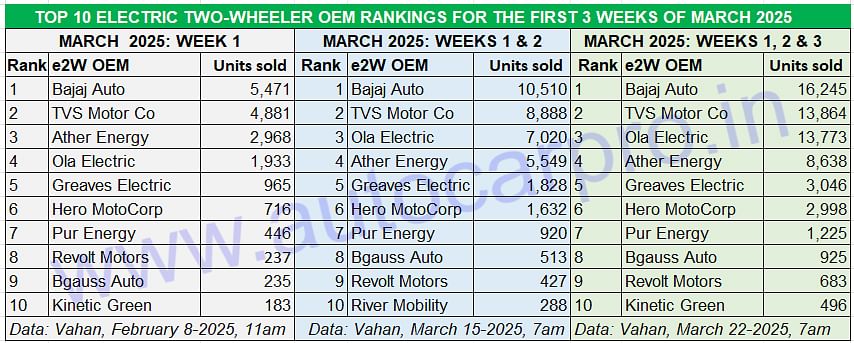

Bajaj Auto sells 16,245 Chetaks in March 1-21, TVS and Ola separated by 91 units

Bajaj Auto, which topped electric two-wheeler retail sales in the first two weeks of March 2025, maintains its lead in the third week with a lead of 2,381 units over TVS which, with 13,864 units, currently has a slender lead over Ola Electric’s 13,773 units as per the latest Vahan data.

Bajaj Auto, which led the Indian electric two-wheeler industry in the first two weeks of March 2025, has maintained its lead in the third week too, with nearly 14,000 Chetaks sold. However, as the latest retail sales data from the Vahan portal (as of March 22, 2025, 7am) depicts, his month’s Week 3 sales numbers reveal that there is now a tussle underway between No. 2 OEM, TVS Motor Co and the No. 3 OEM, Ola Electric.

While Bajaj Auto has clocked total cumulative three-week retails of 16,245 units, which gives it a lead of 2,381 units over TVS Motor Co’s 13,864 units, the iQube manufacturer’s lead over Ola Electric has reduced to 91 units, with Ola registering 13,773 units.

In the first 21 days of March 2025, a total of 65,140 units have been sold. They comprise 19,042 units in Week 1 (March 1-7), 20,580 units in Weeks 2 (March 14-21) and 25,518 units in Week 3 (March 15-21). This takes India e2W Inc’s total retails in the past 11 months and 21 days to 10,84,047 units – 135,534 units ahead of FY2024’s total retails of 948,513 electric two-wheelers.

The rapid pace of growth has meant that the Indian e2W industry has achieved the million-units retail milestone for the first time, news that Autocar Professional broke in its sales analysis on March 1, 2025.

The Top 10 EV OEMs’ combined sales at 58,564 units constitute 90% of total industry sales in the month to date, with the top four – Bajaj Auto, TVS, Ola and Ather – accounting for 52,520 EVs or 81% of monthly sales. Let’s take a closer look at the top six e2W OEMs.

BAJAJ AUTO

BAJAJ AUTO

March 1-21, 2025: 16,245 units / Market share: 25%

FY2025 till March 21, 2025: 212,109 units / Market share: 19%

Bajaj Auto is witnessing the same pace of strong demand it saw last month. The Chetak manufacturer, which was the No. 1 electric two-wheeler OEM in February 2025 as well as December 2024, continues to be in the lead in the last month of FY2025. As per the latest retail sales data on the Vahan portal (March 22-2025, 7am), a total of 16,245 Bajaj Chetaks have been delivered to buyers between March 1 and 21, putting it ahead of TVS Motor Co and Ola Electric.

In the process, the Bajaj Chetak, which currently has a 25% market share this month, has crossed the 200,000 cumulative sales mark for the first time in a fiscal year. At 212,109 units, it has a market share of 19% for the April 2024 to March 21, 2025 period. This is a handsome 98% YoY increase over its FY2024 sales of 106,923 units and reflects just how strong demand for been for the Chetak. Expect Bajaj to clock total FY2025 sales in the region of 220,000 units and set a new fiscal-year high.

In December 2024, Bajaj Auto expanded its Chetak model portfolio with the launch of the new 35 Series which comprises three variants: 3501, 3502 and 3503 and offers a higher range of 153km.

TVS MOTOR CO

TVS MOTOR CO

March 1-21, 2025: 13,864 units / Market share: 21%

FY2025 till March 21, 2025: 220,930 units / Market share: 20%

TVS Motor Co has registered cumulative retail sales of 13,864 electric two-wheelers in the first three weeks of March 2025. This gives it a market share of 21% for this month and takes its cumulative sales in the fiscal to date to 220,930 units and a 20% market share for the fiscal year to date.

