M&HCV bus sector in India in recovery mode

During FY2015-16, the overall CV industry did well to post 11.51% year-on-year growth with sales of 685,704 units (FY2015: 614,948 units).

The medium and heavy commercial vehicle passenger carrier sector is headed for better times.

During FY2015-16, the overall CV industry did well to post 11.51% year-on-year growth with sales of 685,704 units (FY2015: 614,948 units). Expectedly, the M&HCV sector was the big provider to these gains, with sales of 302,373 units and handsome 30% YoY growth (FY2015: 232,755 units). Within this segment, the passenger carrier segment, which comprises about 20 percent of the total M&HCV segment, registered strong double-digit growth after two years of negative growth.

During 2015-16, the M&HCV passenger carrier segment, classified as maximum mass exceeding 7.5T but not exceeding 12T and maximum mass exceeding 12T but not 16.2T has grown 19.5%, selling 43,885 buses as compared to negative growth of 4.83% (36,837 buses) and 17.48% (38,709 buses) during FY15 and FY14 respectively.

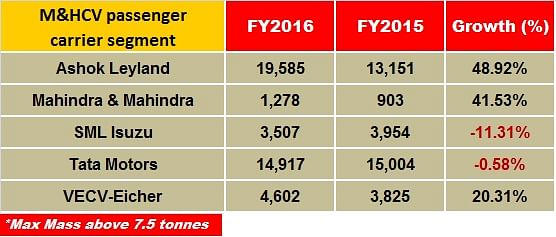

Ashok Leyland, as in the goods carrier segment, also made big gains in this segmentWith sales of 19,586 buses, it posted healthy 48.92% growth (FY2015:13,151 units), which is attributed to its strong performance in the city bus and intercity segment. In the 16.2-tonne segment the company sold 15,511 units, up 55.1% (FY2015: 9,997 units).

Tata Motors with sales of 14,917 units, saw flat growth. (FY15: 15,004 units) while VE Commercial Vehicles recorded 20.31 percent growth in the segment, selling 4,607 units. (FY2015:3,825 units.). SML Isuzu, which has been strong in the 7.5T-12T segment, saw its sales decline by 11.30% to 3,507 units (FY2015:3,954 units). Mahindra & Mahindra registered a growth of 41.5% albeit on a smaller base; the company sold 1,278 units (FY2015: 903 units.)

In its outlook for FY17, the Society of Indian Automotive Manufactures predicts that in the passenger carrier segment, MCVs will likely see moderate growth over a high base with the opening up of roads for private participation to remain a key parameter. Demand from the intercity segment, which saw a sharp growth in FY2016 due to delayed replacement demand, is expected to moderate over a high base. Demand from corporates is also to grow at a faster pace compared to FY2016. State Transport Undertaking sales are also slated to pick up, catering to delayed replacement of over-aged vehicles. Also, JnNURM II orders for about 2,000-2,500 buses are expected to be fulfilled in FY2017.

Also read:

- Ashok Leyland grabs M&HCV market share from Tata Motors in 2015-16

- Indian commercial vehicle exports surge to a three-year high

- India LCV market sees green shoots of recovery after two-year decline

RELATED ARTICLES

Tata Punch to Toyota Taisor: Top 10 compact SUVs in FY2025

With 1.38 million units sold in FY2025, less-than-4,000mm-long or compact SUVs registered 10% growth and accounted for n...

TVS Apache sells 446,218 units in FY2025, grabs 40% share of 150-200cc bike market

TVS Motor Co’s Apache series has hit its second best-ever fiscal sales of 446,218 units in FY2025 – 19,104 units less th...

Maruti Ertiga turns 13, sells 1.21 million units since launch

Launched on April 16, 2012, Maruti Suzuki’s and India’s best-selling MPV for the past six years has clocked its highest ...

By Kiran Bajad

By Kiran Bajad

15 Apr 2016

15 Apr 2016

14598 Views

14598 Views