Escorts Kubota Reports 8.5% Jump in Q3 Profit on Strong Tractor Sales

Escorts Kubota Posts 8.5% Q3 Profit Increase Amid Higher Tractor Sales and Business Restructuring.

Escorts Kubota Limited reported an 8.5% increase in standalone net profit at ₹323.2 crore for the quarter ended December 2024, compared to ₹297.9 crore in the same quarter last year, driven by strong performance in its tractor business despite challenges in the construction equipment segment.

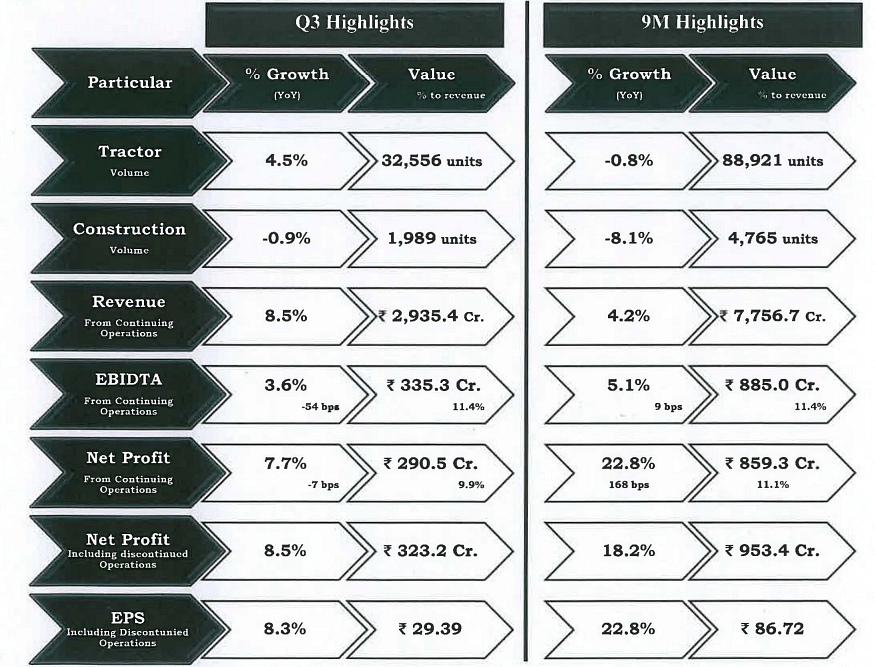

The company's revenue from continuing operations grew 8.5% year-on-year to ₹2,935.4 crore, up from ₹2,706.4 crore in the corresponding quarter. On a sequential basis, revenue showed significant improvement with a 29.6% increase from ₹2,264.9 crore in the September quarter, indicating strong momentum in business activities.

Operational performance remained robust as EBITDA rose 3.6% to ₹335.3 crore compared to ₹323.8 crore in the year-ago period. The sequential growth was particularly notable, with EBITDA surging 44% from ₹232.8 crore in the previous quarter. The company's board has declared an interim dividend of ₹10 per share for shareholders.

The agricultural machinery segment emerged as the primary growth driver, with tractor volumes increasing 4.5% to 32,556 units from 31,155 units in the corresponding quarter. The segment demonstrated strong sequential recovery with a 25.2% growth from 25,995 units in the previous quarter. Revenue from the agri machinery segment expanded by 9.4% year-on-year to ₹2,416.6 crore. However, EBIT margin for the segment contracted to 10.4% from 12.1% in the year-ago quarter, though it improved from 9.1% in the sequential quarter.

In the construction equipment division, sales volume saw a marginal decline of 0.9% to 1,989 units. Despite this, segment revenue grew by 4.1% to ₹515.7 crore, with EBIT margin showing significant improvement at 11% compared to 8.1% in the corresponding quarter. The segment demonstrated strong sequential growth with volumes up 42.7% from the September quarter.

The railway equipment division, now classified as discontinued operations following the board's decision to divest it, recorded revenue of ₹200.4 crore, marking a 2.2% year-on-year decline. Despite lower revenue, the segment's profit after tax increased to ₹32.7 crore from ₹28.1 crore in the year-ago quarter.

For the nine months ended December 2024, the company's standalone revenue from continuing operations increased by 4.2% to ₹7,756.7 crore. Net profit from continuing operations showed substantial growth of 22.8% to ₹859.3 crore, compared to ₹699.6 crore in the corresponding period. The profit before tax from continuing operations rose 7.8% to ₹1,008.2 crore.

On the consolidated front, revenue from continuing operations for the nine-month period grew 3.9% to ₹7,799 crore. Consolidated net profit from continuing operations increased by 21.8% to ₹852.4 crore. The company's earnings per share (EPS) for the nine-month period improved to ₹86.09 from ₹73.51 in the previous year.

Two significant strategic developments marked the quarter. The National Company Law Tribunal approved the amalgamation of Escorts Kubota India Private Limited and Kubota Agricultural Machinery India Private Limited with Escorts Kubota Limited, with the merger effective from September 1, 2024. Additionally, the board approved the sale of its Railway Equipment Division as a going concern on a slump sale basis, signaling a strategic realignment of business focus.

The results reflect Escorts Kubota's strong performance in its core agricultural machinery business, while maintaining profitability across segments despite mixed volume performance. The strategic restructuring initiatives, including the merger and planned divestment of the railway equipment business, indicate the company's focus on streamlining operations and strengthening its position in the agricultural machinery sector. The robust sequential growth across segments also suggests improving business conditions and effective execution of strategic initiatives.

RELATED ARTICLES

Skoda Ready to Go Solo for India EV Business If Right Partner Not Available

The company has reportedly talked to Mahindra & Mahindra, Tata Motors and JSW Group for partnering on its EV business in...

Mercedes-Benz Unveils New CLA in Rome, Claims Most Efficient Model Ever

The automotive giant presented its latest CLA model in Rome, featuring technological innovations and sustainability impr...

Qualcomm Joins KPIT, ZF as Investor in Qorix

Qualcomm Technologies has joined as a strategic minority shareholder in Qorix GmbH, partnering with KPIT Technologies L...

By Autocar Pro News Desk

By Autocar Pro News Desk

10 Feb 2025

10 Feb 2025

8173 Views

8173 Views

Sarthak Mahajan

Sarthak Mahajan

Angitha Suresh

Angitha Suresh