Like Bajaj Auto, TVS has also surpassed the 200,000-units retail milestone in a fiscal for the first time, having sold 183,189 iQubes in FY2024. When March 2025 finally comes to a close, expect TVS’ FY2025 total to ride past the 225,000-units mark. The retail sales gap between TVS and Bajaj on the fiscal year front is currently 8,821 units, with only 7 days left for FY2025 to come to a close.

The company, which has ample manufacturing capacity on hand, is strategically expanding the iQube dealer network. Currently estimated at around 750 touchpoints across India, TVS is increasing the network each month.

OLA ELECTRIC

OLA ELECTRIC

March 1-21, 2025: 13,773 units / Market share: 21%

FY2025 till March 21, 2025: 334,345 units / Market share: 31%

With the latest Vahan retail sales data depicting 13,773 units in the first 21 days of March, Ola Electric has begun moving up the EV OEM ladder-board and currently has an 21% market share for the month – the same as TVS. Ola Electric, which retained its No. 1 title in January 2025, had dropped down by three ranks in February to No. 4.

On the cumulative retail sales front, with 334,345 e-scooters and e-motorcycles sold from April 2024 to March 21, 2025, Ola has surpassed its FY2024 total of 329,947 units. At present, the company has an overall 31% share of the 1.08 million electric two-wheelers sold in India till date this fiscal.

On March 21, 2025, Ola Electric informed the BSE that it had received emails from the Ministry of Heavy Industries dated March 11, 2025 and the Ministry of Road Transport and Highways of India on March 18, 2025 calling for clarification about the “large gap in vehicle registration as per VAHAN portal and sales as per the company’s regulatory filing dated Feb 28, 2025 for the month of February 2025.”

Vahan registration data for February 2025 puts Ola Electric sales at 8,652 units while the company had reported sales of 25,000 units for the month.

In a regulatory filing with the BSE on March 21, Ola Electric released a statement: “Our sales remain strong, and the temporary backlog in February was due to ongoing negotiations with our vendors responsible for vehicle registrations. This backlog is being rapidly cleared, with daily registrations exceeding 50% of our three-month daily sales average. 40% of the February backlog has already been cleared, and the remaining will be fully resolved by the end of March 2025. This is a straightforward case of a temporary registration backlog, yet certain media outlets and vested interests have deliberately misrepresented it as a regulatory issue through misinformation and smear campaigns. This intensified after we discontinued contracts with two nationwide vendors managing our registration process as part of our strategy to streamline operations and drive profitability. Since then, a coordinated effort has been made to create confusion and trigger unnecessary scrutiny.”

What would have given a fillip to Ola’s sales this month was the company’s ‘Holi Flash Sale’ from March 12-17 with discount offers of up to Rs 26,750 on its S1 range of electric scooters. Ola Electric’s mass-market S1 X portfolio is available in three battery configurations (2 kWh, 3 kWh, and 4 kWh). On January 31 this year, Ola launched its Gen 3 scooters in the form of four models – S1 X, S1 X+, S1 Pro and the new flagship S1 Pro+.

Expect Ola to up the ante later this year when it starts delivering its new EVs – the S1 Z priced at Rs 59,999 and the S1 Z+ which costs Rs 64,999 and the Ola Gig, a dedicated product for the gig economy, priced at an extremely affordable Rs 39,999, that it launched in end-November 2024. Deliveries of the S1 Z, S1 Z+, Gig and Gig1 are slated to begin later this year, around April-May.

Meanwhile, Ola has expanded its network to all of 4,000 stores across India. With 3,200 new stores co-located with service centres, this expansion aims to make Ola’s EVs more accessible across metros, Tier-2, and Tier-3 cities.

ATHER ENERGY

ATHER ENERGY

March 1-21, 2025: 8,638 units / Market share: 13%

FY2025 till March 21, 2025: 124,062 units / Market share: 11%

Smart electric scooter manufacturer Ather Energy has sold 8,638 units in the first three weeks of March, which gives it a 13% market share and the No. 4 rank. Cumulative retails in the fiscal to date are 124,062 units and a market share of 11 percent. In FY2024, Ather had sold 109,162 units, which means that it has improved on FY2024’s performance by 13% with one week’s sales still to be counted. Expect Ather to wrap up FY2025 with around 130,000 units.

