Bajaj Auto is No. 1 e2W OEM in March, sells 1,124 Chetaks every day

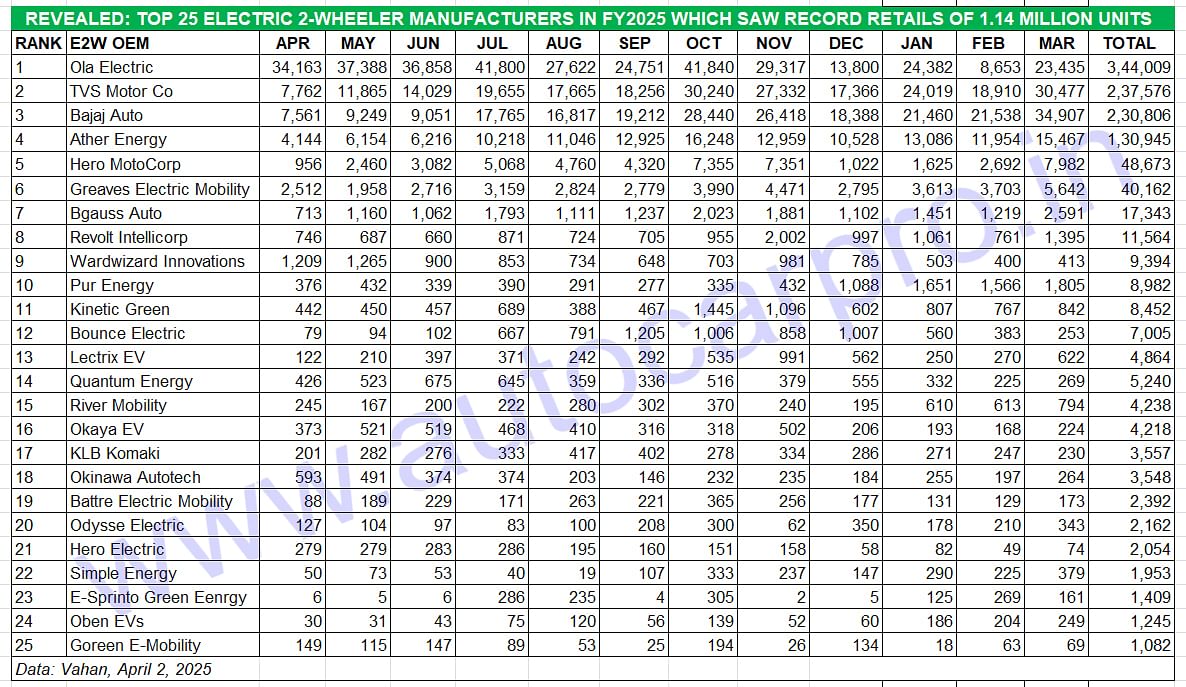

With best-ever monthly sales of 34,863 Chetaks in March 2025, Bajaj Auto has wrapped up FY2025 with total retail sales of 230,761 units, just 6,790 units behind TVS Motor Co which also hit its best-ever monthly sales as did Ather Energy. March 2025, which saw 130,274 electric two-wheelers sold, is the second-best month in FY2025 after the festive October 2024.

Bajaj Auto has wrapped up FY2025 on a high note. The Pune-based company, which entered the electric vehicle industry with the Chetak scooter in January 2020, has registered its best-ever monthly retail sales of 34,863 units in March 2025. While this translates into 1,124 Chetaks being delivered to consumers for each day last month, it also caps off a record fiscal with total 12-month Chetak sales at 230,761 units, up 116% YoY (FY2024: 106,624 units).

