150-200cc sole bike category to see sales decline, TVS rules with 364,000 Apaches

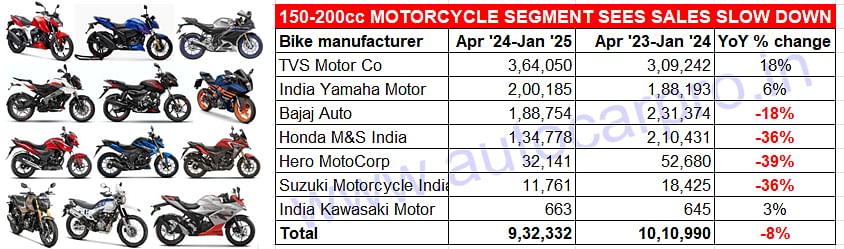

Of the 12 sub-segments in the overall motorcycle segment, this premium commuter bike category which clocked sales of 932,332 units is the only one to see decrease in sales at 8% YoY. While TVS and Yamaha have increased their segment share to 39% and 21% respectively, Bajaj Auto, Honda, Hero MotoCorp and Suzuki are feeling the heat of slowing sales for some products.

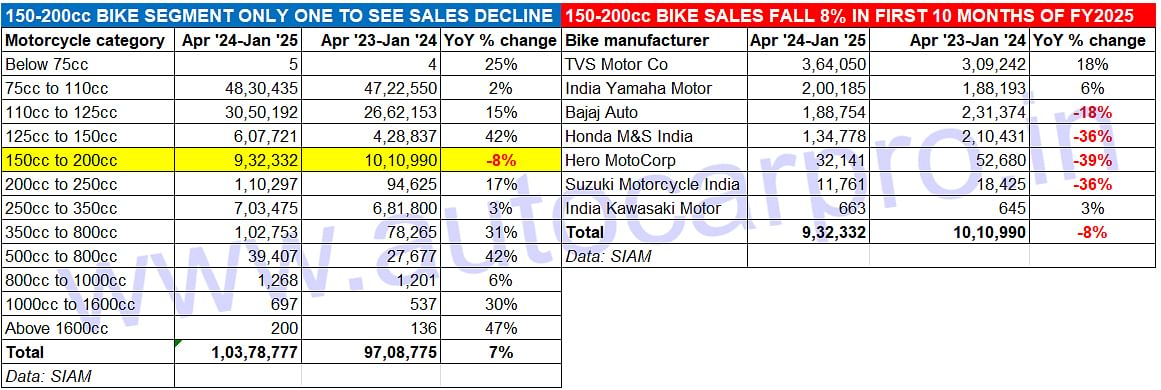

The two-wheeler industry is the biggest volume segment for India Auto Inc and the 16.56 million units (1,65,65,788 / up 10.7% YoY) that OEMs has dispatched to their dealers in the first 10 months of FY2025 are proof of that. Demand has bounced back for both motorcycles and scooters and the results are there to see – while scooters (57,53,946, up 18.5%) account for a 35% share, over a million motorcycles (1,03,78,782 / up 6.9%) have the highest share at 63%. The humble moped (4,33,060 / up 8.3%) has a 4% share. This specific analysis though is about a single, under-performing sub-segment in the 12-sub-segment motorcycle segment.

The 150cc to 250cc category, the third biggest bike volume-wise at 932,332 units, is down 8% on its year-ago sales of over a million units (10,10,990 bikes). Its bike market share is down to 9% vs 10.41% a year ago.

The 150cc to 250cc category, the third biggest bike volume-wise at 932,332 units, is down 8% on its year-ago sales of over a million units (10,10,990 bikes). Its bike market share is down to 9% vs 10.41% a year ago.

As the SIAM-derived data statistics for the 12 motorcycle sub-segments (shown above) reveals, all but one sub-segment – 150cc to 200cc – have registered YoY increases. The biggest volume segment of course is the entry level 100-110cc sub-segment: 4.83 million units, up 2% and a segment share of 46 percent. The 110cc to 125cc with 3.05 million units has seen 15% growth and has a 29% segment share. The 125cc to 150cc sub-segment with 607,721 units sold has clocked robust 42% growth and has a 6% bike market share.

The 150cc to 250cc sub-segment, which is the third biggest volume-wise at 932,332 units at a 9% share, is down 8% on its year-ago sales of over a million units (10,10,990 bikes) when it had a 10.41% bike market share. This category has witnessed 78,658 fewer bikes being sold in the April 2024-January 2025 period, essentially a result of underperformance by four key players Bajaj Auto, Honda, Hero MotoCorp and Suzuki.

TVS has sold 364,050 Apaches, which is an 18% YoY increase and gives it a 39% share of this bike sub-segment. Yamaha too has done well, the combined sales of 200,185 MT-15 V2.0 and YZF R15 bikes giving it a 21% share.

TVS has sold 364,050 Apaches, which is an 18% YoY increase and gives it a 39% share of this bike sub-segment. Yamaha too has done well, the combined sales of 200,185 MT-15 V2.0 and YZF R15 bikes giving it a 21% share.

TVS AND YAMAHA SHINE, BUT BAJAJ, HONDA, HERO & SUZUKI FEEL THE HEAT

A deep dive into the OEM-wise performance for the 150-200cc bike market for the April 2024-January 2025 period reveals some interesting trends as well as some hard market truth for some slow-selling products.