Ather’s main growth drier is the Rizta family e-scooter launched in April 2024. While the S version (2.9 kWh battery) has a 123km range, the Z variant (3.7 kWh) has a 160km range. The Rizta’s highlights include the largest two-wheeler seat in India and storage space aplenty. The Ather Rizta also won Autocar India’s Electric Two-Wheeler of the Year 2025 award.

GREAVES ELECTRIC MOBILITY

March 1-21, 2025: 3,046 units / Market share: 4.67%

FY2025 till March 21, 2025: 37,565 units / Market share: 3.46%

Greaves Electric Mobility (GEM), the EV arm of Greaves Cotton, has clocked retail sales of 3,046 e-scooters and has a 5% share in the month to date. The company, which has a six-model portfolio of e-scooters comprising the Nexus (pictured above), Primus, Magnus LT/EX (100km+ range), Ampere Magnus Special, entry level Rio Li/La Plus and Zeal EX, has cumulative 11-month and 21-day retail sales of 37,565 units. This sees it improve upon its FY2024 sales of 31,276 units by 20 percent.

The Ampere Nexus, GEM’s newest product launched in April 2024, seems to be the key driver of this growth. Targeted at families, the Ampere Nexus has been designed and developed in-house at the Ranipet facility in Tamil Nadu. Equipped with a 3 kWH LFP battery, the Nexus has a claimed top speed of 93kph and a certified range of 136km. Sold in two variants, prices start at Rs 110,000 (ex-showroom) and go up to Rs 120,000.

GEM’s parent company Greaves Cotton, which has embarked on a strategic growth mission, is seeing GEM, its electric mobility division, deliver impressive results, generating revenues of Rs 175 crore in Q2 FY2025 and Rs 302 crore in H1 FY2025. This growth has been enabled by a focused approach on new product launches and a defined path toward profitability. GEM’s current e-two-wheeler sales and service network across India includes over 400 sales and service points.

HERO MOTOCORP

HERO MOTOCORP

March 1-21, 2025: 2,998 units / Market share: 4.60%

FY2025 till March 21, 2025: 43,683 units / Market share: 4%

Hero MotoCorp, with 2,998 units, is just 48 units behind Greaves Electric Mobility in the first three weeks of March and has a similar 4.60% market share for the month to date. However, on the cumulative 11-month and 21-days front, with total retails of 43,683 Vida scooters, Hero MotoCorp is ahead of GEM by 6,118 units.

In early December 2024, Hero MotoCorp expanded its EV portfolio with the launch of the new Vida V2. The Vida 2 is essentially an evolution of the V1 range that the world’s largest ICE two-wheeler began its electric mobility journey in October 2022. The Vida V2 is available in three variants: Lite (Rs 96,000), Plus (Rs 115,000) and Pro (Rs 135,000). The most affordable V2 Lite is an entirely new variant and comes with a small 2.2kWh battery pack that has a claimed 94km IDC range. It also has a lower 69kph top speed compared to the Plus and Pro variants, which have top speeds of 85kph and 90kph, respectively. Only two riding modes are available on the V2 Lite – Ride and Eco – but the rest of the feature-set is very similar to the other two, including the 7-inch touchscreen TFT display.

Hero MotoCorp has started scaling up brand presence for Vida and its network now stands at 203 touchpoints comprising 180 dealers across 116 cities. The company, which has the V1 Plus and V1 Pro EVs, plans to expand its portfolio – within the mid- and affordable segment – within FY2025. And it already has around 2,500 charging stations in collaboration with Ather Energy, in which Hero MotoCorp is an early investor.

ALSO READ: Can Revolt Motors retain first-mover advantage in India’s electric motorcycle market?

RELATED ARTICLES

Maruti Nexa sales cross 500,000 for second fiscal in a row, 6 of 8 models see decline in FY2025

In FY2025, Maruti Suzuki's premium Nexa channel sold 543,050 passenger vehicles compared to 561,050 units in FY2024. Of ...

Nexa models sell 3.1 million units in 10 years, take 31% share of Maruti Suzuki sales in FY2025

From a 5% share of Maruti Suzuki’s passenger vehicle sales in FY2015 to 31% in FY2025, the Nexa premium channel continue...

Exclusive: Maruti Fronx is first Nexa SUV to hit 300,000 sales

Baleno-based Maruti Fronx becomes the first premium SUV from the Nexa channel to achieve cumulative sales of 300,000 uni...

22 Mar 2025

22 Mar 2025

11751 Views

11751 Views

Autocar Professional Bureau

Autocar Professional Bureau