India’s component industry notches 18.3% growth in FY2018, turnover crosses $50 billion

Despite ongoing challenges like the ongoing shift to BS VI norms, along with other regulations, component makers put on a strong show. ACMA president calls for uniform GST of 18 percent to drive growth.

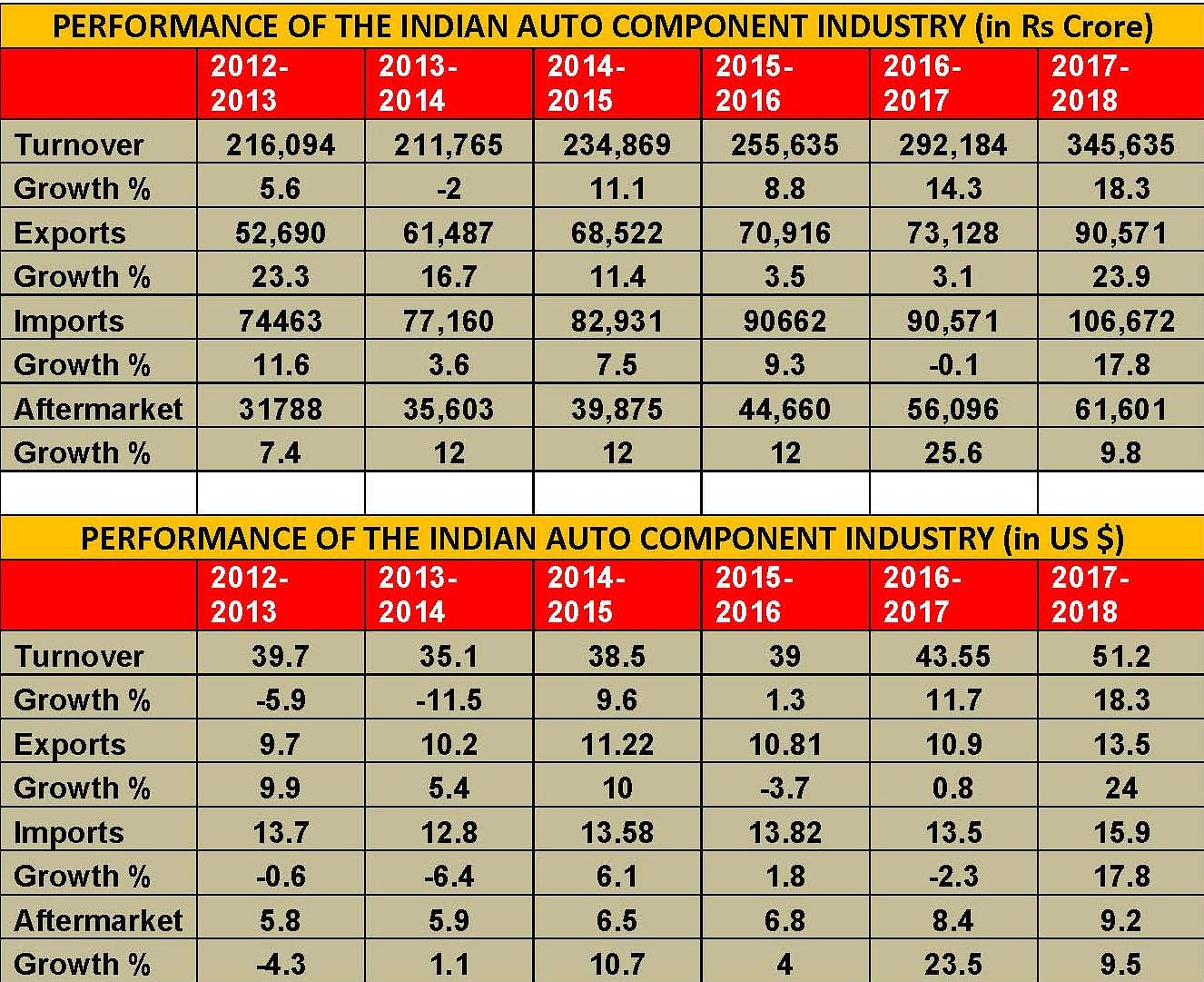

Like the Indian automobile industry, which is firing on all cylinders, the automotive component industry too has announced robust numbers for FY2018. The component industry, which contributes 2.3 percent to India’s GDP and 4 percent to India’s exports, registered revenue of Rs 3.45 lakh crore (US$ 51.2 billion) for FY2018, which marks solid growth of 18.3 percent year on year. In comparison, the Indian automobile industry saw growth of 16.22 percent (including exports) in FY2018.