TVS Motor Co, which has four models of the Apache RTR Series – RTR 160, RTR 165, RTR 180 and RTR 200 – in the 150-200cc bike category, leads with 364,050 units in the first 10 months of FY2025. While this is an 18% YoY increase and gives it a 39% share of this sub-segment, it also means the Apache is TVS’ best-selling motorcycle in the current fiscal and ahead of the TVS Raider (340,699 units, down 14% YoY). The Apache bikes’ pricing starts at Rs 120,400 for the RTR 160 2V, rises to 133,200 for the RTR 180 and Rs 147,800 for the top-end RTR 200 4V.

India Yamaha Motor has registered wholesales of 200,185 motorcycles in the current fiscal, up 6% YoY, giving it a 21% share of this bike category. Yamaha has two models – the MT-15 V2.0 / YZF R15 – both powered by the same 155cc engine and developing maximum power of 18.4-18.6 hp. While the MT-15 costs Rs 172,900, the three-variant YZF R15’s pricing starts at Rs 165,000 and goes up to Rs 196,000. It is learnt that of the two Yamahas, the MT-15 is the one with more demand and nearly 50% YoY growth while the R15 is witnessing tepid offtake.

Bajaj Auto has registered wholesales of 188,754 units in the past 10 months in this category, down 18% YoY (April 2023-January 2024: 231,374 units). This translates into 42,620 fewer bikes compared to the year-ag period. The Pune-based OEM has 9 models in this category – 6 Pulsars (150, N150, N160, NS160, NS600, RS 200 priced from Rs 110,400 through to Rs 157,400), Avenger 160 Street (Rs 177,700), KTM 200 Duke (Rs 203,400), KTM RC200 (Rs 219,500). While the Pulsar model sales are around 20% down YoY, demand for the KTM is more or less constant.

Honda Motorcycle & Scooter India (HMSI) has seen the highest rate of volume-wise decline in the 150-200cc category: 134,778 units, down 36% YoY and 75,653 fewer bikes sold YoY. Honda has four models here – the Unicorn 160, SP160, Hornet 2.0 and the CB200X. The Unicorn 160 (RS 119,481, ex-showroom Delhi), which typically accounts for the bulk of sales, has seen demand slow down substantially in the 10-month period. Will the December 2024 launch of the updated Unicorn 160, which received a minor update in the form of an OBD2B-compliant engine and a few new features, revive sales? We will have to wait a few months. Meanwhile, in comparison, the 162cc SP160 (Rs 121,951) is seeing handsome demand and a near-doubling of sales. The recently updated SP160 is now also OBD2B emission compliant and also sports a 4.2-inch TFT display with Bluetooth connectivity, making it the only commuter in the class to do so. The 184cc Hornet 2.0 (Rs 143,451, ABS & OB2) and CB200X (Rs 151,450) are both witnessing good demand, indicative of the customer movement towards higher-powered bikes.

Hero MotoCorp is ranked fifth in this bike category with 32,141 units, down 39% YoY (April 2023-January 2024: 52,680 units). The company has two products here – the 163cc-engined Xtreme 160R and the 199.6cc Xpulse 200 4V. Of the two, the Xpulse 200 (Rs 146,200) is seeing far more customer demand, particularly after the recent update. It is offered in two variants – Standard and Pro (Rs 153,600). The Pro is essentially the erstwhile Rally Edition but the more extreme version of an already capable off-road motorcycle.

Between April 2024 and January 2025, as per SIAM wholesales data, Suzuki Motorcycle India sold 11,761 units of the 155cc Gixxer and Gixxer SF, down 36% YoY and priced at Rs 134,800 and Rs 137,100 respectively.

India Kawasaki Motor, the last of the bikemakers in this list, sold 663 units of the 177cc W175 priced from Rs 129,000 through to Rs 135,000 for the W175 Street.

ARE 150-200cc MOTORCYCLE BUYERS MIGRATING?

The premium commuter bike category is the third largest sub-segment of the overall motorcycle market in India.

The premium commuter bike category is the third largest sub-segment of the overall motorcycle market in India.

The premium commuter 150-200cc motorcycle sub-segment, the third largest contributor to the overall bike market, is one that is impacted by both the 125-150cc category and the ones above it. In the past 10 months, the 125-150cc commuter bikes have seen handsome growth – 42% YoY – with OEMs selling 607,721 units (an additional 178,884 units) and their segment share increasing to 6% from 4.41% a year ago. This can both be surmised as buyers conserving cash as well as preferring fuel efficiency over performance. However, with the Union Budget promising to put more money into motorists’ wallets, this dynamic could likely change later this year.

As the 12-sub-segment data table shown above indicates, the 200-250cc (additional 15,672 units sold YoY) and 250-300cc (additional 21,675 units sold YoY) segments have registered strong gains, possibly pointing to a trend of premium commuter bike buyers migrating from the 150-200cc market to those above. This is also helped by the reducing price gap between these bikes and feature-rich premium 150-200cc commuter bikes. Many first-time bike buyers, who cannot afford a big, muscular superbike, are keen on a smaller, style, performance-oriented machine with value for money written all over it.

RELATED ARTICLES

TVS Apache sells 446,218 units in FY2025, grabs 40% share of 150-200cc bike market

TVS Motor Co’s Apache series has hit its second best-ever fiscal sales of 446,218 units in FY2025 – 19,104 units less th...

Maruti Ertiga turns 13, sells 1.21 million units since launch

Launched on April 16, 2012, Maruti Suzuki’s and India’s best-selling MPV for the past six years has clocked its highest ...

SUVs power UV share of PVs to 65% in FY2025, car and sedan share plunges to 31%

Utility vehicles once again were a vital buffer to plunging sales of passenger cars in FY2025. At 2.79 million units, SU...

25 Feb 2025

25 Feb 2025

6253 Views

6253 Views

Autocar Professional Bureau

Autocar Professional Bureau