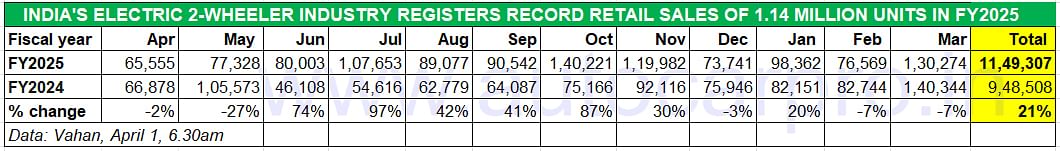

The Indian two-wheeler industry has also witnessed a record fiscal with total retails of 1.14 million units, which is a robust 21% YoY increase (FY2024: 948,514 units). As reported last month, the rapid pace of growth has meant that the Indian e2W industry has achieved the million-units retail milestone for the first time, news that Autocar Professional broke in its sales analysis on March 1, 2025.

As the 12-month sales break-up (shown below) depicts, March 2025 with 130,274 units is the second highest month of sales after the 140,221 e2Ws sold in the festive month of October 2024. March 2025 retails though are down &% YoY (March 2024: 140,344 units)

Electric two-wheeler OEMs have sold over 1.14 million units in FY2025, up 21% on FY2024's 948,508 units and surpassed the million milestone for the first time.

Electric two-wheeler OEMs have sold over 1.14 million units in FY2025, up 21% on FY2024's 948,508 units and surpassed the million milestone for the first time.

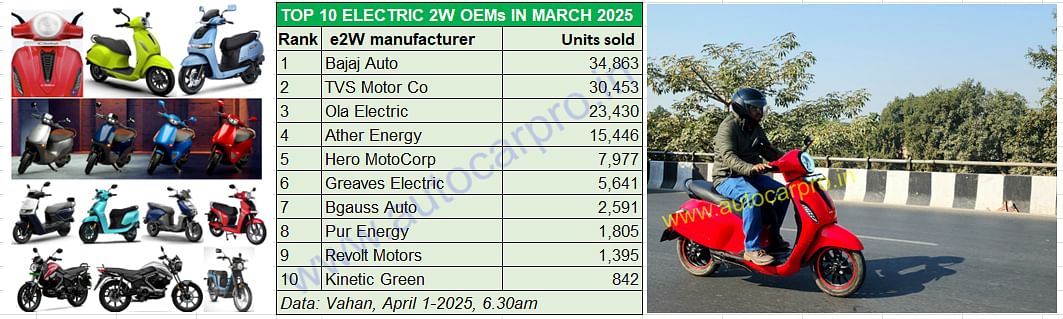

Legacy OEMs Bajaj Auto (34,863 units) and TVS Motor Co (30,453) have both hit their best-ever monthly retails in March 2025, as also for FY2025.

Legacy OEMs Bajaj Auto (34,863 units) and TVS Motor Co (30,453) have both hit their best-ever monthly retails in March 2025, as also for FY2025.

The Top 10 EV OEMs’ combined sales at 124,443 units constitute 95% of total industry sales in March 2025, with the top four – Bajaj Auto, TVS, Ola and Ather – accounting for 104,192 EVs or 80% of monthly sales. Let’s take a closer look at the top six e2W OEMs.

The Bajaj Chetak 35 Series, which comprises three variants – 3501, 3502 and 3503 – and offers a higher range of 153km, has helped accelerate sales.

The Bajaj Chetak 35 Series, which comprises three variants – 3501, 3502 and 3503 – and offers a higher range of 153km, has helped accelerate sales.

BAJAJ AUTO

March 2025: 34,863 units

FY2025: 230,761 units, up 116% YoY. Market share: 20%

FY2024: 106,624 units, Market share: 11%

With best-ever monthly sales of 34,863 units in March 2025, Bajaj Auto has topped the e2W industry for the second month running, after February 2025. Having been No. 1 for the first time in December 2024, last month’s performance makes it the third time in the past 12 months that the Bajaj Chetak has outsold the competition. Bajaj Auto's previous best monthly sales were in October 2024 (28,415 units).

The consistent and strong growth all through the fiscal has meant that Bajaj Auto sold a record 230,761 Chetaks in FY2025, up 116% (FY2024: 106,624 units) and selling an additional 124,137 units to surpass the 200,000 milestone for the first time in a fiscal year. Resultantly, the company’s e2W market share has nearly doubled to 20% from 11% in FY2024.