Apex industry body ACMA says the FY2018 numbers represent the supply from the component industry (both ACMA members and non-members), on-road and off-road vehicle manufacturers and the aftermarket in India along with exports. It also includes captive component supplies to OEMs.

Commenting on the industry’s performance, Vinnie Mehta, director-general, ACMA, said: “The past year witnessed an upswing in the overall performance of the vehicle industry, despite it facing several regulatory challenges. The component industry, in tandem, posted an encouraging performance with significant YoY growth of 18.3 percent, registering turnover of Rs 3,45,635 crore. Furthermore, exports grew by 23.9 percent to Rs 90,571 crore (US$ 13.5 billion).”

Commenting on the industry’s performance, Vinnie Mehta, director-general, ACMA, said: “The past year witnessed an upswing in the overall performance of the vehicle industry, despite it facing several regulatory challenges. The component industry, in tandem, posted an encouraging performance with significant YoY growth of 18.3 percent, registering turnover of Rs 3,45,635 crore. Furthermore, exports grew by 23.9 percent to Rs 90,571 crore (US$ 13.5 billion).”

Speaking about the need for government intervention to sustain long-term growth in the auto component industry, Nirmal Minda, president, ACMA, said: “The dynamics of the automotive markets are undergoing a significant transformation as the industry strives to become compliant with various regulations related to emissions, safety and environment including the transition from BS IV to BS VI. Key trends such as vehicle connectivity, electrification of vehicles, share mobility and Industry 4.0 among others are also redefining mobility. To support the changing customer needs and to stay relevant, the auto component sector needs to be encouraged with supportive government policies.”

He continued, “One of the key demands of the industry has been a uniform 18 percent GST rate across the auto component sector. Currently, 60 percent of auto components attract 18 percent GST, while the balance 40 percent, the majority of which are two-wheeler and tractor components attract 28 percent. The latter high rate has led to flourishing grey operations in the aftermarket. A benign rate of 18 percent will not only ensure better compliance, but will also ensure a larger tax base. Further, considering the significant technological changes that the industry is undergoing, there is a critical need for creating a fund to support indigenous R&D and technology creation in the component industry as also for technology acquisition from other parts of the world. Lastly, as we prepare for the introduction of electric mobility in the country, a well-defined, technology-agnostic roadmap with clear responsibilities of each stakeholder will go a long way in ensuring a smooth rollout as well as leading to creation of a local supply base for the same.”

Exports on the upswing

Exports of the made-in-India components are up significantly by 23.9 percent to Rs 90,571 crore, compared to Rs 73,128 crore in FY2017. Europe accounted for 34 percent of the exports, followed by North America (28%) and Asia (25%). The key export products included drive transmission and steering, engine components, body/chassis, suspension and braking.

Meanwhile, imports of auto components rose by 17.8 percent to Rs 1,06,672 crore in FY2018 from Rs 90,571 crore in FY2017. While Asia accounted for 60 percent of imported, Europe (30%) and North America (8%) were the next biggest suppliers.

As a result of the growing vehicle parc in India, the aftermarket brings grew by 9.8 percent to Rs 61,691 crore (+9.8%) in FY2018 from Rs 56,096 crore in FY2017.

RELATED ARTICLES

Rajiv Bajaj reappointed MD and CEO of Bajaj Auto for five-year term

Bajaj Auto’s Board of Directors has approved the re-appointment of Rajiv Bajaj as the company’s MD and CEO for another f...

JSW MG Motor launches Comet EV Blackstorm edition

The key highlights of the Comet EV Blackstorm, which is now the top-end variant, are its ‘Starry Black’ exterior along w...

Maruti Suzuki begins production at new Kharkhoda plant

Phase 1 of the Kharkhoda plant will have an annual production capacity of 250,000 units and produce the Brezza compact S...

By Autocar Professional Bureau

By Autocar Professional Bureau

06 Aug 2018

06 Aug 2018

6428 Views

6428 Views

Ajit Dalvi

Ajit Dalvi