What has helped accelerate sales, particularly in the last four months, is the new 35 Series launched in December 2024. The 35 Series Chetak comprises three variants – 3501, 3502 and 3503 – and offers a higher range of 153km.

Bajaj Auto, which has been engaged in an intense battle for supremacy with legacy rival TVS Motor Co, is just 6,790 units at the end of FY2025. The sales gap between these two OEMs in FY2024 was 76,565 units, which indicates just how rapid demand has been for the Bajaj Chetak.

FY2025 saw TVS Motor Co clock total retails of 237,551 units, up 30% YoY (FY2024: 183,189 units), which translates into an additional 54,362 units.

FY2025 saw TVS Motor Co clock total retails of 237,551 units, up 30% YoY (FY2024: 183,189 units), which translates into an additional 54,362 units.

TVS MOTOR CO

March 2025: 30,453 units

FY2025: 237,551 units, up 30% YoY. Market share: 21%

FY2024: 183,189 units, Market share: 19%

TVS Motor Co has been the longstanding No. 2 e-two-wheeler OEM. It came very close to being No. 1 in January 2025 but was pipped to the post by Ola by just 542 units. In March 2025, the TVS iQube was bought by 30,453 consumers, which gives it a monthly market share of 23 percent.

This is TVS' best-ever monthly sales tally, improving upon its October 2024 retails of 30,180 units.

For entire FY2025, TVS Motor Co has clocked total retails of 237,551 units, up 30% YoY (FY2024: 183,189 units), which translates into an additional 54,362 units and gives it a market share of 21% for the fiscal year, up 2% on FY2024’s 19 percent.

Like Bajaj Auto, TVS has also surpassed the 200,000-units retail milestone in a fiscal for the first time and has hit record retails. However, what the sales of the two legacy companies reveal is that the sales gap, which was 76,565 units in FY2024, has shrunk to 6,790 units in FY2025.

TVS, which has ample manufacturing capacity on hand, is strategically expanding the iQube dealer network. Currently estimated at around 750 touchpoints across India, TVS is aggressively increasing its EV network each month.

With 344,004 e-scooters and e-motorcycles sold between April 2024 and March 2025, Ola has registered a 4% YoY increase in FY2025.

With 344,004 e-scooters and e-motorcycles sold between April 2024 and March 2025, Ola has registered a 4% YoY increase in FY2025.

OLA ELECTRIC

March 2025: 23,430 units

FY2025: 344,004 units, up 4% YoY. Market share: 30%

FY2024: 329,947 units, Market share: 35%

Ola Electric, which remains the overall e2W market leader for the third straight fiscal year, sold 23,430 units in March 2025 for a market share of 18% last month. The company, which retained its No. 1 title in January 2025, had dropped down by three ranks in February to No. 4. Its improved performance in March sees it move up to second position after Bajaj Auto and ahead of TVS Motor Co.

On the cumulative retail sales front, with 344,004 e-scooters and e-motorcycles sold between April 2024 and March 2025, Ola has registered a 4% YoY increase, surpassing its FY2024 total of 329,947 units by 14,057 units. This gives the company an FY2025 market share of 30%, down by 5% on the 35% market share it had in FY2024.

Ather’s main growth driver is the Rizta family e-scooter launched a year ago.

Ather’s main growth driver is the Rizta family e-scooter launched a year ago.

ATHER ENERGY

March 2025: 15,446 units

FY2025: 130,913 units, up 20% YoY. Market share: 11.39%

FY2024: 109,161 units, Market share: 11.50%

Smart electric scooter manufacturer Ather Energy sold 15,446 e-scooters in March 2025, which gives it a 12% market share and the No. 4 rank. Ather’s total FY2025 retails at 130,913 units are a 20% YoY increase, having sold an additional 21,752 units, and give a market share of 11.395 compared to 11.50% in FY2024 when it had sold 109,161 units.

March 2025's sales are the e-scooter start-up's second best monthly retails since October 2024's 16,233 units.

Ather’s main growth driver is the Rizta family e-scooter launched a year ago. While the S version (2.9 kWh battery) has a 123km range, the Z variant (3.7 kWh) has a 160km range. The Rizta’s highlights include the largest two-wheeler seat in India and storage space aplenty. The Ather Rizta also won Autocar India’s Electric Two-Wheeler of the Year 2025 award.

The new Vida V2, launched in Dcember 2024, has given Hero MotoCorp a fresh sales charge. March 2025's 7,977 units are its best monthly sales yet.

The new Vida V2, launched in Dcember 2024, has given Hero MotoCorp a fresh sales charge. March 2025's 7,977 units are its best monthly sales yet.

HERO MOTOCORP

March 2025: 7,977 units

FY2025: 48,668 units, up 175% YoY. Market share: 4%

FY2024: 17,720 units, Market share: 2%

Hero MotoCorp has closed FY2025 with its best-ever monthly retails of 7,977 units, improving upon October (7,350 units) and November 2024 (7,344 units). This takes its FY2025 total to 48,668 units, which constitutes handsome 175% YoY growth (FY2024: 17,720 units).

In early December 2024, Hero MotoCorp expanded its EV portfolio with the launch of the new Vida V2. The Vida 2 is essentially an evolution of the V1 range that the world’s largest ICE two-wheeler began its electric mobility journey in October 2022. The Vida V2 is available in three variants: Lite (Rs 96,000), Plus (Rs 115,000) and Pro (Rs 135,000). The most affordable V2 Lite is an entirely new variant and comes with a small 2.2kWh battery pack that has a claimed 94km IDC range.

Hero MotoCorp has started scaling up brand presence for Vida and its network now stands at 203 touchpoints comprising 180 dealers across 116 cities. The company, which has the V1 Plus and V1 Pro EVs, plans to expand its portfolio – within the mid- and affordable segment – within FY2025. And it already has around 2,500 charging stations in collaboration with Ather Energy, in which Hero MotoCorp is an early investor.

Greaves Electric Mobility's Ampere Nexus has provided the bulk of the sales.

Greaves Electric Mobility's Ampere Nexus has provided the bulk of the sales.

GREAVES ELECTRIC MOBILITY

March 2025: 5,641 units

FY2025: 40,161 units, up 28% YoY. Market share: 3.49%

FY2024: 31,276 units, Market share: 3.29%

Greaves Electric Mobility (GEM), the EV arm of Greaves Cotton, is ranked fifth for March 2025 and sixth for FY2025. In March, the company sold 5,641 e-scooters – its best-ever monthly retails yet – which gives it a 4% share for the month.

The company has a six-model portfolio of e-scooters comprising the Nexus (pictured above), Primus, Magnus LT/EX (100km+ range), Ampere Magnus Special, entry level Rio Li/La Plus and Zeal EX.

GEM’s FY2025 retails of 40,161 units are up 28% on its FY2024 sales of 31,276 units and give it a market share of 3.49%, marginally improving upon its 3.29% share of FY2024.

The Ampere Nexus, GEM’s e-scooter launched in April 2024, has provided the bulk of the sales. Targeted at families, the Ampere Nexus has been designed and developed in-house at the Ranipet facility in Tamil Nadu. Equipped with a 3 kWH LFP battery, the Nexus has a claimed top speed of 93kph and a certified range of 136km. Sold in two variants, prices start at Rs 110,000 (ex-showroom) and go up to Rs 120,000.

RELATED ARTICLES

Maruti Grand Vitara is fastest midsize SUV to 300,000 sales

Launched on September 26, 2022, the Maruti Grand Vitara, which was the fastest among midsize SUVs to the 100,000, 200,00...

Ola Electric holds onto lead over TVS and Bajaj in first three weeks of April

Having taken the lead early in April, Ola has sold 12,546 units in the April 1-21 period, just 84 units ahead of TVS iQu...

TVS iQube and Bajaj Chetak sales cross one million units since launch

Combined sales of the TVS iQube and Bajaj Chetak electric scooters, which were launched in January 2020, have surpassed ...

01 Apr 2025

01 Apr 2025

7170 Views

7170 Views

Autocar Professional Bureau

Autocar Professional Bureau